In a recent communication to Crescat’s clients and dedicated followers, Kevin C. Smith, Founder & Chief Investment Officer of Crescat Capital LLC, is making an emphatic call to action. Smith is urging investors to pay close attention to what he believes is a prime moment to allocate capital to Crescat’s investment strategies, describing it as one of the most opportune times in the firm’s history.

Smith is highlighting a unique confluence of factors that he finds exhilarating. This alignment of macroeconomic dynamics and promising value opportunities is presenting itself on both the long and short sides of the market, according to Smith. Drawing upon his extensive career experience, he has coined this phenomenon the “Great Rotation.”

The “Great Rotation” is not only a declaration of the market’s current state but also an invitation for investors to explore and participate in this strategic shift. Crescat Capital LLC, under Smith’s leadership, is poised to navigate this dynamic landscape, providing investors with the guidance and strategies needed to capitalize on this exciting market scenario.

As we await Crescat’s forthcoming monthly research letter, it’s evident that Kevin C. Smith is determined to lead investors through what he believes could be a historic opportunity. Stay tuned for further insights into the “Great Rotation” and how you can be part of it.

Two factors are conspiring to set this major investor shift into motion:

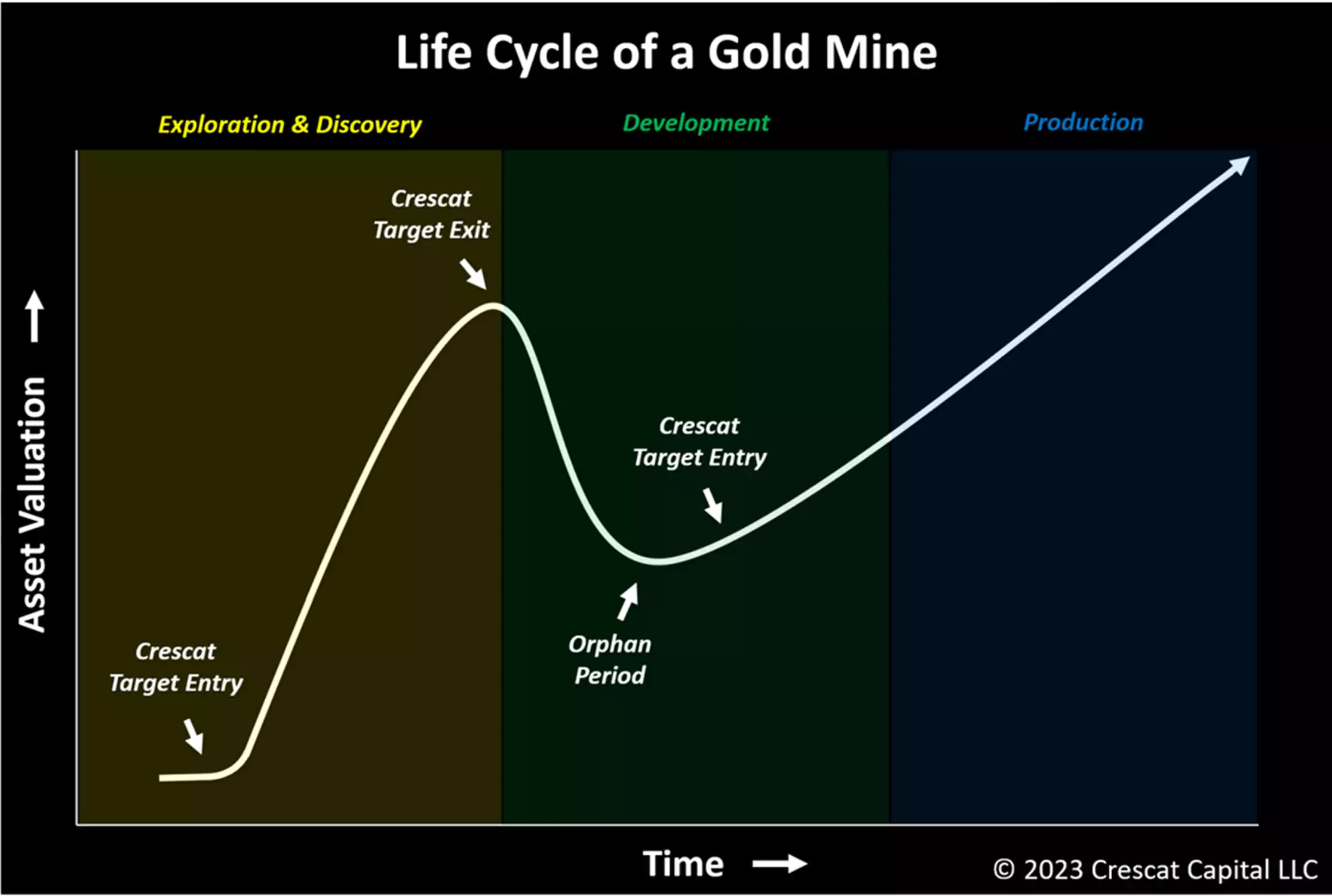

- A capitulation selloff in deeply undervalued, high-quality precious metals exploration stocks ahead of a likely new secular breakout and run in gold that presents a generational buying opportunity.

