By James Hyland

As the world moves towards a more sustainable future, electric vehicles (EVs) have gained significant momentum. With their potential to reduce carbon emissions and dependence on fossil fuels, EVs have become a popular choice among consumers and governments alike. However, the rise of EVs has also led to an increased demand for certain critical minerals and metals, with copper being one of the most important ones. The relationship between copper and EV sales worldwide is a complex one, driven by factors such as technological advancements, government policies, and market dynamics.

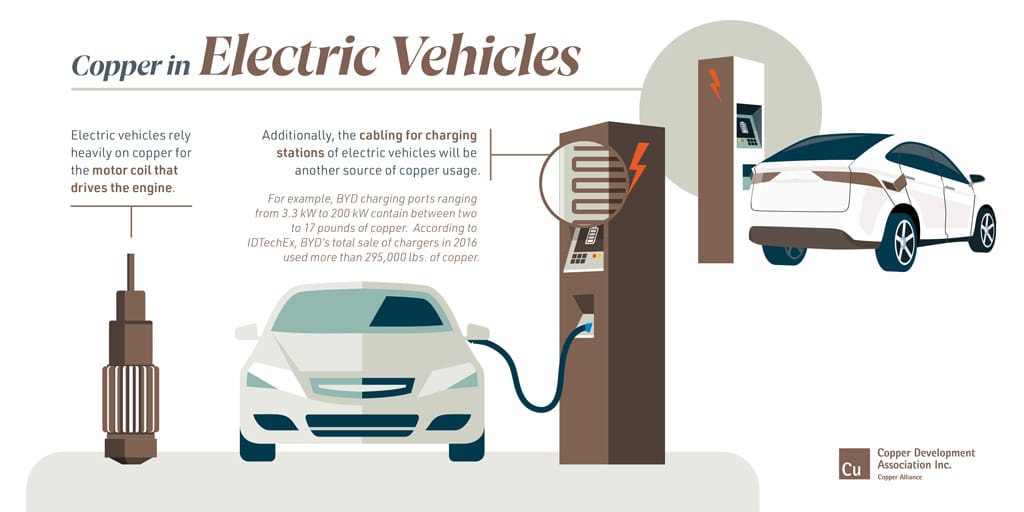

Copper is a key component in EVs, used in electric motors, batteries, wiring, and charging stations. The relationship between copper and EV sales worldwide is an important topic to explore, as the demand for copper is expected to increase with the growth of the EV market. In this essay, we will examine the relationship between copper and EV sales worldwide, looking at the current state of the market, trends, and future projections.

According to a report by the Copper Development Association, an EV can contain over one mile of copper wiring. The report also states that the copper content is bound to be high in commercial EVs compared to passenger EVs, with its content in a battery electric bus being over 800 pounds, whereas in a hybrid electric bus it is nearly 200 pounds. The growing electrification trend in commercial vehicles is expected to positively influence market growth over the forecast period.

The International Energy Agency (IEA) estimates that the global EV fleet consumed about 50 TWh of electricity in 2021, which accounts for less than 0.5% of current total final electricity consumption worldwide. In 2021, consumers across the world spent an estimated USD 250 billion on EV purchases. The growth in EV sales is driving investment in electrification, which represented more than 65% of overall end-use investment in the transport sector in 2021. Recent analysis by the IEA estimates that this share will increase to more than 74% in 2022.

The demand for copper due to electric vehicles is expected to increase significantly in the coming years. The global copper in electric vehicles market growth is attributable to the increasing production of electric vehicles (EVs) worldwide and superior characteristics of copper. The metal enhances energy efficiency when used in any system, thus optimizing lifecycle costs and helping in reducing greenhouse gas emissions.

However, there are warning signals coming from the supply chain, with bulk material prices increasing for the entire auto industry. Recentley, the price of copper rose more than 33%, affecting both conventional and electric cars. Additional challenges were posed by increased prices for materials needed to manufacture batteries. Innovation and alternative chemistries that require smaller amounts of critical minerals, as well as extensive battery recycling, can ease demand pressure and avoid bottlenecks. Incentivizing battery “rightsizing” and the use of copper in EVs can help to reduce the demand for critical minerals.

The future looks bright for copper and electric cars, more than 10 million electric cars were sold worldwide in 2022 and that sales are expected to grow by another 35% this year to reach 14 million. The IEA estimates that EVs would need to displace more than 7 Mb/d of oil in 2030 to be in step with the Net Zero Scenario. The growth of the EV market is expected to significantly impact copper demand in a sustainable world. The demand for copper due to electric vehicles is expected to increase significantly in the coming years, with the growing electrification trend in commercial vehicles positively influencing market growth over the forecast period.

The primary focus of electric car sales has predominantly revolved around three key markets: China, Europe, and the United States. China, leading the pack, accounted for 60% of global electric car sales in 2022, establishing itself as the frontrunner. Presently, over half of all electric cars worldwide can be found in China. Europe and the United States, the second and third largest markets, experienced significant growth with sales rising by 15% and 55% respectively in 2022.

In conclusion, the relationship between copper and EV sales worldwide is intertwined and mutually reinforcing, as the demand for copper is expected to increase with the growth of the EV market. Copper is a key component in EVs, used in electric motors, batteries, wiring, and charging stations. The demand for copper due to electric vehicles is expected to increase significantly in the coming years, with the growing electrification trend in commercial vehicles positively influencing market growth over the forecast period. However, there are warning signals coming from the supply chain, with bulk material prices increasing for the entire auto industry. Innovation and alternative chemistries that require smaller amounts of critical minerals, as well as extensive battery recycling, can ease demand pressure and avoid bottlenecks. Incentivizing battery “rightsizing” and the use of copper in EVs can help to reduce the demand for critical minerals.