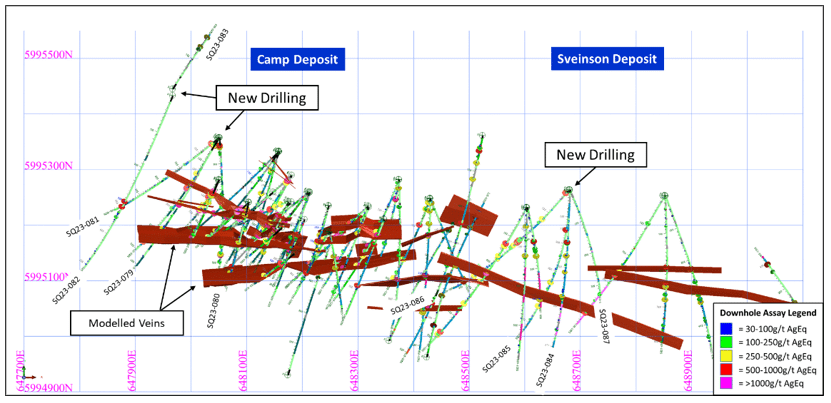

Equity Metals Corporation reports final assays from its Spring 2023 core drilling program on the Company’s 100% owned Silver Queen Ag-Au project, located in central British Columbia. The new assays extend new mineralization in several areas: the west side of the Camp Deposit; a blind, hangingwall vein north of the main Camp veins; and a previously undrilled portion of the Sveinson Deposit.

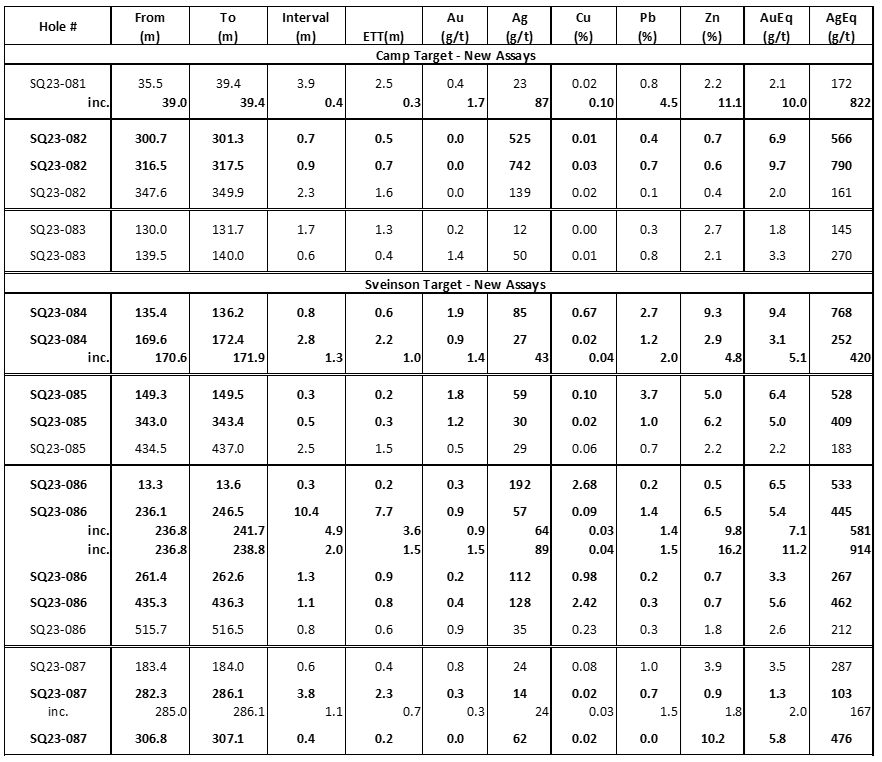

Sveinson Deposit: Drilling returned multiple gold and base-metal-enriched intercepts including:

- a 1.5 metre (est. TT) interval grading 1.5g/t Au, 89g/t Ag, 1.5% Pb and 16.2% Zn (11.2g/t AuEq or 914g/t AgEq) within a 7.7 metre interval averaging 0.9g/t Au, 57g/t Ag, 1.4% Pb and 6.5% Zn (5.4g/t AuEq or 445g/t AgEq) from drillhole SQ23-086; and

- a 2.2 metre (est. TT)interval grading 0.9g/t Au, 27g/t Ag, 1.2% Pb and 2.9% Zn (3.1g/t AuEq or 252g/t AgEq)from drillhole SQ23-084.

These results are from two of four holes that tested a 200-metre drilling gap in the Sveinson deposit (see Figure 2 and Table 1). Each of the four holes contain multiple intercepts, which help to build continuity to depths of up to 350 metres below surface in several veins initially identified in 2022 drilling.

Camp Deposit: Drill highlights include:

- a 0.7 metre (est. TT) interval grading 742g/t Ag, 0.7% Pb and 0.6% Zn (9.7g/t AuEq or 790g/t AgEq) from drill hole SQ23-082.

