by Lobo Tiggre – Tuesday, August 04, 12:00pm, UTC, 2020

As I type, gold just rose above $2,010 and silver topped $25. Long-suffering gold and silver bugs can be forgiven for breaking out some champagne as monetary metals reach new multi-year highs.

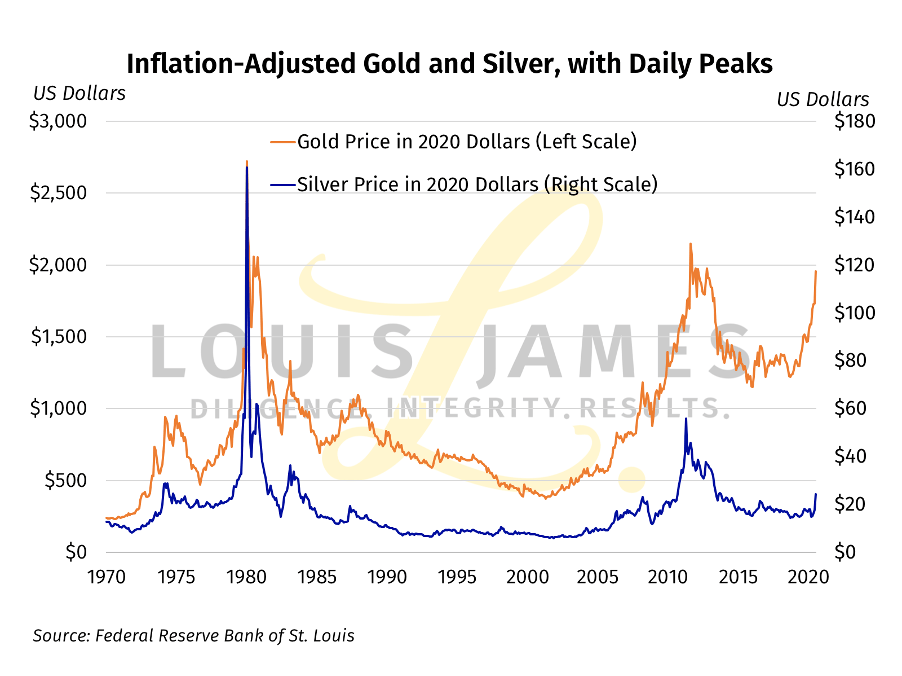

Looks like an all-time-high for gold… but is it?

We all know that inflation erodes fiat currencies, including the US dollar, every year. We refer to interest rates as “real” when adjusted for inflation. By that standard, the real price of gold has a long way yet to go to reach new highs.

In “real” terms, gold has to rise more than $700 to beat the all-time, inflation-adjusted high of $2,722.18 in 1980.

It needs to rise above $2,149.69 just to beat its 2011 peak.

Even this lower number would result in a larger number of headlines, which would attract more generalist investors to the space. And I don’t just mean those buying bullion. I’m talking about the gold stocks, which are already catching—and apparently keeping—generalist attention.

Gold rising toward $2,700 could easily spark a true market mania.

That’s great for gold bugs like me—but as I’ve been saying, silver offers even greater upside.

Just to match its 2011 peak, silver has to reach $55.78.

To reach a “real” all-time-high, silver has to top $160.59.

It gets better.

I put the word real in quotes above because I used CPI inflation data from the BLS. Many who’ve been studying monetary metals for a long time—and many more who remember what their grocery bills used to be just a few years ago—believe BLS numbers to be BS numbers that vastly understate reality.

The above chart is a conservative case; fully inflation-adjusted—truly real—gold and silver prices would be much higher.

Now here’s where your Due Diligence Guy has to rain on the parade a bit…

My conclusion from this is NOT that everyone should throw caution to the wind and pay whatever they have to in order to buy gold and silver stocks immediately.

Realize that record gold prices are going to bring all sorts of critters out of the woodwork, encouraging you to do just that.

And if gold keeps screaming upward from here to $2,700 or much higher, that might work out.

Today’s champagne is looking like just a taste of better things to come.

But…

It’s possible that gold has just peaked.

I don’t think it has.

A significant breather, now that gold has reached an important psychological level seems much more likely.

I have to say, however, that we’ve not seen much pausing for consolidation since gold blew past $1,800.

Still, experience tells us that nothing goes straight up forever. When prices go as vertical as gold and silver have recently, then tend to see pullbacks that are just as steep.

Buyers can and should look to high volatility to be their friend.

It would be irresponsible of me to pretend gold prices can only rise—as so many folks did in 2011.

No pundit, “expert who predicted 2008,” nor similar guru can promise us we won’t lose money by giving in to the fear of missing out (FOMO) now.

So, at the risk of sounding like a broken record, I will reiterate my call to make sure you don’t let any big wins you have—or are about to have—slip through your fingers.

I am not urging anyone to sell now.

But I do think it makes sense to use my Upside Maximizer strategy to enjoy the rally and still lock in gains (Free article here.)

Discipline pays,

If you’d like disciplined, no-hype guidance on how to best play this bull market for gold and silver, I humbly suggest you subscribe to The Independent Speculator. You can try it out on a monthly basis, and then upgrade to the lower yearly rate only when you’re satisfied that you want my service on your side going forward.

“Louis James” was legendary speculator Doug Casey’s protégé at Casey Research for almost 14 years, until early 2018. He joined the Casey team in 2004. By 2007, he was writing and making investment recommendations in Casey’s flagship newsletter, the International Speculator. Now he brings his experience, his connections and his deal flow directly to you, without the barrage of marketing hype used by larger publishers.