Monthly market Insights – Review of April 2024

Market Indices

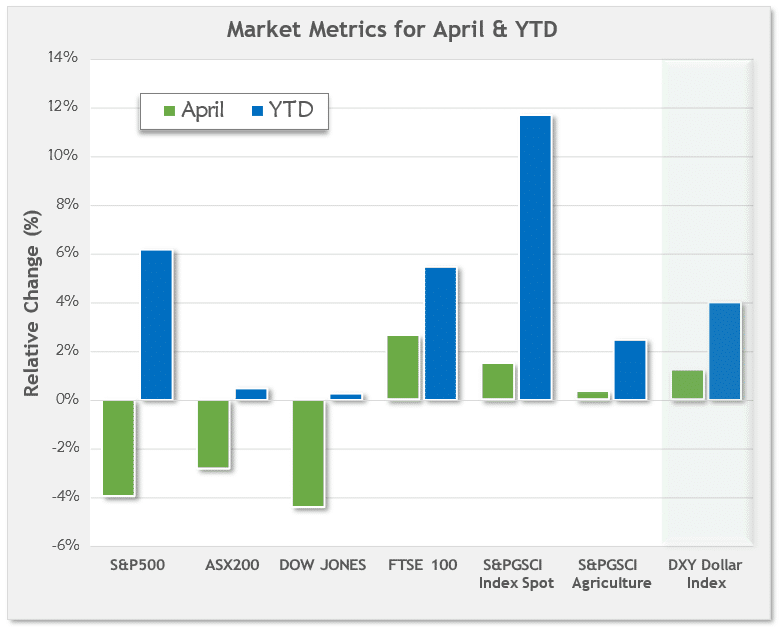

The US equity markets’ recent uptrend was interrupted in April (4% drop M- o-M SPX) due primarily to mixed earnings from the “magnificent 7” MegaCap tech stocks and a surprise uptick in inflation with rate cuts now less likely.

- Tesla missed revenue forecasts but bounced on news cheaper models are forthcoming along with some AI-innovations.

- lphabet surpassed expectations with a record quarterly net income, causing its stock to surge by 10%.

- Microsoft also posted gains following robust results.

- Despite Meta’s significant earnings increase, its shares fell after announcing large investments in AI projects that are not yet profitable.

- Higher than anticipated inflation in March has dampened expectations for interest rate cuts by the US Federal Reserve this year.

ASX 200 resources index dropped 2.8% in line with both the S&P500 and Dow Jones indicating that the recent global bull run in equities is reversing as inflation remains persistent.

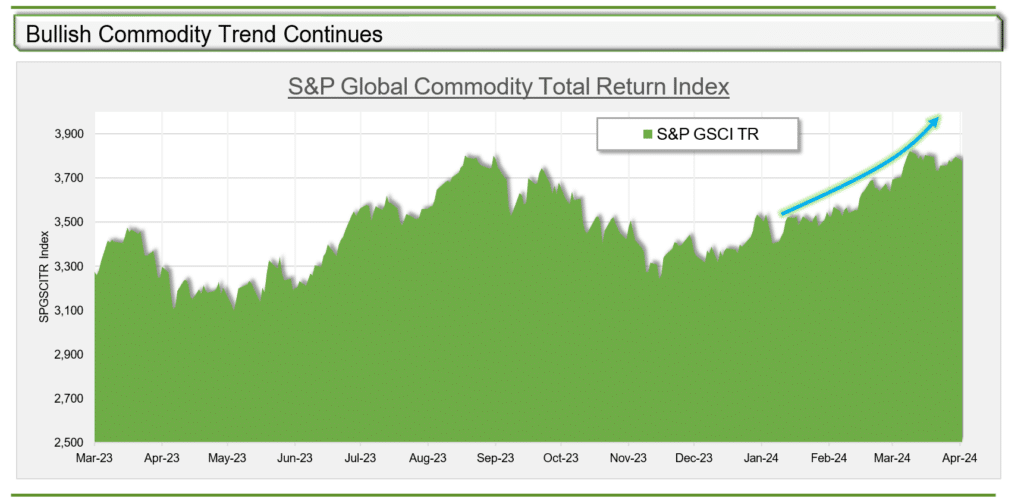

Global commodity indices continued upward as capital flows back into “real” assets with S&PGSCI up 1.5% and its Argi equivalent up 0.3%.