- A highly speculative double-top fizzling out of hyper-overvalued mega-cap tech stocks that presents a timely selling and/or shorting opportunity ahead of a likely stagflationary profit squeeze and recession.

High Intrinsic-Value Metal Discoveries Hiding Out in Deeply Undervalued Explorers

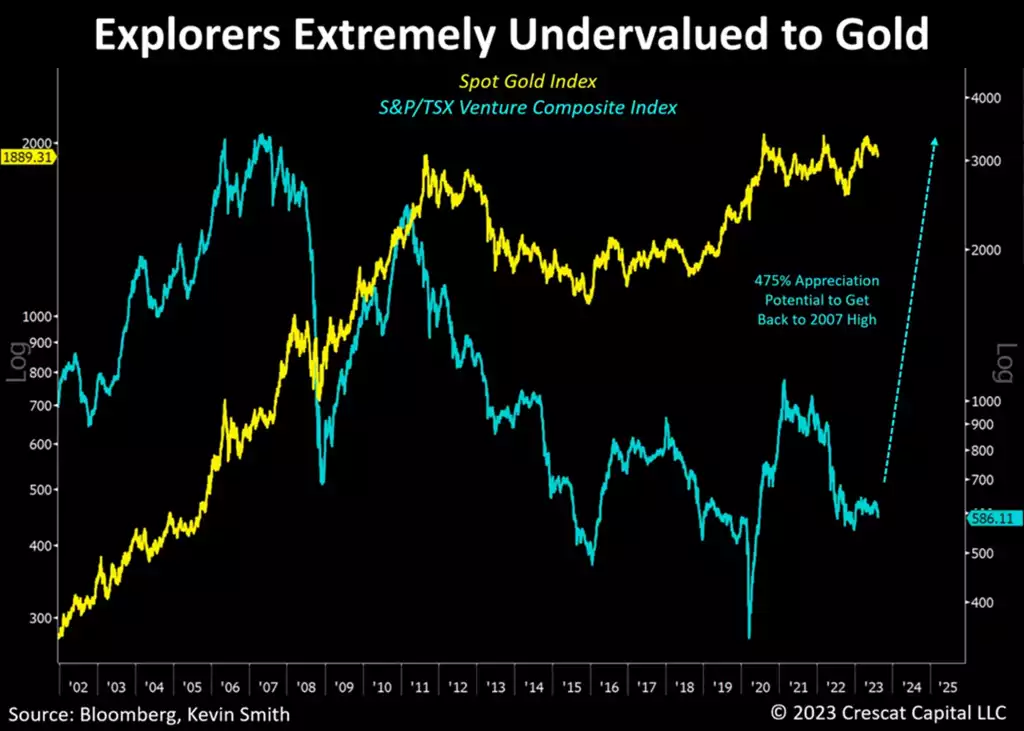

The mining industry, and the exploration segment in particular, is so undeservedly beaten down that it is ripe for a major turn. To understand how deeply depressed the exploration industry is, the S&P/TSX Venture Composite Index which is the benchmark for mining explorers, has a 475% appreciation potential just to get back to its peak from 16 years ago. That is quite possible, and I think inevitable with gold price itself getting ready to break out to new all-time highs; creating a long-term, cup-and-handle consolidation pattern for gold in the chart below.

But now imagine where our premier explorer holdings with their bona fide and incipient high-grade new discoveries are likely to go in a new raging bull market for precious metals. Our portfolio of explorers has been thoroughly vetted by Quinton Hennigh, Ph.D., Crescat’s highly experienced geologic and technical director.

