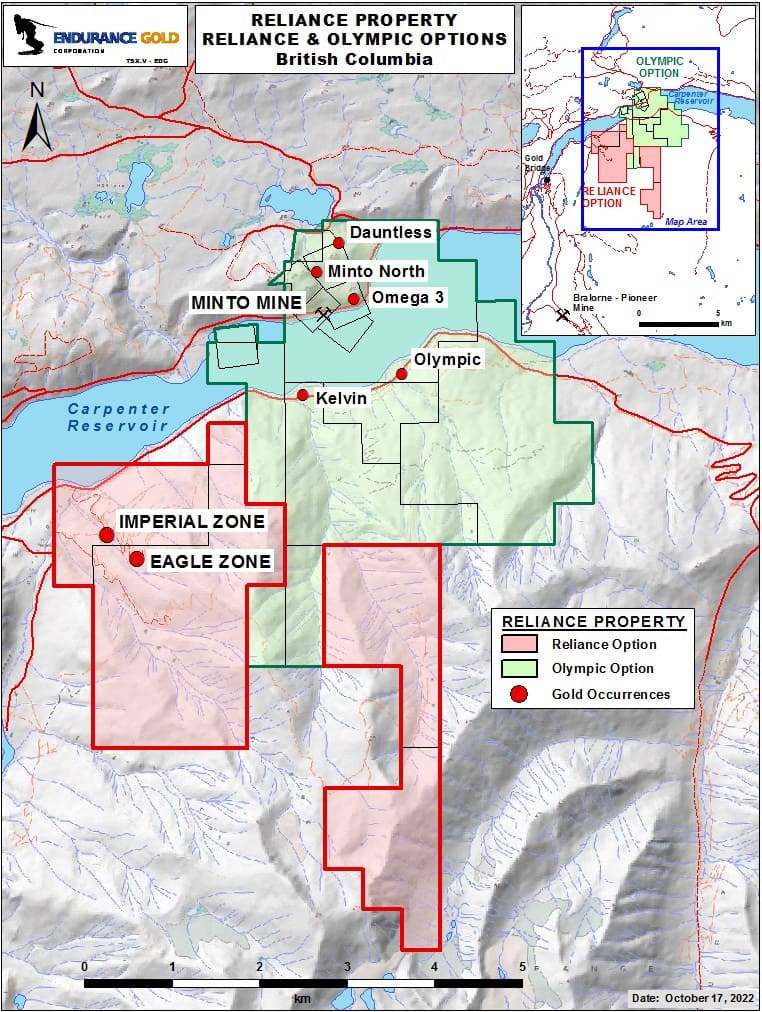

Endurance Gold Corporation announce that it has finalised a comprehensive option and royalty agreement to earn a 100% ownership in the former Minto Gold Mine, Olympic and Kelvin gold prospects contained within a parcel of crown grants and mineral claims. The Olympic Claims are located immediately adjoining and contiguous with the Company’s Reliance Gold Property in southern British Columbia. The road-accessible Reliance Property, including the Olympic Claims, is located 4 kilometers east of the village of Gold Bridge, and 10 km north of the historic Bralorne-Pioneer Gold Mining Camp which has produced over 4 million ounces of gold.

The acquisition of the Olympic Claims was announced on May 2, 2022 in a letter agreement which has now been replaced by a comprehensive option and royalty agreement.

The Olympic Claims are owned by Avino Silver & Gold Mines Ltd. and are located on the north and south shores of BC Hydro’s Carpenter Lake Reservoir in the Bridge River Valley, east of the Royal Shear trend and the Company’s current drilling focus. The year-round road-accessible properties including the Reliance Property and Olympic Claims total approximately 2,475 hectares.

Under the terms of the finalized comprehensive option and royalty agreement with Avino, the Company can earn a 100% interest in the Olympic Claims for:

- A total cash consideration in the aggregate amount of $100,000 ($10,000 paid);

- the allotment and issuance of up to a total of 1,500,000 common shares of the Company (100,000 Shares issued); and

- exploration expenditures in the aggregate amount of $300,000.

- all to be incurred by December 31, 2024.

- A payment of 100,000 Shares and $15,000 cash is due on or before December 31, 2022.

On vesting its ownership interest, the Olympic Claims will be subject to a 2% net smelter return royalty, of which 1% NSR can be purchased by the Company for $750,000 and the remaining balance of the NSR can be purchased for $1,000,000.

As part of the final requirement to earn its interest, the Company agreed to grant to Avino 750,000 share purchase warrants by December 31, 2024, that offer Avino the option to purchase additional shares in the Company for a period of three years from the date of issuance. The exercise price of the Warrants will be set at a 25% premium to the 20-day Volume Weighted Average Share Price at the issuance date. During the Option, if the Company is successful in defining a compliant mineral resource of at least 500,000 gold-equivalent ounces on the Olympic Claims then the Company will be obliged to pay Avino a $1,000,000 discovery bonus.

The original letter agreement was accepted by the TSX Venture Exchange in May 2022 and the terms accepted at the time remain unchanged. Any Shares or Warrants to be issued will be subject to a four-month hold period on issuance as per the policies of the TSX Venture Exchange.

Exploration Activity on the Olympic Claims – The Olympic Claims are underlain by “epizonal” orogenic-type gold targets that include the former producing Minto Mine that has produced 17,500 ounces of gold at an average grade of 6.3 grams per tonne gold prior to World War II. In addition, there are eleven historic government-documented mineral occurrences on the Olympic Claims which include the Minto North, Dauntless, Kelvin and Olympic gold prospects, many of which have also been explored with small underground workings prior to World War II. These prospects are associated with regional-scale structural deformation and/or iron carbonate alteration with analogies to the recent discoveries by the Company at the Eagle and Imperial zones, but on sub-parallel regional structures.

As examples of the gold potential of the Olympic Claims, in 2005 Avino reported 14.76 gpt gold over 9.0 metres (“m“) (estimated true width of 4.5 m) from chip samples in trenching on the Minto North target. At the Olympic Target, 1988 drilling reportedly intersected 8.2 gpt gold over 3.48 m.

Since acquisition in May, the Company has completed georeferencing of all existing access roads and trails, rock sampling, channel sampling, stream sediment sampling, soil sampling, and biogeochemical sampling. Results are pending on most of the early stage exploration activity.

Endurance Gold Corporation is a company focused on the acquisition, exploration and development of highly prospective North American mineral properties with the potential to develop world-class deposits.