The Federal Reserve is likely to maintain its key interest rate at the current level during this week’s meeting due to sticky inflation, low unemployment & a persistently strong US economy (US GPD was 1.4% (annualised) over Q1, slightly missing expectations).

The US dollar index rose by 1.2%, reflecting ongoing demand for USD amid a robust US economy and a possible “flight to safety” to US assets as global geopolitical tensions continue to escalate.

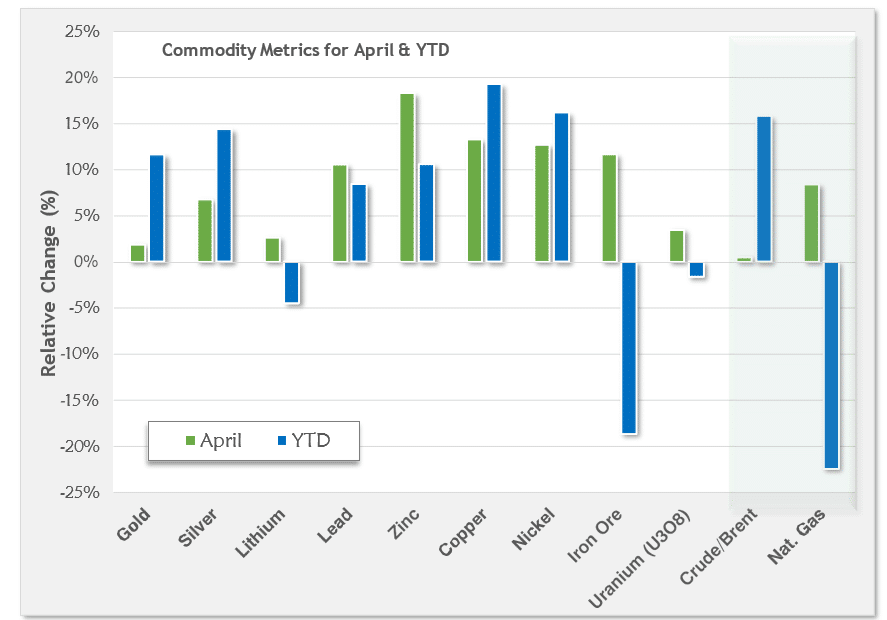

Commodities – all monitored have appreciated in value during April

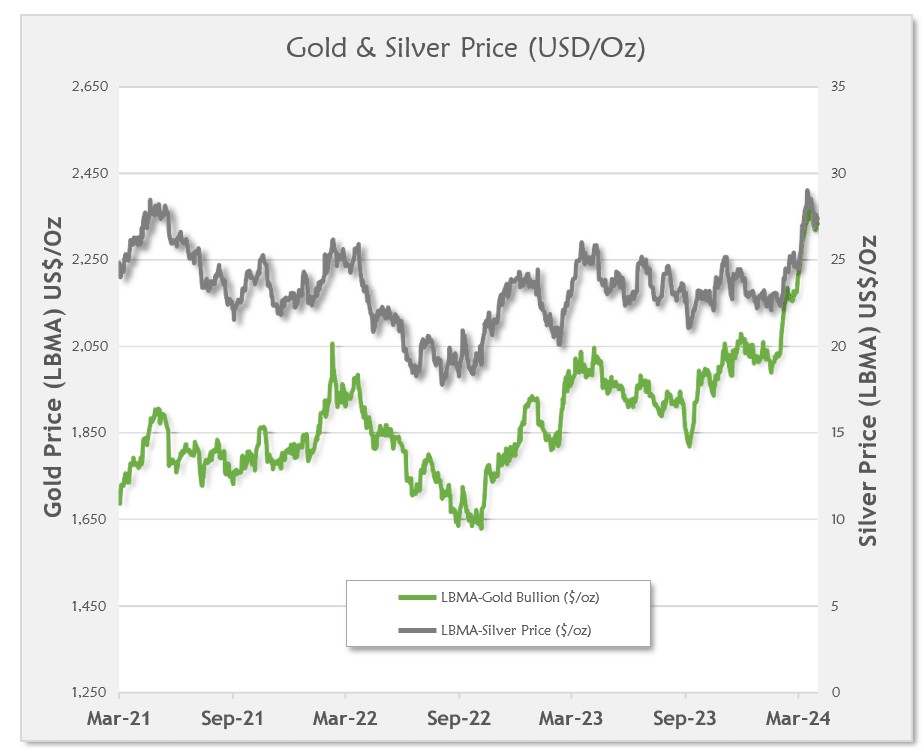

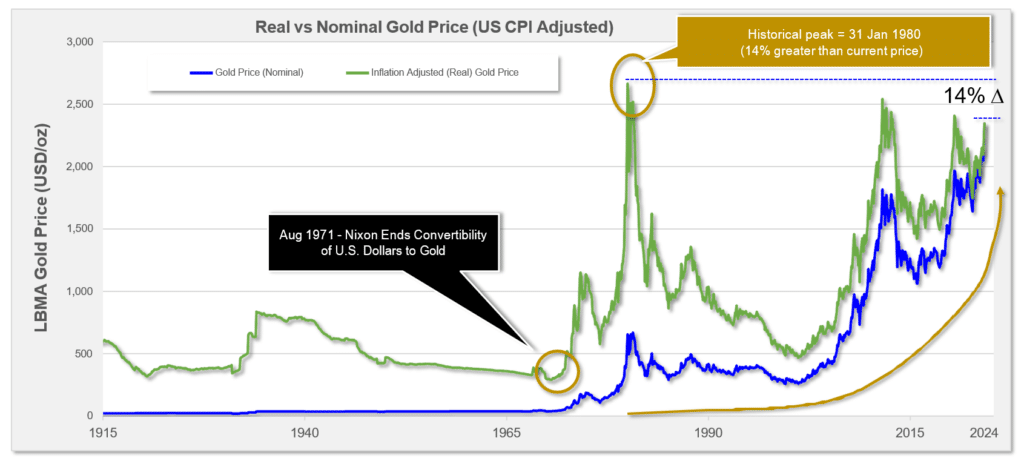

- The Gold price in USD has experienced a record-setting surge, climbing beyond a nominal all-time peak of $US2400 at the start of April, with a minor pullback since.