This interval is one of two higher-grade silver intercepts from drill hole SQ23-082 that extend mineralization in the Camp Deposit an additional 100 metres laterally to the west, beyond which it remains open for further drill testing. Mineralization was also identified near the top of hole SQ23-081 and is similar in tenor to previously reported intercepts in drill holes SQ23-079 and -080, confirming a blind shallow target north of the main vein set under alluvium.

George Lake Target

The Company also reported that it has now completed 2,324 metres of new core drilling in 7 holes on the George Lake target as part of its 2023 Summer drill program. Drilling has confirmed visual mineralization around historical intercepts adjacent to the Bulkley Crosscut (historic underground workings) and extends the lateral projection of mineralization approximately 400 metres to the southeast and up to 250 metres below surface. Mineralization remains open along strike and at depth. Assay results from this drilling and over 1,400 soil samples, which were collected on the property in June, are pending and are anticipated in the coming weeks.

Drilling is currently suspended due to wildfire risk in the area but will resume on the Cole Lake target once conditions allow.

“Work on the Silver Queen project through 2023 continues the systematic delineation of new mineralization throughout the property through a combination of extending currently known veins as well as drill testing new targets developed through compilation of historical data and recent surface work on the property. The property already contains a significant existing mineral resource base that was updated in 2022, doubling the earlier 2019 resource, which we believe will increase with the further development and exploration of these new targets. Today’s news appears to support our view.”

VP Exploration Rob Macdonald

Samples were analyzed by FA/AAS for gold and 48 element ICP-MS by MS Analytical, Langley, BC. Silver (>100ppm), copper, lead and zinc (>1%) overlimits assayed by ore grade ICP-ES analysis, High silver overlimits (>1000g/t Ag) and gold overlimits (>10g/t Au) re-assayed with FA-Grav. Silver >10,000g/t re-assayed by concentrate analysis, where a FA-Grav analysis is performed in triplicate and a weighed average reported. Composites calculated using a 80g/t AgEq (1g/t AuEq) cut-off and <20% internal dilution, except where noted. Reported intervals are core lengths, true widths undetermined or estimated. Accuracy of results is tested through the systematic inclusion of QA/QC standards, blanks and duplicates into the sample stream. AuEq and AgEq were calculated using prices of $1,800/oz Au, $22/oz Ag, $3.50/lb Cu, $0.95/lb Pb and $1.30/lb Zn. AuEq and AgEq calculations did not account for relative metallurgical recoveries of the metals.

Pb and $1.30/lb Zn. AuEq and AgEq calculations did not account for relative metallurgical recoveries of the metals.

About Silver Queen Project

The Silver Queen Project is a premier gold-silver property with over 100 years of historic exploration and development and is located adjacent to power, roads and rail with significant mining infrastructure that was developed under previous operators Bradina JV (Bralorne Mines) and Houston Metals Corp. (a Hunt Brothers company). The property contains an historic decline into the No. 3 Vein, camp infrastructure, and a maintained Tailings Facility.

The Silver Queen Property consists of 45 mineral claims, 17 crown grants, and two surface crown grants totalling 18,852ha with no underlying royalties. Mineralization is hosted by a series of epithermal veins distributed over a 6 sq km area. An updated NI43-101 Mineral Resource Estimate with effective date December 1st, 2022 was detailed in a News Release issued on Jan 16, 2023, which can be found by clicking here and the full Technical Report can be found on SEDAR and the Company’s website.

More than 20 different veins have been identified on the property, forming an extensive network of zoned Cretaceous- to Tertiary-age epithermal veins. The property remains largely under explored.

About Equity Metals Corporation

Equity Metals Corporation is a member of the Malaspina-Manex Group. The Company owns 100% interest, with no underlying royalty, in the Silver Queen project, located along the Skeena Arch in the Omineca Mining Division, British Columbia. The property hosts high-grade, precious- and base-metal veins related to a buried porphyry system, which has been only partially delineated. The Company also has a controlling JV interest (57.49%) in the Monument Diamond project, NWT, strategically located in the Lac De Gras district within 40 km of both the Ekati and Diavik diamond mines. The Company also has royalty and working interests in other Canadian properties, which are being evaluated further to determine their value to the Company.

Robert Macdonald, MSc. P.Geo, is VP Exploration of Equity Metals Corporation and a Qualified Person as defined by National Instrument 43-101. He is responsible for the supervision of the exploration on the Silver Queen project and for the preparation of the technical information in this disclosure.

On behalf of the Board of Directors

“Joseph Anthony Kizis, Jr.”

Joseph Anthony Kizis, Jr., P.Geo

President, Director, Equity Metals Corporation

For further information, visit the website at https://www.equitymetalscorporation.com; or contact us at 604.641.2759 or by email at [email protected].