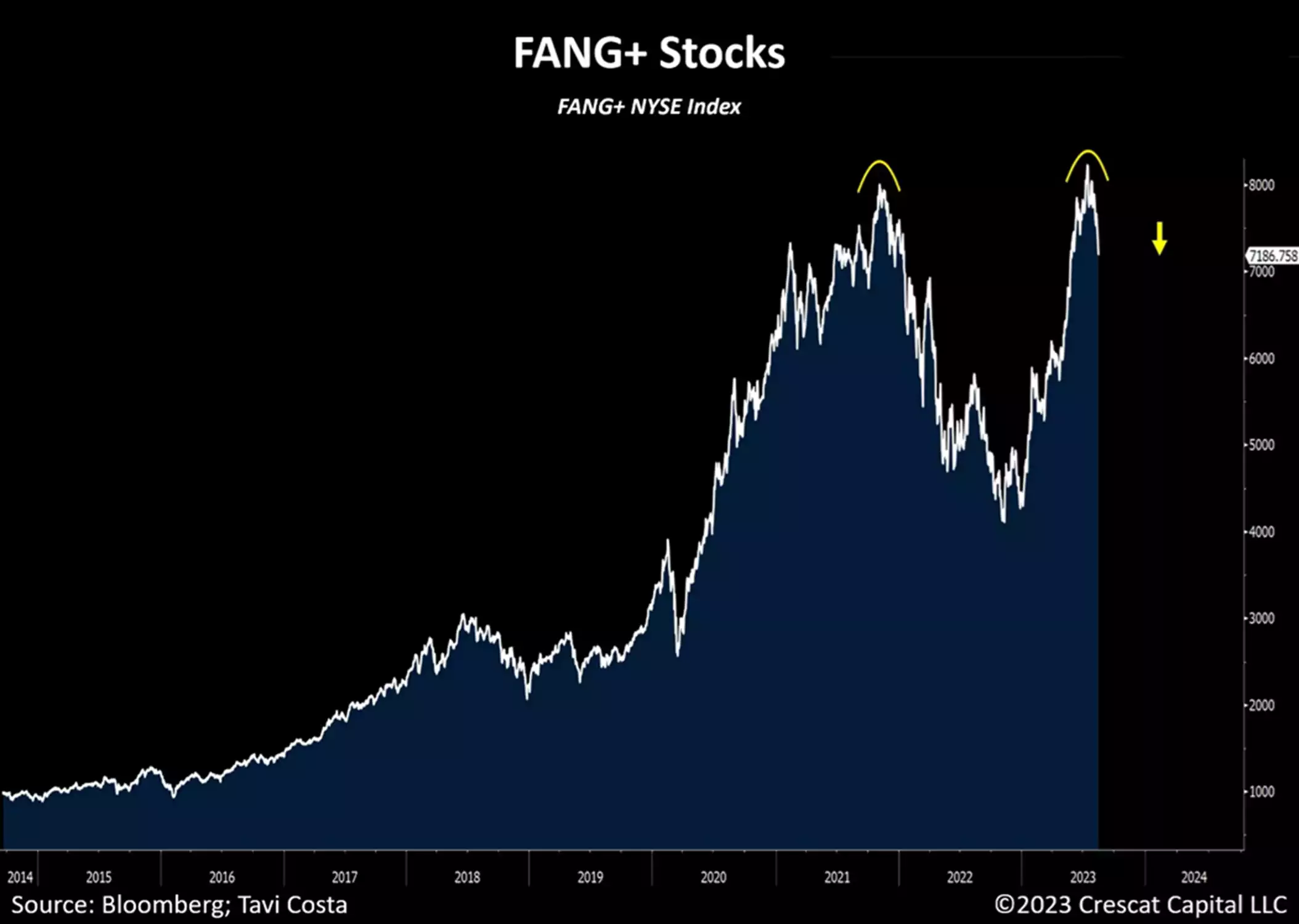

Megacap Tech Headed for Wreck

The short opportunity in overvalued megacap tech stocks and other short themes that we are expressing in our Global Macro and Long/Short Funds is equally compelling. The double-top formation in the NYSE FANG+ index is a bearish technical sign. The historically tight risk premia (low earnings yield relative to Treasuries) for this group of former winners combined with the Fed tightening is the bigger fundamental and macro setup. The trailing aggregate P/E for these ten megacap companies is a historically high 45 times. In this case, analysts’ highly questionable year-ahead earnings growth projections fueled by “AI” euphoria are contributing to ludicrous mispricing.

Our research shows these companies’ forward 12-month combined earnings are doomed to disappoint while their stock prices should become the subject of a violent repricing. For the roadmap, refer to the performance of large-cap tech stocks during the 2001 recession in the wake of the Internet bubble.

Stagflationary Hard Landing Looms

“In my strong view, based on my firm’s deep macro analysis, the popular notion that the economy is headed for a disinflationary soft landing will be proven completely wrong on both counts over the next year. In other words, we have the macro setup for both the re-emergence of rising inflation and a downturn in inflation-adjusted GDP directly ahead of us.“

Kevin C. Smith, Founder & Chief Investment Officer

Supply-shock vengeance from critical commodities, such as energy, food, and shelter, and the metals at the core of all of these, should trigger the next inflation wave. In turn, inflation will drive the hard landing for both the real economy and overvalued financial assets. Furthermore, we believe the true cost-of-living increase for basic needs is already hitting hard across the broad middle and lower-income classes. It is setting off increased labor strife that will only feed an ongoing wage-price spiral that in our view could be the bane of policymaker existence for years to come.

“For now, because of the likely incorrect macro narrative being spun by Wall Street cheerleaders and the financial media, and the correspondingly lopsided market positioning, there are incredible value-oriented, contrarian investment opportunities that abound on both the long and short side of the market.“

Kevin C. Smith, Founder & Chief Investment Officer

Metals Are the Common Denominator

The long-side opportunities that excite me and our firm the most are the deeply undervalued precious and base metal explorers that control vast, high-grade mineral resources. They can strongly benefit throughout the likely coming business cycle shift that starts with a stagflationary recession favoring precious metals and then morphs into a commodity-driven expansion favoring all metals, particularly of the electrification-oriented variety.