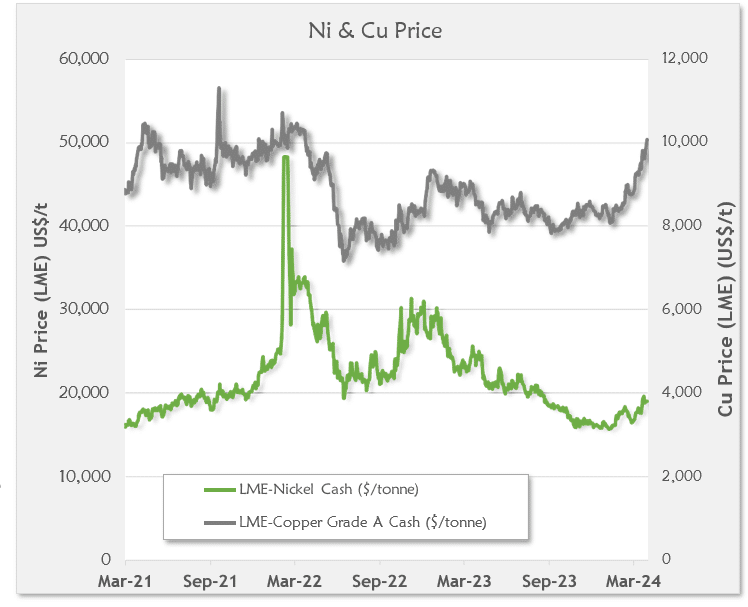

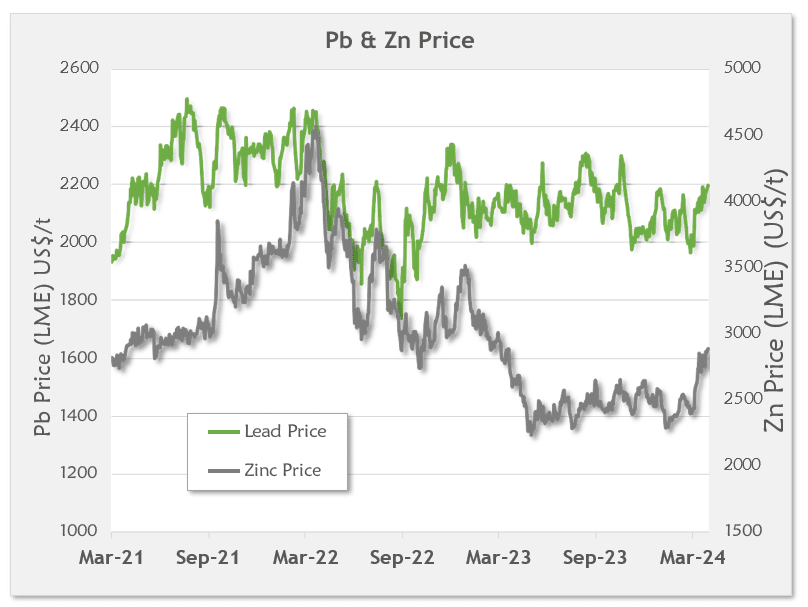

- All base metals experienced an increase in price over April as demand increases from manufacturing sector improvements in the USA and China, and supply disruptions. Peak performers: Zinc up 18.3%, Copper up 13.2%

- In April, futures prices for copper are now surpassing spot prices, resulting in the largest contango seen in >two decades. This is very bullish for the red metal.

- Lithium (carbonate) prices have consolidated following recent significant declines from Chinese destocking & slowing electric vehicle sales.

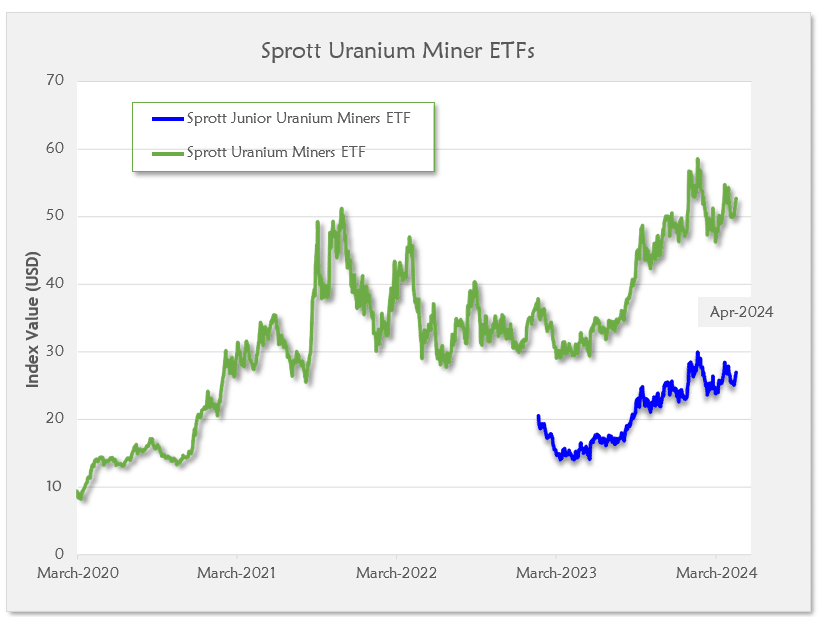

- Uranium price consolidated following recent rapid uptick. Price outlook remains very bullish on demand / supply fundamentals.

- Iron ore rebounded following its recent decline as increased industrial demand emanates from China’s improving manufacturing sector, however, the outlook remains uncertain.

- Natural gas and oil both increased over April.

Manufacturing Purchasing Managers’ Index (PMIs)

- PMI Indices are commonly used as an indicator of the overall economic condition in the manufacturing sector.

