From Gainesville Coins by Jan Nieuwenhuijs | Published May 30, 2024

July 1, 2024 | 10:22 AM

Sturdy central bank gold buying since 2009 and a rising gold price has grown the precious metal’s share of global international reserves to the detriment of fiat currencies. By the end of 2023 gold surpassed the euro and the next fiat currency to be challenged is the US dollar.

Image via Flickr, Bank of England gold vaults

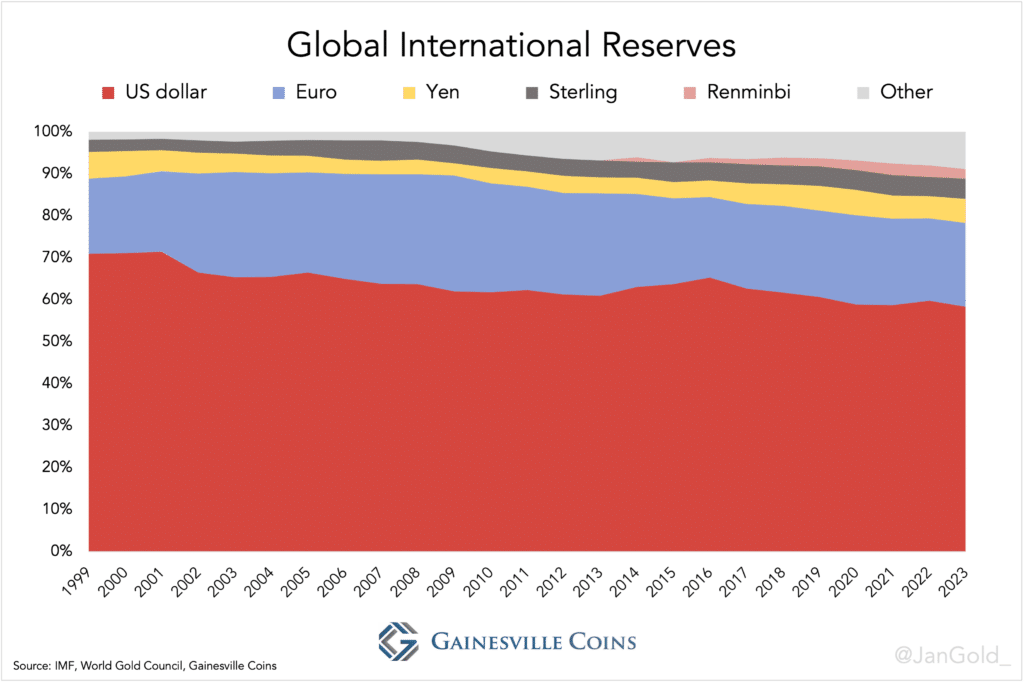

Often when financial analysts draw charts on the distribution of international reserves they focus on foreign exchange (omit gold) and start when the euro was introduced in 1999. Based on such charts the dollar’s share of total reserves appears to be falling slowly, from a peak of 72% in 2001 to 58% in 2023. In addition, it seems there is not one specific currency that is competing with the dollar.

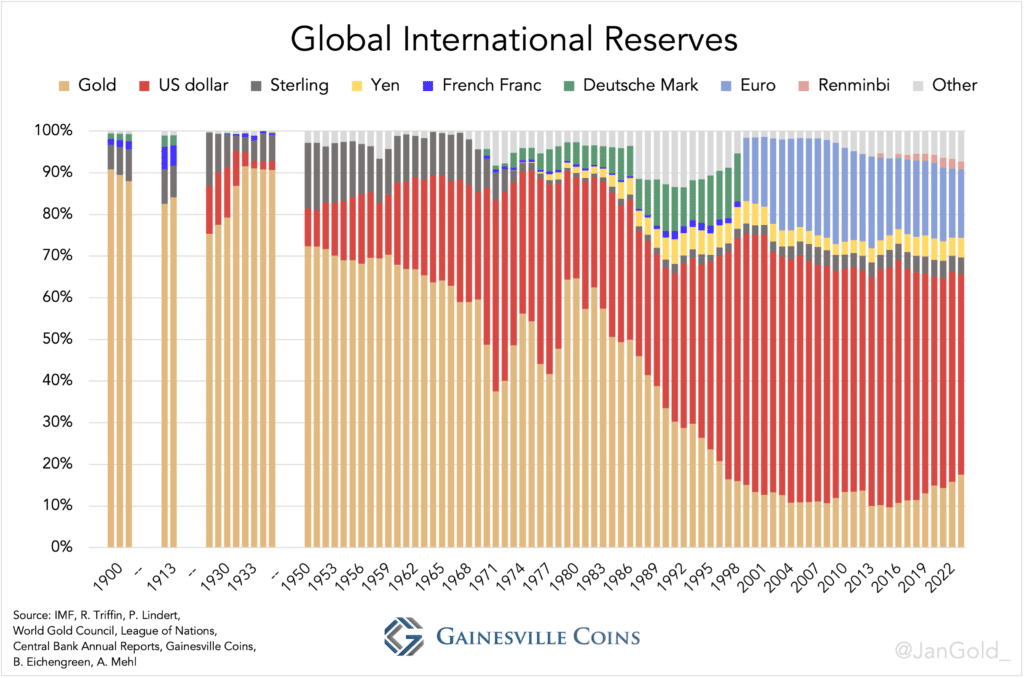

But why not include gold and look back as far as possible? By combining multiple sources, we get a glimpse of the dissemination of reserve currencies from 1899 until 1935 (both fiat and gold), and a full picture starting from 1950.

