This article is republished with permission from Ron Struthers. Original publication can be found on Substack’s @playstocks.

This is a weekly 4 year chart of copper prices. Copper started a steep rise in April, completing with new highs of $5.20 on May 20. I have little doubt that this is just early days in this new bull market. Copper is up about 38% from the 2023 lows.

The copper market is hot and more so than gold. With gold, there is disbelief because the market does not understand why prices are rising. We see this is spades with the gold mining stocks, still lagging the price increase in gold. However, with copper, the bullish market is easy to understand because it is the move to electrification and green energy. This has been harped about for years and now it is catching up with a copper market in under supply. There has been little investment and very few new copper mines in the past decades.

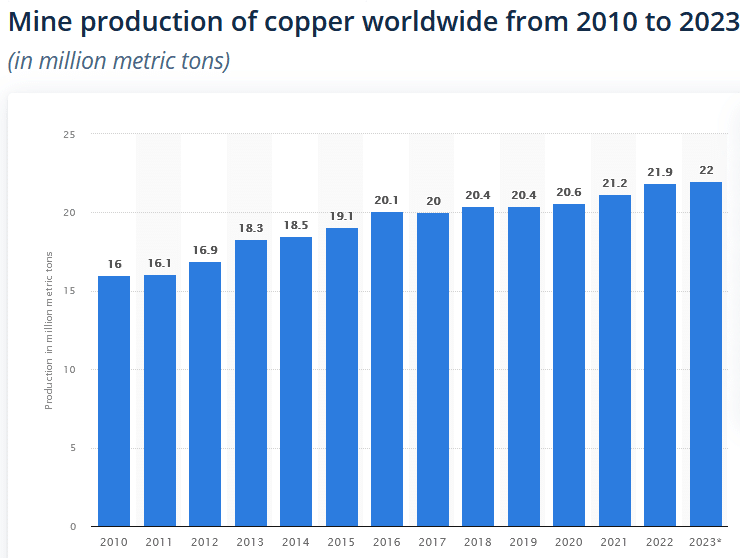

We can see that increased production of copper has only been incremental since 2016. Supply from scrap has been making up the rest to meet demand, but this source will not increase much. The global copper demand is forecast to grow by 2%-3% in 2024, with total consumption expected to reach around 26 million metric tons, reflecting the increasing demand from various sectors including electric transport and energy infrastructure. The copper market is going to be in short supply for many years, perhaps decades until way more investment comes into the sector, than building mines takes 5 to 10 years from discovery.

Today’s strong copper market comes as no surprise and I went into much detail on this in my Dr. Copper Shortage report in December 2023. It is a good time to add another advanced copper junior to our list and this one is under valued compared to it’s peers.

Giant Mining Corp. – – CSE:BFG – – – – OTC:BFGFF

Shares outstanding 3.4 million free trading

Financing 15.45 million at $0.20 on May 1st

and 4.6 million at $0.30 May 14th

Total shares outstanding 23.45 million – – – Fully Diluted 44 million

The company’s asset is 100% of the 3,404 hectare Majuba Hill porphyry copper deposit, a copper, silver and gold project located in Pershing county, Nevada, 251 km (156 miles) northeast of Reno. Access by U.S. Highway 80 Interstate/Freeway from Reno. Gravel road access maintained by Pershing County. There is a primary electric power line with substation 22 miles from Majuba. The project contains historic underground mines that produced 2.8 million pounds of copper.

Management

David Greenway CEO has over 20 years of expertise in managing, financing, and developing growth strategies for a range of public companies. With a strong background in the resource sector, Mr. Greenway has demonstrated his ability to drive success and create value. Through his strategic vision and business acumen, he has played a pivotal role in the growth and development of numerous listed companies, in highly competitive markets.