- They are widely tracked and reported on as leading economic indicators.

- A level above 50 indicates economic expansion, while <50 indicates a contracting economy

- Three indices are presented across:

- MPMIGLMA: Global Manufacturing PMI, a composite index produced by J.P.Morgan, S&P Global & ISM)

- NAPMPMI: US Manufacturing PMI represented by the ISM (Institute for Supply Management) Manufacturing)

- CPMINDX: Chinese Manufacturing PMI represented by the China Manufacturing Purchasing Managers Index

Commodity Reviews

Gold / Silver

Hot demand drives Au prices to new (nominal) highs / Ag breaks out

- The nominal price of gold has experienced a record-setting surge, climbing

20 percent in just two months to surpass $US2400 (A$3754) per ounce.

This remarkable rise has occurred despite high real bond yields that adjust

for inflation, and a strong US dollar, both of which typically undermine

gold’s performance. - Safe-haven demand for Au is high amid two ongoing geopolitical conflicts,

and central bank purchases are rising steadily. - GDX (VanEck Vectors Gold Miners ETF) and GDXJ (VanEck Vectors

Junior Gold Miners ETF) are exchange-traded funds (ETFs) that provide

investors with exposure to the US gold mining industry – both up ~ 9%

over April signifying a sentiment change amongst US investors. - US Economy Signals Stagflation: Q1 2024 US GDP up 1.6%, missing

2.5% forecast. Core PCE price index up 0.3% last month; annual rate at

3.1%. Gold prices rise amid stagflation concerns. - China’s Gold Demand Rises: Q1 gold consumption up nearly 6% due to

safe-haven demand. Central bank purchases continue, total reserves now

at 2,262.67 tons. - Industrial Demand for Silver Hits New Highs: 2023 industrial demand at

record 654.4 million ounces, driven by green economy. Total silver

demand down 7% year-on-year. - Silver demand heavily influenced by industrial demand (most conductive

metal) i.e. solar PV, semiconductors. Monetary demand is anticipated to

increase when (if) Gold has a sustained breakout.

Silver is still “cheap” compared to historical standards – the Gold/Silver Ratio

Gold is still “cheap” historically when inflation is factored in

Uranium

Some pullback, but price outlook remains very bullish on demand / supply fundamentals

- Recent significant uptick in yellowcake (U3O8) spot price has been driven by a continued decline in mobile uranium inventories.

- Structural supply shortage projected over next 10 years with limited scope for near-term supply response.

- Significant resurgence in global interest in nuclear power due to its low carbon emission intensity and practicality for achieving “net zero” targets by 2050.

- Several new nuclear reactor builds underway (dominated by China) and also, restarts in USA, Japan & Europe.

- enCore Energy Sets Ambitious Production Goals: Company aims to increase production with key workforce retention amidst expansion. Targets 5 million pounds of uranium oxide by 2028.

- Boss Energy Commences Uranium Production: First uranium drum produced at Honeymoon, South Australia. Production set to increase to 2.45 million pounds/year.

- Paladin Resumes Production at Langer Heinrich: Namibian mine back in operation, producing yellowcake after six years.

- Rio Tinto to Oversee Ranger Mine Rehabilitation: Management of Ranger uranium mine’s closure in Northern Territory handed to Rio Tinto by ERA.

Sprott Uranium Miner EFTs show increase in NAV

- Sprott miner EFTs trade ~ with spot price. Both up year to date with Juniors outpacing larger Miners as speculative money comes back into the sector

INVESTOR INTEREST DRIVEN BY:

- Major demand anticipated over coming years from AI & datacentre boom (highly energy intensive), with major tech companies seeking reliable base load power and a low carbon dioxide emission footprint.

- Fast Developing tech require increased datacentre usage.

- Term contracting (volume & price) increases since mid- 2023 – signalling contracting has returned to fundamentals

- Chinese demand for nuclear energy expected to grow from 18% to 35% of global uranium requirements by 2040

- COP28: 22 countries have launched a declaration to triple nuclear energy by 2050 (Recognised as a ‘green’ source of energy)

Uranium – Historical Spot Price adjusted for Inflation

How “cheap” is the current Yellowcake spot price on an inflation adjusted basis?