Metals are the common denominator for the macroeconomic climate ahead. In our analysis, they are the most critical resource needed for the green energy movement to reduce the world’s economic reliance on hydrocarbons and bring down greenhouse gas emissions. Metals are the key to harnessing electricity. They are the most important raw material for the global power infrastructure, including the electricity grid transmission and storage, i.e., batteries. We need them for renewable energy production through wind and solar. They are also key to the generation and transmission of nuclear power which through small modular reactor technology is the re-emerging energy solution that offers both high energy return on energy invested (EROI) and low greenhouse gas emissions to reduce the world’s long-term reliance on oil and gas. In the short run, the world still relies on oil and gas. The cyclical past underinvestment there, in direct opposition to the CAPEX cycle ahead of the GFC, risks near-term commodity supply-shocks and a second wave of long-term structural inflation that will catch the average investor off-guard.

The problem is that due to anti-mining sentiment and underinvestment for more than a decade across the major mining companies in the G7 economies, mine lives and grades have all been declining, not just for gold and silver but for all crucial metals that the world needs to meet the demands of the energy transition. Silver fantastically fits in both the precious and electrification metal buckets. The lack of new supplies of copper, nickel, zinc, cobalt, and manganese is a problem for the future electricity demand. Lithium is one exception where investment has already been strong and supplies are increasing amid apparent high demand, but valuations for these miners are high, and there is the risk of competing new metals for batteries.

Monetary Metals Likely to Explode Higher

“The demand for monetary metals, including both gold and silver, should absolutely explode in the inflationary hard landing that we envision. Monetary metals will likely be among the first commodities to break out to the upside in the months ahead. As overvalued financial assets come crashing down, investors will first look for the safest inflationary hedge to round out their portfolios.“

Kevin C. Smith, Founder & Chief Investment Officer

Because of the structural supply-demand imbalances, we believe metal prices have the potential to explode. The companies that stand to benefit the most in this environment are the exploration-focused miners that control the large new high-grade deposits, like the super-undervalued ones in our portfolio. Once metals prices rise, the large mining companies will have little choice but to buy companies like those in our activist exploration bucket to catch up with their past lack of investment, and I am highly confident that they will be paying substantial premiums compared to where the market is valuing our companies today.

The managements of the major mining companies were rightfully accused of poor capital allocation in the last cycle. They spent like drunken sailors, literally buying up everything in the 2000s, including many low-grade uneconomic deposits that would never become mines. They bought them anyway and overpaid because it was a bull market and investment capital was abundant. But because of the shareholder boycott and somewhat rightfully deserved abuse ever since then, managements have gone completely the other way in the last decade-plus and have grossly underinvested. To their defense, they haven’t had the capital to invest while policy headwinds have also been fierce.

I believe the policy environment will shift entirely out of necessity in the coming years under expanded fiscal stimulus programs that will benefit mining companies once the stagflationary shocks really start hitting. At that point, existing fiscal programs like the Inflation Reduction, Infrastructure, and CHIPS Acts will likely expand to continue the trend toward manufacturing onshoring, infrastructure rebuilding, and electrification. That will be the government’s push to get the economy out of the recession, and it should be a substantial driver of a long-term commodity bull market cycle at the core of the next economic expansion. I envision a long-term commodity bull market emerging just like the one that came out of the tech bust in 2001. But rather than being driven by China’s meteoric infrastructure build, as it was at that time, it will likely be driven by a similar effort across G7 economies.

“I believe the negative sentiment from the general investment community toward the mining industry is way overdone. The true problem is that the industry has been starved of the capital it desperately needs to meet critical demand. This risks large upward price shocks in commodity prices. What goes around comes around.“