Larry Segerstrom, Msc., MBA, Director is a bilingual P.Eng and Geologist, possesses over 38 years of technical, operational, and business expertise. His contributions to the discovery and progress of numerous porphyry copper-gold projects are notable. With an MSc. in Economic Geology (University of Arizona) and an MBA in Global Management, he is widely respected as a qualified person under National Instrument 43-101 regulations

Brad Dixon, B.Sc., JD, Director is a partner at Givens Pursley LLP and Litigation Group co-chair, brings 20+ years of experience specializing in complex commercial litigation. His expertise encompasses diverse disputes in construction, secured transactions, real estate, employment, and natural resources.

Buster Hunsaker, B.S., M.S. – Senior Geologist and Qualified Person, Technical Advisor is an accomplished exploration geologist, providing comprehensive turn-key exploration services to senior and junior mining companies in North America, South America, and Mongolia. With a wealth of experience and expertise, he excels in property valuation, data analysis, and reporting, including the preparation of NI 43-101 Technical Reports. Mr. Hunsaker’s broad skill set, and industry knowledge make him a valuable asset in the successful execution of exploration projects.

I have known David Greenway and Larry Segerstrom for about 2 decades and I know they will do their best for shareholders. Giant Mining has a diverse management team and numerous advisors that you can view here on their web site.

Perfect Timing

Timing can be everything. Majuba Hill got going in 2020 just as the copper price and mining stocks peaked that we now know in hindsight. They had good drill results in 2022 and 2023 but nobody cared in those crappy markets. I believe this go around Giant Mining has prefect timing for the upside as the mining and copper bull market has only just begun.

The year 2022 was important historically for Majuba Hill, with the completion of the most ambitious drilling program to that date. They intersected the longest intercepts of copper mineralization ever drilled at Majuba Hill, alongside significant findings of silver, gold, and molybdenum. These results have been crucial to refining the Company’s exploration targets for 2024.

Result Highlights

MHB-27: 1136 ft (346.3 m) @ 0.25% CuEQ starting at 710 ft (216.4 m) including:

- 834 ft (254.2 m) @ 0.31% CuEQ from 750 to 1584 (228.6-482.8 m)

- 119 ft (36.3 m) @0.14% CuEQ from 1727-1846 ft (526.4-562.7m)

MHB-28: 1287 ft (392 m) @ 0.30% CuEQ starting at 245 ft (74.7 m), including:

- 652 ft (198.7 m) @ 0.33% CuEQ from 595 to 1247 ft

- 192 ft (58.5 m) @ 0.21% CuEQ from 1340 to 1532 ft

- 105 ft (32 m) @ 0.18% CuEQ from 1542 to 1647 ft

MHB-29: Intersected granodiorite porphyry at 3403 ft (1037 m). The entire hole is mineralized with 3607 ft (1099.4 m) @ 0.05% CuEQ from 0 to 3607 ft.

Strong potassic alteration that is overprinted by pervasive propylitization.

Zoning within the Majuba Target Zone indicates MHB-29 is southwest of the main mineralized zone.

Drill intersected 26 intervals greater than 0.20% CuEQ.

MHB-27 is mineralized throughout the entire hole with 3500 feet (1066.8 m) @ 0.18% CuEQ from 0-3500 feet (0-1066.8 m).

The year 2023 also moved the project ahead significantly with a new 43-101 report completed. Giant Mining not only expanded its drilling efforts but also significantly enhanced the geological map of Majuba Hill. These efforts have resulted in a clearer understanding of the deposit’s mineralization controls and the potential for further expansion of copper mineralization.