- The previous spot price peak was June 2007 where it reached US$136/lb.

- Inflation adjusting this into today’s dollars it equates to US$207/lb (⇛ 137% above current spot price)

- Hence, significant room for the spot price to keep increasing before reaching most recent high.

- In real terms the U3O8 price remains modest

Lithium

Minor rebound this month as price stabilizes ~ US$15/kg

- Lithium prices consolidate amid surplus and steady production expansions: Despite global demand and importance in EVs, price recovery remains slow due to ongoing surplus and aggressive expansion by major producers.

- Mt Holland mine begins production in Western Australia: Joint venture by SQM and Wesfarmers initiates lithium hydroxide production, aiming to supply nearly one million EVs annually for 50 years.

- Tianqi Lithium pushes for shareholder vote on SQM and Codelco JV: Concerns over lack of financial transparency in the deal prompted by Chile’s push to increase state role in lithium industry.

- Chile solicits proposals for lithium extraction at Salares Altoandinos: Rio Tinto, Eramet, and LG Energy among 30 companies submitting technological proposals, highlighting environmental considerations.

- US BLM advances Ioneer’s Rhyolite Ridge lithium mine in Nevada: Project poised to supply lithium for 370,000 EVs annually, balancing economic benefits against biodiversity concerns with a new mine design.

Nickel & Copper

Surge in both Cu & Ni prices underpinned by improved demand

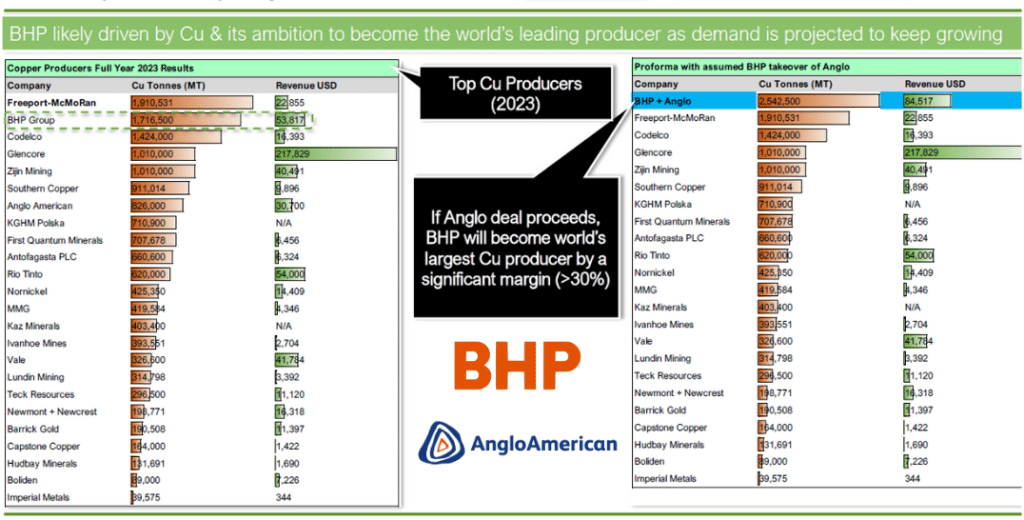

Copper

- Supply gap concerns: Increasing metal requirements for clean energy solutions highlight a looming shortfall in copper, crucial for electric vehicles and renewable energy infrastructure. Price up ~ 12% MoM.

- Global mining investment too low: Rio Tinto chairman Dominic Barton warns that inadequate investment in mining is jeopardizing the global energy transition, risking a significant supply gap in copper & others.

- BHP mulls higher bid for Anglo American’s copper assets: After initial $39-billion offer rejection, BHP are likely to up their bid.

- Anglo American boosts Q1 copper output by 11%: Increases at Quellaveco, Collahuasi, and El Soldado driven by high-grade ore.

- Global interest surges in Zambian copper mines: Companies like Rio Tinto and Manara explore stakes in First Quantum’s operations.

- Codelco’s production drops amid aging assets: Chile’s state-run firm faces 9.6% decline in output, signaling supply challenges.