Kevin C. Smith, Founder & Chief Investment Officer

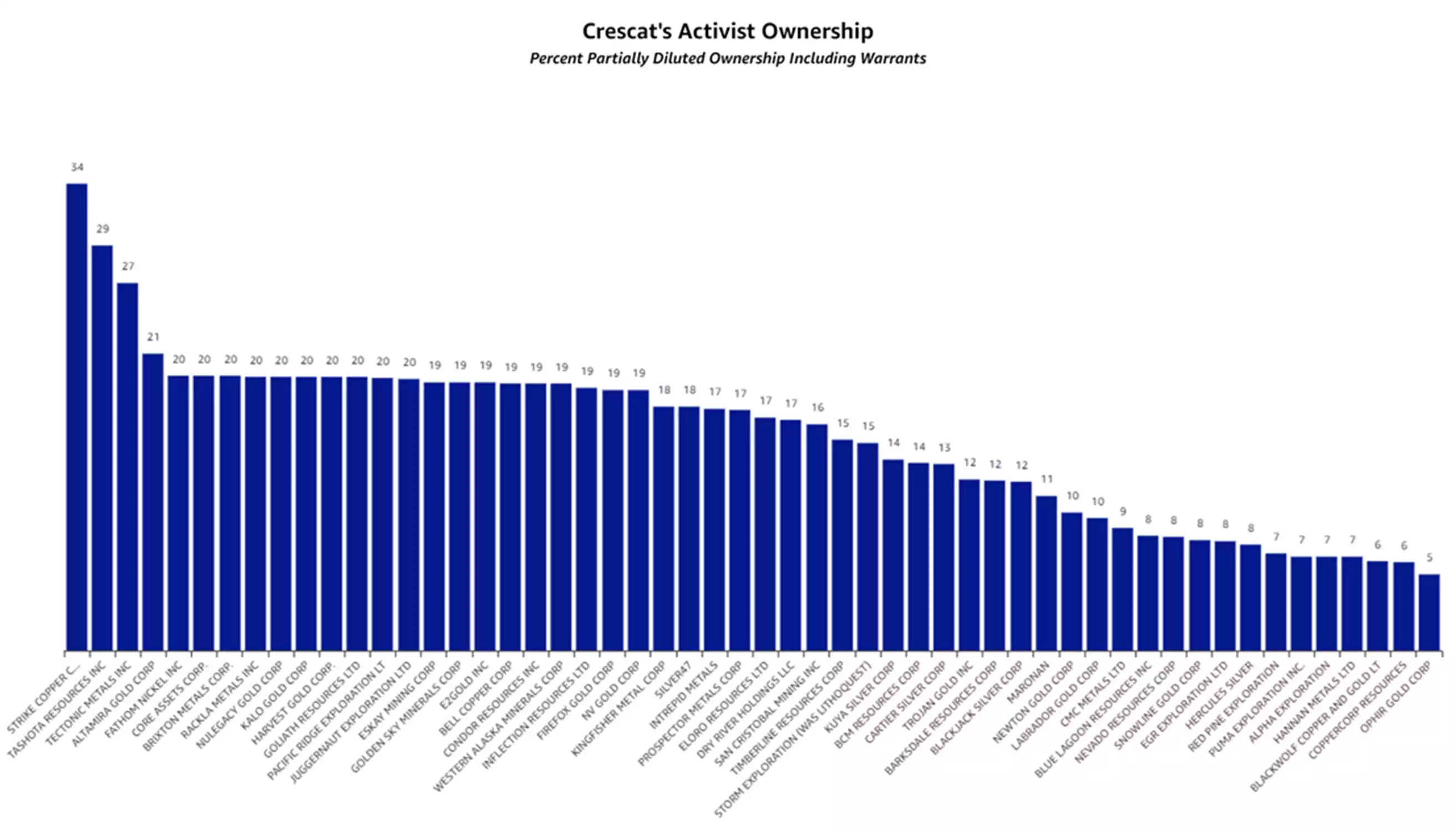

What we are doing is indeed a distressed industry opportunity and a chance for us to bring institutional capital intelligently into mining exploration to get some of the best early-stage investments ahead of a major new commodity cycle. The market has been so depressed that Crescat’s funds have been able to acquire substantial activist stakes of more than 5% ownership across 55 companies already over the past three years. It has been an extraordinary amount of due diligence and steady accumulation over this time.

Sam Zell told Quinton, Tavi, and me that we were “ahead of the curve” when we pitched him on our activist metals strategy one year ago. You should have seen his eyes light up, by the way, when we told him about Snowline. Unfortunately, he passed away in May of this year. Sam Zell was a master macro timer. He is the type of investor who I think would be loading the boat right now on a strategy like ours if he were still alive. Those are the types of investors we are seeking to attract and retain now. I believe we indeed are early and ahead of the curve, which is exactly where we want to be. We are doing it in what I think is the most intelligent way possible with Quinton’s expert guidance, and we intend to capitalize on that for our clients in spades. I am confident that other smart, large pools of capital will very soon start to see this industry-wide opportunity and get on board. I am dedicated to going after as much of that money as we can and channeling it through Crescat to further catalyze this opportunity in the best way possible for all our clients.

Overvalued Financial Assets Offer Ripe Short Opportunities

the same time, I continue to believe there are incredible short opportunities in the market, and I am determined to exploit them for our clients in our Global Macro and Long/Short funds. The market at large is ripe for a potentially violent repricing of a broad variety of overvalued financial assets. On the equity side, we are currently short megacap tech, private equity sponsors, and a variety of overvalued and highly-levered equities based on our models mostly through put options. In fixed income, we think the setup for shorting the junk bond market ahead of a stagflationary recession is amazing, and we are positioned for that via index puts in the Global Macro fund.

Confessions of a Die-Hard Value Investor

I have been managing money professionally for clients for 31 years and have been invested alongside them the entire time. As the largest investor across our hedge funds, along with my wife, Linda my co-founder and

Crescat’s chief operating officer, we have never been more excited than we are today about the opportunities to capitalize on both the long and short sides of the market ahead of a likely critical macro inflection in the business cycle.

Please understand that I am a die-hard value investor with a mindset that pullbacks are part of the game and never a permanent loss of capital. At Crescat, we strive to cultivate clients who can have that same frame of mind. It is guided by our firm’s investment principles and models that give us the understanding that the intrinsic value of our portfolios is always substantially greater than the market price. As such, we are confident that pullbacks are great opportunities for both new and existing investors to deploy new capital into our strategies.