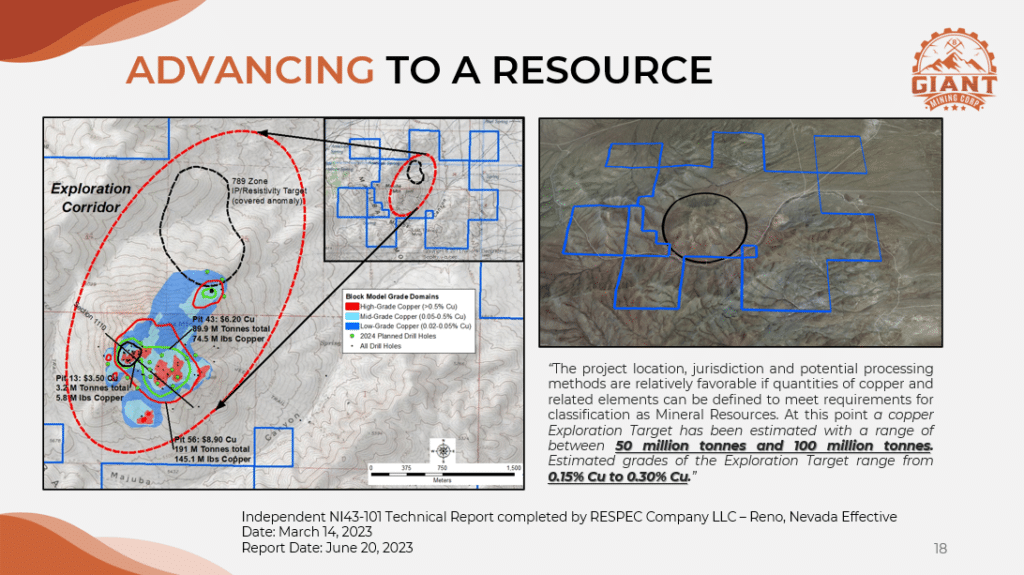

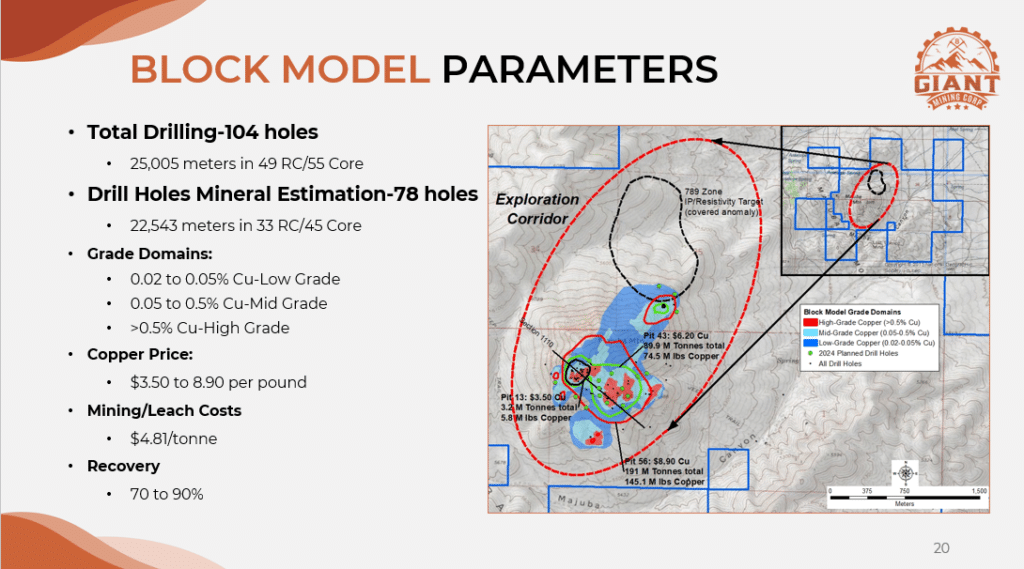

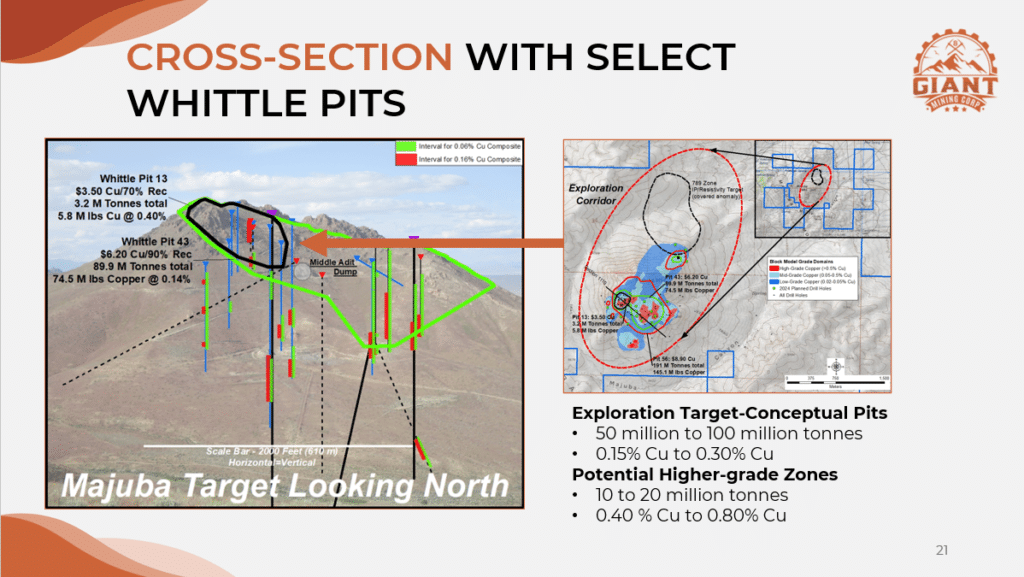

In the NI43-101 Report, Jeffrey M. Bickel, C.P.G. described the copper mineralization and developed a 3D block model that measured 50 million tonnes to 100 million tonnes of copper mineralization ranging from 0.15% Cu to 0.30% Cu, with potential for a higher-grade zone of 10 million tonnes to 20 million tonnes grading between 0.40 % Cu and 0.80% Cu. This outlines an initial and significantly expandable potential of 660 million pounds of copper.

Exploration Program 2024

This graphic from their presentation is a good illustration of the target and exploration goals for 2024. The target in black outline would be the starter pit with higher grade and continuing mining lower grade outlined in green. There is also potential to expand the size of the over all pit.

With recent financing s, Giant Mining is advancing the Company’s exploration and development initiatives, in alignment with the recommendations provided in the June 2023 NI43-101 report. BFG has committed to drilling 16 reverse circulation (RC) holes and two shallow core holes, which are designed to infill and expand the mineral potential. The Company’s exploration efforts will be further enhanced by the drilling of two deep core holes, each reaching a depth of 3,500 ft. (1,066m). This significant investment in deep-core drilling is crucial for accurately determining the vertical extent of the mineralization, significantly enhancing the company’s resource evaluation efforts.

Additionally, BFG. is set to commence a comprehensive metallurgical study to improve the understanding of the ore’s characteristics and processing efficiency at Majuba Hill. A sequential copper analysis program will provide the foundational metallurgical understanding of the copper deposit utilizing vast library of existing pulps and core from earlier drilling.

Conclusion

BFG is well financed with just over $4.4 million raised in recent financing s. The drill phase is coming soon and based on past results we know with confidence that this drill round will provide some excellent numbers.

The market has changed drastically with majors going after copper projects everywhere including early stage. Copper prices have just come off record highs and I am quite certain they will continue much higher. Junior mining stocks have been edging higher and this is only very early stages of their next bull market and it is the same for copper prices. They have only just started.

The stock at $0.85 may look like it is expensive but there are only 23.45 million shares out so the market valuation is only about $20 million. Here are 7 comparable copper discoveries –

Comparable Copper Juniors

Midnight Sun, MMA has only inferred resources as well and has a market value of about $53 million but does have two JVs with majors. I have no doubt majors are interested in BFG too.

Great Pacific Gold announced a buyout of a private copper junior, Tinya Valley Copper for $16 million in stock. What surprised me is how grass roots the project is, as it has not had one drill hole yet.