- Teck Resources’ copper production jumps 74% in Q1: Driven by new QB mine in Chile, projecting competitive annual production.

Nickel

- Ni surged ~13% in the wake of sanctions on Russian metal supplies, improved demand from Chinese manufacturing, & news of regulations by China’s NDRC to regulate steel production.

Lead & Zinc

Both base metal prices rebound on improving demand fundamentals

Zinc

- Tightening supply has driven the London Metal Exchange three-month (LME 3M) zinc price to US$2,882/t at the end of April, triggered by Young Poong Corp. curtailing production at its Seokpo smelter in early March.

- Vedanta’s profits fall 27% amid lower metal prices and rising costs: Indian conglomerate struggles with weaker aluminium and zinc markets.

- Boliden’s earnings halved due to adverse conditions: Bad weather, lower grades, and strikes impact first-quarter profitability in Sweden.

- Glencore PLC’s Nordenham zinc smelter in Germany has resumed operations partially, but given curbed production at Seokpo, we expect a more sedate rise in global refined zinc supply in 2024.

Lead

- Lead demand growth has rebounded in April following improved demand from China & tightening supply. Prices on the LME ended April at ~ US$2,196/t

Iron Ore

Prices rebound slightly in April and remain elevated based on historic norms, but outlook remains uncertain

- The IODEX 62% Fe fines benchmark reversed its recent downtrend during April as Chinese demand outlook improved. However, the mid-term outlook remains uncertain with recessionary fears in both USA & China.

- Steel market fundamentals have improved in China, with inventories declining up and demand improving from the construction and manufacturing sectors.

- Despite a muted overall global demand for steel, the World Bank anticipates that iron ore prices will remain above the critical threshold of $US100 ($153) per ton. This forecast contrasts with the more pessimistic predictions offered by numerous analysts.

- Rio Tinto’s iron ore shipments drop 5% in Q1: Weather impacts lead to reduced shipments, stable production expected in 2024.

- Vale’s Q1 profits dip due to lower commodity prices: Earnings fall to $1.7 billion, slightly below forecasts. Vale & BHP approaches settlement over Mariana dam disaster.

Oil & Natural Gas

Improvement in price over April

- Oil & NG prices volatile amid Israeli conflict in the Middle East and U.S.

- The recent rise in LNG prices is primarily attributed to supply worries, fuelled by the conflict in the Middle East. Concerns persist that the ongoing unrest might disrupt shipments from Qatar, the world’s third- largest LNG exporter.

- Although these disruptions have not yet occurred, the cost of LNG shipments has increased as vessels heading to Europe are avoiding the Red Sea. This precautionary route change is in response to missile strikes by Yemen’s Iran-aligned Houthi group, which have targeted several vessels, though none were LNG carriers.

- Norway wealth fund criticized for inadequate climate action: NGO highlights fund’s insufficient backing for shareholder proposals on emission reductions.

- Turkey negotiates major LNG purchase with ExxonMobil: Seeks to diversify energy sources and reduce reliance on Russian gas

- Russia vows to counteract EU sanctions on LNG: Kremlin plans to mitigate impact on its liquefied natural gas operations.

- Woodside Energy faces shareholder rejection of climate plan: Activists

score symbolic victory against Australia’s top gas producer.