I cannot convey how excited I am about the outlook for our exploration-focused activist metals portfolio. I believe it is one of the single best distressed deep value/high appreciation potential plays in the market today. After an unbelievable 16-year bear market, this industry segment has endured insult to injury since the Fed began raising interest rates in March of 2022. The crazy thing is that these rate hikes only make the structural commodity supply problem for the metals worse by starving the industry of the capital it desperately needs to increase supply. The only further ensures a likely brutal stagflationary recession on the horizon.

Our activist metals long side is a finely crafted portfolio with multi-bagger appreciation potential discoveries in great mining jurisdictions. This is the stuff that the world desperately needs. It is in short supply and will soon be in very high demand, not just the electrification metals but the monetary metals too as long-term inflation is setting up to emerge in a big way.

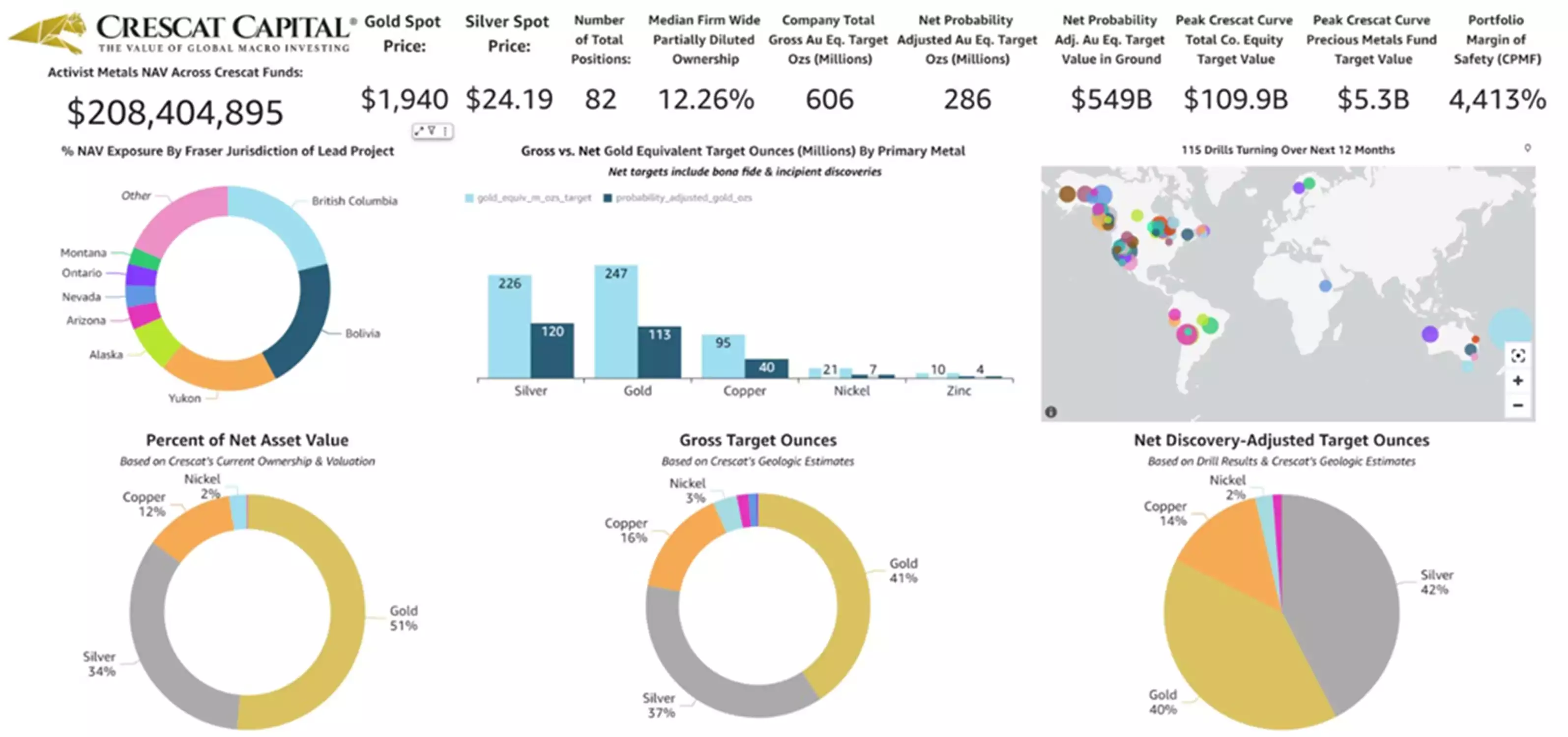

This has been extremely frustrating, to be involved in making so many great discoveries when the world doesn’t seem to care or be paying attention at all, but I am undeterred and more determined to raise capital than ever. The upside opportunity is incredible here, many multiples of what we are down from our high-water marks, which I am confident we can make up very quickly. I wish I could convey better how strong our portfolio is especially in terms of how much metal our companies control compared to what the market is giving them credit for. This dashboard is an attempt to explain that:

I think metals exploration could be the biggest investment opportunity on the planet right now. Our portfolio therein is guided by Quinton Hennigh Ph.D., a highly experienced geologist who is a true leader in the industry at creating value through discovery and activist involvement. Quinton has over three decades of mining experience with both major mining companies and junior explorers. He has guided us to what we believe is the best upside value creation possible in the industry. It is the exploration and discovery side of the industry where the billionaires in this industry have made their fortunes. This is why we are focused here in a diversified way at this incredible macro time.

