Atomic Minerals Corporation announce the commencement of Phase 1 drilling at the Harts Point Uranium Project (“Harts Point” or the “Property”) in San Juan County, southeast Utah.

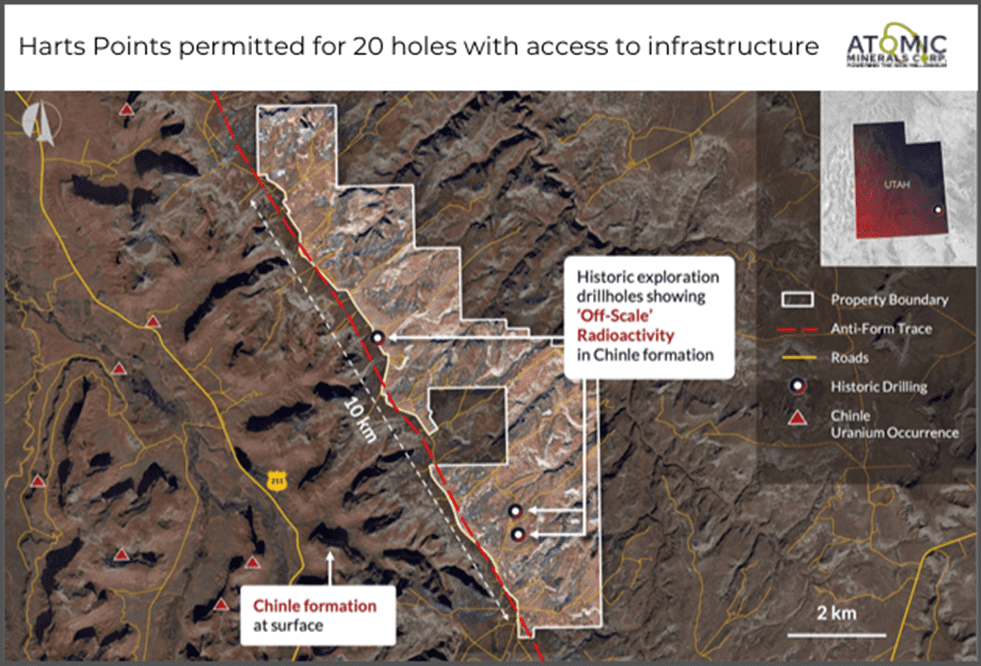

Harts Point is fully permitted for 20 drill pad locations; the initial holes will focus on a 5 kilometer strike length where historic oil and gas holes recorded “off-scale” radioactivity at the base of the uraniferous Chinle Formation. Favourable results will lead to the next series of holes which will evaluate the Chinle trend along strike to determine its full extent.

“We are thrilled to announce the commencement of drilling operations at Harts Point, a significant milestone in our exploration journey. With our JV partner, Kraken Energy, by our side, we are confident in the success of this endeavor. The target rich Chinle Formation and the exceptional historical radioactivity results have fueled our excitement. We are fully committed to unlocking the mineral potential of this area and look forward to uncovering valuable insights through this drilling campaign.“

commented Clive Massey, President & CEO of Atomic Minerals.

“With two additional wholely owned projects in similar geological settings, 10 Mile in Utah and Dolores in neighbouring Colorado we eagerly await the commencement of the Harts Point drill program as we endeavor to build Atomic Minerals into a significant player in the uranium space.“

he continued.

Harts Point Property Highlights:

- World class uranium jurisdiction: located in the center of the Colorado Plateau, which has produced over 328 million (“M”) pounds (“lbs.”) U3O8 at 0.2 to 0.4% U3O8 since the 1950s1.

- Property consists of 324 lode mining claims on Bureau of Land Management (“BLM”) ground that covers an area of 2,622 hectares (“ha”) (6,480 acres).

- Harts Point Anticline is Analogous to the Lisbon Valley Anticline: where the Lisbon Valley Uranium District hosted 17 large uranium mines which produced approximately 80M lbs U3O8 at 0.34% U3O8 from 1948 to 19882.

- The dimensions of these tabular sandstone-hosted uranium deposits range from 2 to 13 meters (“m”) (7 to 43 feet) thick, 100 to 3,048 m (328 to 10,000 feet) long, and 31 to 427 m (100 to 1,400 feet) wide3.