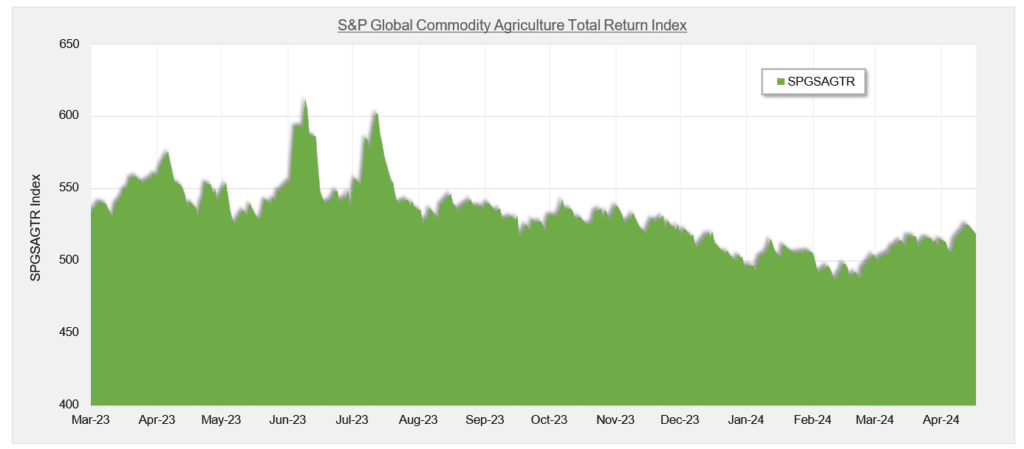

Agriculture

This sub-index of the S&P GSCI, provides investors with a benchmark for investment performance in the agricultural commodity markets.

Cocoa uptrend has softened but large increase has lifted the overall Index. Coffee also increasing due to shortages.

Other Commodity Sector Updates

“Critical Minerals” News from across the sector

- Energy Fuels Acquires Base Resources: Following the transaction, Base shareholders will hold 16.4% of the new entity. This move aims to boost Energy Fuels’ production of Rare Earths concentrates at its White Mesa mill. Base has a significant monazite resource in Africa.

- Australian Government Funds Critical Minerals Projects: The Australian government has announced A$585 million in loans to support critical minerals projects. This includes A$400 million to Alpha HPA for a high-purity alumina facility in Gladstone, and A$185 million to Renascor Resources for a graphite concentrator in the Eyre Peninsula.

- Gina Rinehart Buys Stake in Lynas Rare Earths: Gina Rinehart’s Hancock Prospecting acquired a 5.82% interest in Lynas Rare Earths, fuelling speculation of potential sector consolidation after her investments in Australian lithium and previous merger talks between Lynas and MP Materials.

- American Rare Earths Turns Down Halleck Creek Offer: American Rare Earths rejected a US$400 million proposal from SPAC Papaya Growth Opportunity to acquire and list its Halleck Creek project on Nasdaq, opting to keep project flexibility.

- Zijin Mining’s Radiation Issue: Zijin Mining faced a license suspension after its Congolese copper and cobalt shipments were returned due to excessive radiation levels, prompting an ongoing investigation.

- Congo’s Inquiry into Apple’s Supply Chain: The Congolese government questioned Apple about the presence of conflict minerals in its supply chain, requesting a response within three weeks amid accusations of mineral laundering by Rwanda.

- Metals X Profits from Rising Tin Prices: Australia’s largest tin producer, Metals X, benefited from high tin prices in the March quarter, despite a production dip at its Renison mine joint venture with Yunnan Tin, producing 2272 tonnes of tin-in-concentrate compared to 2714 tonnes in the previous quarter.

- Cobalt: Radiation issues halt shipments: Shipments from Zijin Mining’s Congolese copper and cobalt project suspended over excessive radiation levels.

- Advancements in PGMs: Platinum Group Metals and AngloAmerican Platinum collaborate on developing higher-energy-density batteries using palladium and platinum, targeting commercial prototypes within the year.

- Aluminium: Glencore’s $1.06bn deal with Rusal – Amid controversy, Glencore maintains its purchase of Russian aluminium despite expiring contract and Western sanctions.

- Aluminium: LME restricts Russian supplies – New rules to prevent traders from exploiting loopholes with Russian aluminium amid UK and US sanctions.

Chart of the Month – Copper supply crunch

The world now depends more than ever on older mines with declining ore grades

Chart of the Month – Copper

BHP Proposal to buy Anglo American PLC

Eden Asset Management

CONTACT DETAILS

Name: Nicholas Boyd-Mathews

Phone: +61 8 6391 0107

Email: [email protected]

Office: Bowman House, Suite 2, 38 Colin Street, West Perth, WA 6005 Australia

Postal: PO Box 573, West Perth WA 6872

Web: www.eden-asset.com

REFERENCES: S&P Global Capital IQ, Bloomberg, Incrementum AG, Numerco