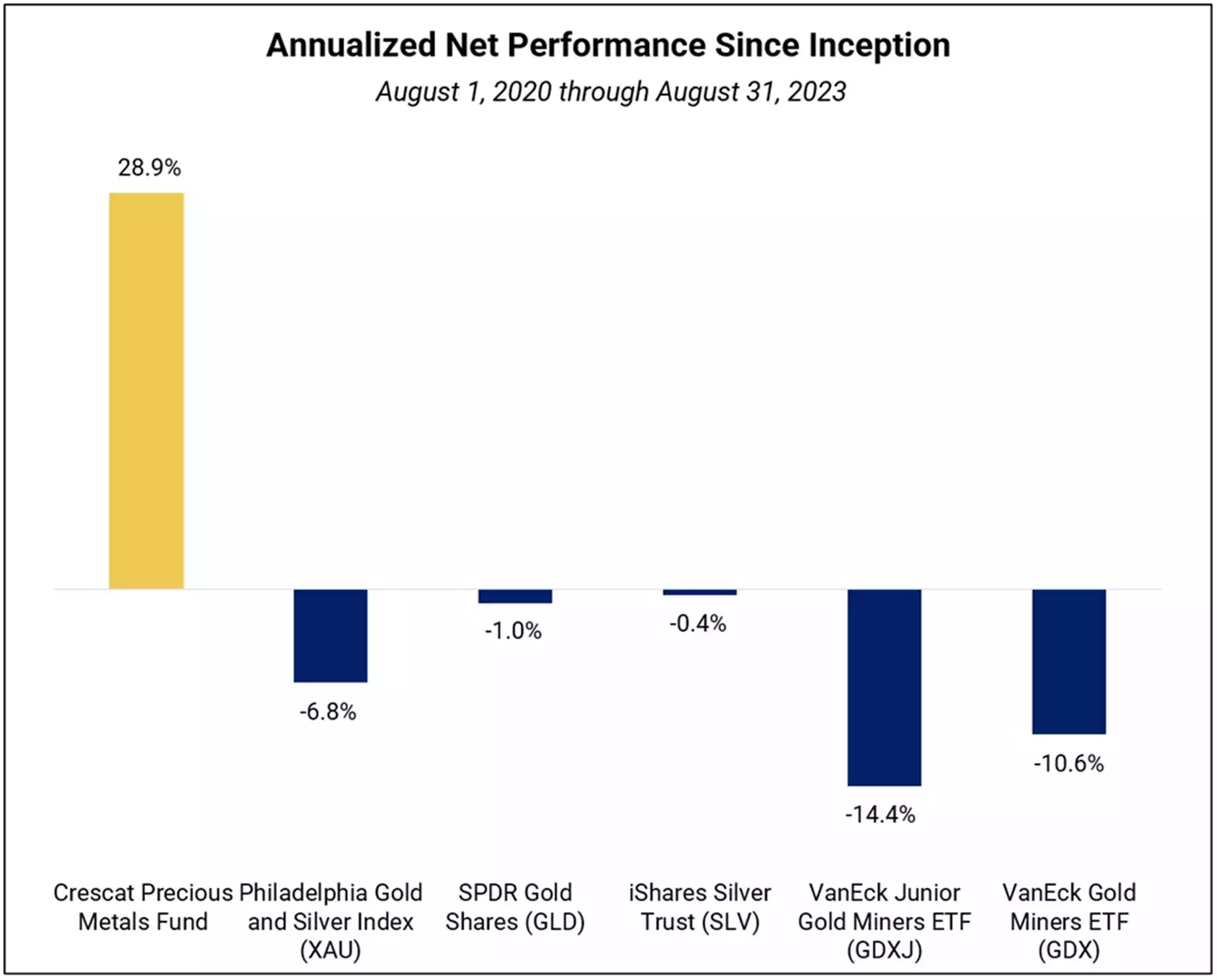

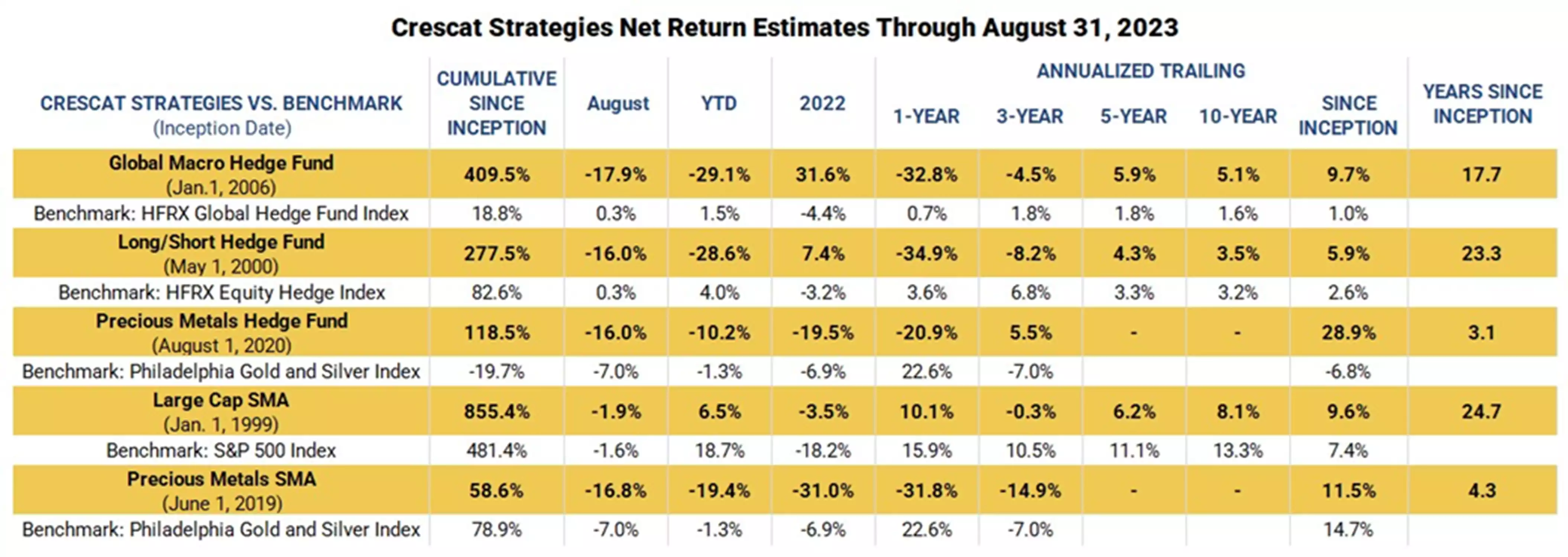

Please keep in mind that even with the pullback in our Precious Metals Fund that has persisted throughout the Fed rate hike campaign of the last 16 months, our fund has substantially outperformed the relevant benchmarks since inception as shown in the chart below. If we can do this in a bear market being invested fully long across the industry, imagine what we will be able to do in what is likely to be a coming raging bull market.

Performance data represents past performance, and past performance does not guarantee future results. Performance data is subject to revision following each monthly reconciliation and/or annual audit. Historical net returns reflect the performance of an investor who invested from inception and is eligible to participate in new issues. Net returns reflect the reinvestment of dividends and earnings and the deduction of all fees and expenses (including a management fee and incentive allocation, where applicable). Individual performance may be lower or higher than the performance data presented. The performance of Crescat’s private funds may not be directly comparable to the performance of other private or registered funds. The currency used to express performance is U.S. dollars. Investors may obtain the most current performance data and private offering memorandum for Crescat’s private funds by emailing a request to [email protected].

If you are interested in delving deeper firsthand with me, I would love to have a Teams video conference with you to take you through our portfolios and walk you through the timely opportunities we see in the market today across our funds and SMA strategies. Please reach just reach out to me or Marek to set that up. Our contact information is directly below.

Kevin C. Smith, CFA

Founder & Chief Investment Officer

[email protected]

(303) 228-7374

Please also feel free to reach out to anyone on our senior operations and investment team. Their contact information is below.

Linda Carleu Smith, CPA

Co-Founder & Chief Operating Officer

[email protected]

(303) 228-7371

Tavi Costa

Member & Macro Strategist

[email protected]

(303) 228-7375