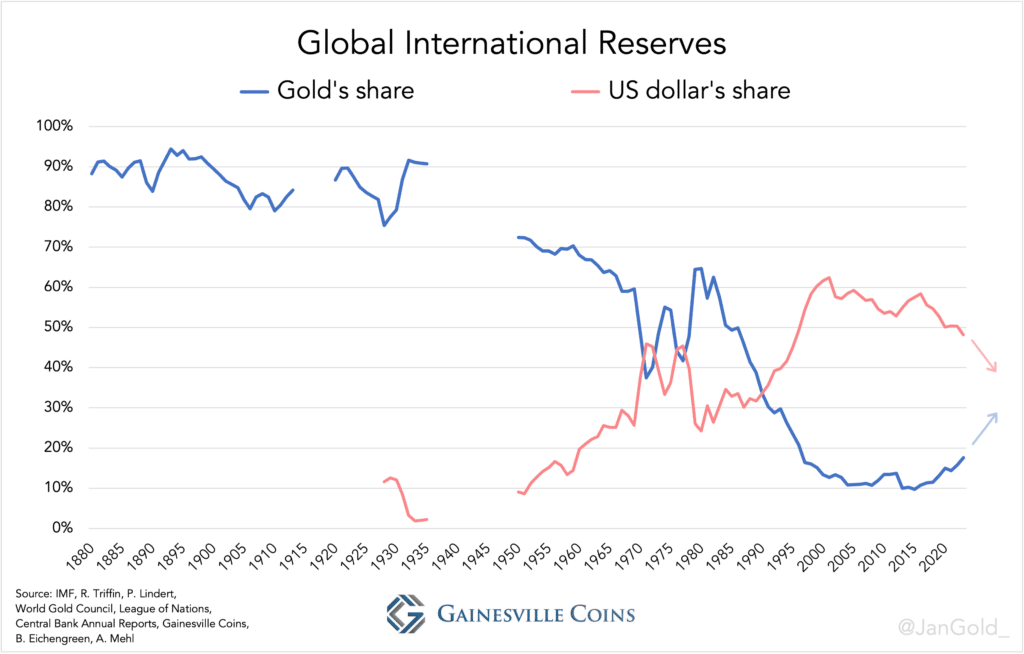

This paints a whole different story. Instead of showing only the demise of the dollar at snail pace, the historic balance between gold and fiat currencies is revealed. It’s not the dollar that normally backs the international monetary system, it’s gold. Gold used to make up the majority of international reserves, even when sterling was said to be the world reserve currency before the dollar. In a chart covering more years but only gold and the dollar, the latter’s reign becomes even more relative.

The above chart displays that the dollar’s share of total reserves has fallen to 48% in 2023—caused by a declining trust in “credit assets” (fiat currencies), due to worrying asset bubbles, escalating wars, and fear of inflation—while gold is making ground.

Based on personal calculations of official gold reserves that include covert acquisitions, for example by the Chinese central bank, gold’s percentage of total reserves reached 18% in 2023, up from 11% in 2008. Gold has currently surpassed the euro, which got stuck at 16%. As the problems haunting fiat currencies won’t fade anytime soon it’s possible gold will overtake the dollar as well in the decade ahead (explained more detailed here).

Be sure not to miss the X-post below that includes a video illustrating the development of reserve assets since 1950 in a bar chart race!

About Jan Nieuwenhuijs – independent financial researcher and gold analyst.

Numismatic Expert & Journalist

Jan Nieuwenhuijs began his career in the Dutch movie industry as a sound engineer. In 2014, he made a significant career shift to become a financial researcher with a focus on gold. Initially, his research centered on the Chinese gold market, earning him global recognition for his in-depth analysis and insights.

Jan’s expertise quickly expanded to other areas of the gold market, including the COMEX futures market, the London Bullion Market, and the Turkish gold market. Over time, he broadened his scope to encompass macroeconomics, exploring the international monetary system, central bank gold policies, the mechanics of the global gold market, gold prices, and general economic principles.

In addition to his professional pursuits, Jan enjoys a variety of activities in his personal life. He is an avid sports enthusiast, a keen reader, and a dedicated meditator. He also has a passion for watching documentaries, which complements his continuous quest for knowledge and understanding of the world.

Follow Jan on X

Follow Jan in LinkedIn

Follow Jan on the web at https://www.thegoldobserver.com/

Disclaimer

Nothing written by Jan Nieuwenhuijs constitutes investment, legal, tax, or other advice. It should not be used as the basis for any investment decision(s) which a reader thereof may be considering. The purpose of this article is to provide objective, educational and interesting research and commentary, and is not intended to constitute an offer, solicitation or invitation for investing in or trading gold.