American Eagle AE has a market value of $95 million with their NAK property in Central BC, Canada. They acquired the site in December 2021, and has drilled 17 holes for a total of 13,854 meters during 2022 and 2023 exploration programs. On January 8, the company announced results from the final hole of its 2023 program, which returned the highest grading. It reported a 302 meter intersection containing 0.53 grams per metric ton (g/t) gold, 0.4 percent copper, 1.27 g/t silver and 431.4 parts per million molybdenum.

Libero Copper LBC has a value of $25 million. Their Putumayo project in Colombia has seen limited exploration. From a November 2021 reported inferred values of 4.6 billion pounds of copper and 510.5 million pounds of molybdenum from 636 million MT grading 0.33 and 0.036 percent, respectively.

Chakana Copper PERU has a value of $25 million. In Peru, an initial inferred resource estimate released in February 2022 shows the site hosts 191,000 ounces of gold, 11.7 million ounces of silver and 59,200 MT of copper.

Northwest Copper NWST has a value of $44 million with their Kwanika-Stardust property in NW BC. It is a bit more advanced with Open Pit M&I resources 385 million pounds copper at Kwanika Central at 0.26% copper and 155 million pounds of copper at 0.28% at Kwanika South. These resources also include about 585,000 ounces gold and 3.34 million ounces silver.

Kodiak Copper KDK has a value of $38 million with their MPD copper project in Southern BC. They consolidated 4 properties with lots of historic drilling. KDK has drilled 123 holes since 2019 There is no resource calculation but they have discoveries on a few targets. Best drill holes are:

- 535 meters of 0.49% copper and 0.29 g/t gold in the Gate Zone

- 254 meters of 0.49% copper (0.58% CuEq) in the West Zone

- 116 meters of 0,34% copper (0.45% CuEq) in the Man Zone

Hercules Silver BIG has a value of $194 million and was known as a silver property in Idaho. However in October 2023 they discovered a copper porphyry at depth with the discovery hole starting at 256 meters and ran 0.84% copper, 0.01% molybdenum and 2.6 g/t silver over 185 meters. The stock ran from $0.25 to $1.60 on that and the current valuation is based on a $0.79 share price. It highlights how a copper discovery can respond in this recent market.

Great Pacific’s Tinya is not a good comparison because it has not had a drill hole yet, but I wanted to highlight the high valuation for a grass roots project. The average value of the other 7 companies is $67.6 million. If Giant Mining receives a valuation on average to these it would be $2.88 per share.

Giant Mining has some advantages with a tight share structure (low number of shares), in a very good district of Nevada with great infrastructure. I believe they also have good timing as far as getting started at the beginning of a bull market.

On the chart, the $2.88 valuation fits above resistance around $2.50. The resistance level around $1.80 is weak resistance. There is resistance around $2.50 and it is not very strong. We could easily see a move to $3.00 before there is strong resistance. A key level short term is a close over $1.00 for a higher high. Stock from the finance rounds will not become free trading until the beginning of September so little selling to get in the way this summer.

Ron Struthers owns shares of Giant Mining and they are a paid advertiser at my website playstocks.net

Thanks for reading Ron’s Substack! Subscribe for free to receive new posts and support my work.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Ron Struthers

Struthers Resource Stock Report

http://www.playstocks.net

For 27 years, Ron Struthers, founder and editor of Struthers’ Resource Stock Report and Playstocks.net, has consistently beat the comparable benchmarks selecting stocks in the precious metals, oil & gas, clean-tech and disruptive technology sectors. In 2017, 35 stocks in the precious metals sector saw an average gain of 62% and energy clean-tech an average gain of 65%. In disruptive technology, 16 picks saw an average gain of 55%. Past performance is no guarantee of future gains. Struthers leverages his vast network of contacts, approaches investments from a value perspective seeking several 100% gain potential and uses technical analysis to aid in buy and sell levels.