Quinton T. Hennigh, Ph.D.

Member & Geologic and Technical Director

[email protected]

(720) 938-1945

Important Disclosures

Performance data represents past performance, and past performance does not guarantee future results. An individual investor’s results may vary due to the timing of capital transactions. Performance for all strategies is expressed in U.S. dollars. Cash returns are included in the total account and are not detailed separately. Investment results shown are for taxable and tax-exempt clients and include the reinvestment of dividends, interest, capital gains, and other earnings. Any possible tax liabilities incurred by the taxable accounts have not been reflected in the net performance. Performance is compared to an index, however, the volatility of an index varies greatly and investments cannot be made directly in an index. Market conditions vary from year to year and can result in a decline in market value due to material market or economic conditions. There should be no expectation that any strategy will be profitable or provide a specified return. Case studies are included for informational purposes only and are provided as a general overview of our general investment process, and not as indicative of any investment experience. There is no guarantee that the case studies discussed here are completely representative of our strategies or of the entirety of our investments, and we reserve the right to use or modify some or all of the methodologies mentioned herein.

This presentation is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. Securities of a fund managed by Crescat may be offered to selected qualified investors only by means of a complete offering memorandum and related subscription materials which contain significant additional information about the terms of an investment in the Fund and which supersedes information herein in its entirety. Any decision to invest must be based solely upon the information set forth in the Offering Documents, regardless of any information investors may have been otherwise furnished, and should be made after reviewing such Offering Documents, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment in the Fund.