By Alain Corbani, Head of Mining at Montbleu Finance SAS

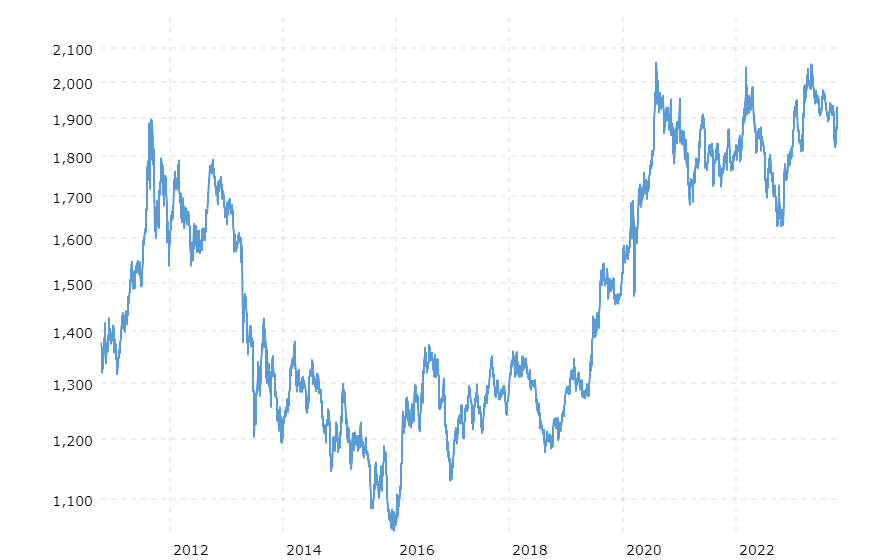

To better understand what is brewing in the gold and gold mining sector today, it is necessary to take a few steps back. Let us return for a moment to the summer of 2022 when the Federal Open Market Committee considered the level of federal rates “close to neutral.” A month later, on August 31, 2022, at the Jackson Hole economic symposium, Jérôme Powell specified that “the restoration of price stability will probably require the maintenance of a restrictive policy for a certain time” and that “history strongly warns against premature easing of monetary policy.” In the month that followed, gold lost $100 per ounce and the US 10-year nominal rates rose one hundred basis points to move close to 4%.

“In October 2022, the consensus established that this restrictive monetary policy would negatively impact growth and that the pause in federal fund rates was within reach due, among other things, to a deceleration of the inflationary pressures. In response to this environment, gold, over the following three months, gained $200 per ounce and hit $1950 on January 31, 2023.”

Alain Corbani, Head of Mining at Montbleu Finance

The first three quarters of 2023 looked remarkably similar to the fourth quarter of 2022, with rates moving up and down in tune with the publication of economic statistics. In mid-September 2023, the resilience of the deceleration of inflationary pressures (lagging indicator), American economic growth (reacceleration?) and the job market strength (lagging indicator) allowed the 10-year nominal rates to rise by 80 basis points to reach 4.80% exerting downward pressure on gold which lost $100 prior to the Israeli-Palestinian conflict.

Since the summer of 2022, the US 10-year nominal rates as well as real rates increased by two hundred basis points. Over the same period, gold gained $100 (prior to the Israeli-Palestinian conflict). The positive performance of gold in a such hostile environment gives us a hint at its significant upside potential when monetary policies will pause and ultimately ease. This is the scenario that we favor because restrictive monetary policies will inevitably have a negative impact on economic growth. The deterioration of the US leading economic indicators, the absolute and relative non-sustainable increasing costs of the service of the debt, the (inverted) yield curve, which is reverting fast, are all warning signs of an economic slowdown.

It is no coincidence that Janet Yellen (US Treasury Secretary) wondered on Tuesday October 3, 2023 during the Fortune CEO Initiative conference in Washington about “the resilience observed by economic actors which suggested that rates will stay higher for longer” and she concluded: “I think this is by no means obvious.”

This configuration brings very encouraging news for gold and hence for gold mines, as both asset classes are strongly correlated (with a historical correlation of more than 80%). The lagging effects of the restrictive monetary policy implemented by the Federal Reserve take longer than expected which give investors a sentiment of false comfort. The full impact of these rate hikes has not been felt yet. It is just a question of time and time is fast approaching. Fasten your seat belts. Gold and gold mines are again ready to outperform, in the same fashion they did in 2016 and in 2020.

Alain Corbani, Head of Mining at Montbleu Finance

Alain Corbani, Head of Mining at Montbleu Finance SAS, has a finance career spanning over 30 years. Montbleu Finance, an Asset Manager located in Paris, France, was founded in 2007. Alain serves as an analyst and portfolio manager and has extensive expertise in the mining and natural resources sector. His role at Montbleu Finance involves overseeing the firm’s mining investments and managing the Global Gold & Precious Fund, which focuses on investments in gold and precious metals. Alain Corbani’s experience and leadership in the field make him a key figure in the finance industry, particularly in the domain of mining and precious metal investments.

For more information on Alain Corbani and Montbleu Finance visit www.montbeufinance.fr