- Significant Historic Uranium Production:

- Several historic mines located 11 km (7 miles) west of the Harts Point Property produced approximately 280,000 lbs. U3O8 at 0.3% U3O8 from the favorable Chinle Formation host rock4.

- The Lisbon Valley Anticline is located 31 km (19 miles) to the east of the Harts Point Property produced approximately 80M lbs. U3O8 0.34% U3O82.

- Historic Exploration: Three wide-spaced historic oil and gas wells on the Property (Figure 1) along the east flank of the Harts Point Anticline show ‘off-scale’ radioactivity within the favorable Chinle Formation host rock.

- Drilled between 1953 and 1980, historic drill holes 43-037-10438, 43-037-30109, and 43-037-30623 showed off-scale radioactivity readings between 2.1 to 3.7 m thickness (7 to 12 feet) from depths of 390 to 417 m (1,280 to 1,368 feet).

- Permitted to Drill: The Harts Point Property is permitted for up to 20 exploration drill pads.

- Excellent Infrastructure: located approximately 64 km (40 miles) north of the White Mesa uranium processing facility.

- There is excellent access throughout the Property, which is situated 45 km (28 miles) from the town of Monticello, Utah.

References:

1 Holger Albrethsen, Jr. and Frank E. McGinley (1982). Summary History of Domestic Procurement Under U.S. Atomic Energy Commission Contracts, September 1982.

2 Chenoweth, W.L. (1990). Lisbon Valley, Utah’s Premier Uranium Area, a Summary of Exploration and Ore Production. Utah Geological Survey Open File Report 188, July 1990.

3 Gordon W. Weir and Willard P. Puffett (1981). Incomplete manuscript on stratigraphy and structural geology and uranium-vanadium and copper deposits of the Lisbon Valley area, Utah-Colorado. Open-File Report 81-39. Pages 153 to 163. United States Department of the Interior Geological Survey.

4 Chenoweth, W.L. (1993): The geology and Production History of the Uranium deposits in the White Canyon Mining District, San Juan County, Utah, Utah Geological Survey Miscellaneous Publication 93-3.

The data disclosed in this news release is related to historical drilling results. Atomic Minerals has not undertaken any independent investigation of the sampling, nor has it independently analyzed the results of the historical exploration work to verify the results. Atomic Minerals considers these historical drill results relevant as the Company is using this data as a guide to plan exploration programs. The Company’s current and future exploration work includes verification of the historical data through drilling.

Qualified Person

Mr. R. Tim Henneberry, P.Geo. (BC), is the “Qualified Person” under National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and is responsible for the technical contents of this news release and has approved the disclosure of the technical information contained herein.

About Harts Point:

Harts Point is located in the center of the Colorado Plateau, referred to by some as “the Athabasca Basin of the US” and is 64 kilometers (“km”) (40 miles) north of the White Mesa Uranium Mill, the only fully licensed and operating conventional uranium mill in the United States. The Property consists of 324 lode mining claims on Bureau of Land Management (“BLM”) ground and drill permits are in place for up to 20 exploration drill holes.

Atomic Minerals has granted Kraken Energy the right to earn a 65% interest in Harts Point. Kraken Energy must complete US$1.5 million in exploration expenditures within 18 months and a further 10% interest to 75% by completing a further US2.0 million in exploration expenditures and issuing 2 million shares to Atomic Minerals within the next 30 months. Atomic Minerals retains a 2% Net Smelter Return Royalty which can be reduced to 1% through a US$5 million payment. Upon completion of 65% or 75% interest, a joint venture will be formed.

About the Company

Atomic Minerals Corp. is a publicly listed exploration company on the TSX Venture Exchange, trading under the symbol ATOM. Led by a highly skilled management and technical team with a proven track record in the junior mining sector, we have a history of successful achievements. Our core objective at Atomic Minerals is to identify untapped opportunities in regions with previous uranium discoveries. These areas, although underexplored, hold immense potential and benefit from stable geopolitical and economic environments.

The Company possesses projects of significant technical merit in two prime locations. Firstly, we have initiated ventures in the Four Corners region, specifically focusing on the Colorado Plateau within the United States. Secondly, we are actively engaged in the Athabasca Basin in Saskatchewan, Canada.

ON BEHALF OF THE BOARD OF DIRECTORS

“Clive Massey”

Clive H. Massey

President & CEO