By Jay Martin

“Last month, the financial world was abuzz with news of two significant bank insolvencies in California – Signature Bank and Silicon Valley Bank. These events captured the attention of everyone in the financial media, sparking rampant speculation about how contagious the failures might become and which banks might be next in line.”

Jay Martin

In moments of crisis, it’s important to remember the “head fake” – that while everyone watches the chaos unfold, someone with foresight is making a strategic move behind the scenes.

Around this time, I wrote about the Knickerbocker Crisis of 1907. The public, bankers, and politicians were all focused on a series of trust insolvencies. When the Knickerbocker Trust collapsed in October of 1907, fear spread like wildfire. Wall Street was teeming with frantic depositors trying to salvage their savings. By October 24, eight New York banks and trusts had gone bust, and the New York Stock Exchange plummeted to a ten-year low.

Yet, amidst the turmoil, John Pierpont Morgan executed a brilliant power play. While everyone else was preoccupied with bank runs, collapsing stocks, and floundering federal intervention, Morgan seized the opportunity to consolidate his control over America’s steel industry.

He used the distraction of the banking crisis to secure an exemption of antitrust laws, allowing him to acquire the Tennessee Coal, Iron, and Railroad Company in the early hours of November 1, 1907. Morgan already had control over U.S. Steel Company – a firm scrutinized by antitrust laws for its domination of over 60% of America’s steel trade. The acquisition would give him a virtual monopoly on the steel industry. On any other day, the purchase would never have received government approval.

This month, the financial world is abuzz with on a new bank insolvency, First Republic Bank. Here, we find Jamie Dimon, at the helm of J.P. Morgan Chase, following in the footsteps of his predecessor. Amidst the chaos of failing banks, he has scooped up the client base of the struggling First Republic Bank, further solidifying his position as “America’s Banker” and inching closer to controlling 20% of all U.S. deposits.

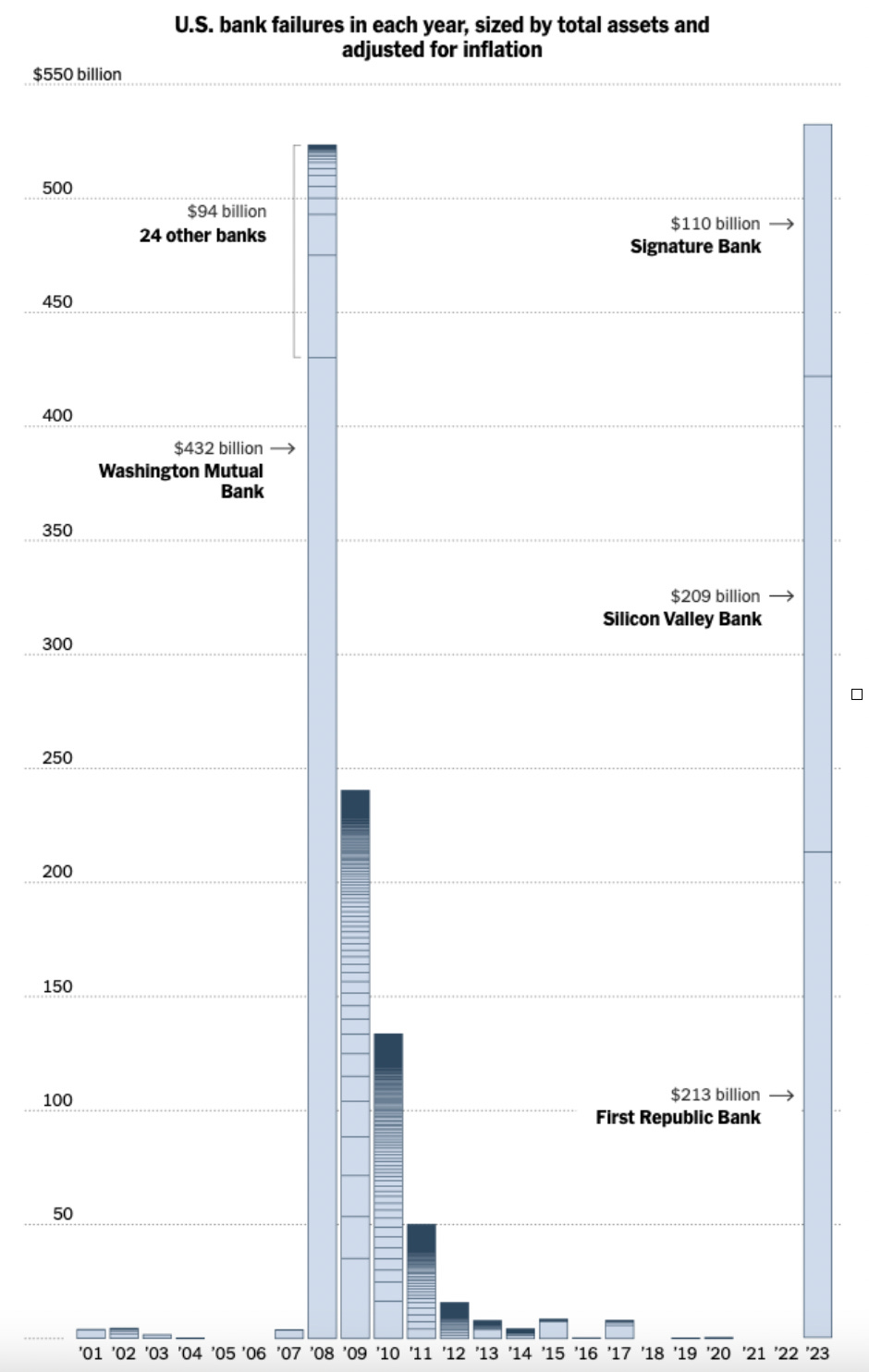

Some might argue that the acquisition of First Republic by J.P. Morgan is a mere drop in the bucket compared to their overall assets under management – First Republic had $213 billion in assets under management, while J.P. Morgan boasts $2.5 trillion. However, focusing on the incremental growth of J.P. Morgan misses the larger picture. Although there have only been three major bank failures in 2023, their collective asset value already surpasses that of all 25 banks that failed in 2008.

Source, the New York Times, via the Federal Insurance Deposit Corporation

There is nothing trivial about J.P. Morgan Chase or any bank absorbing the assets of First Republic.

Dimon’s power move is a clear indication of what’s to come, and his competitors are surely searching for their own opportunities. J.P. Morgan and Bank of America currently control over 32% of America’s deposits. Add Wells Fargo to the mix, and the number jumps to 43%. The top 15 banks already control 75% of deposits in the U.S.

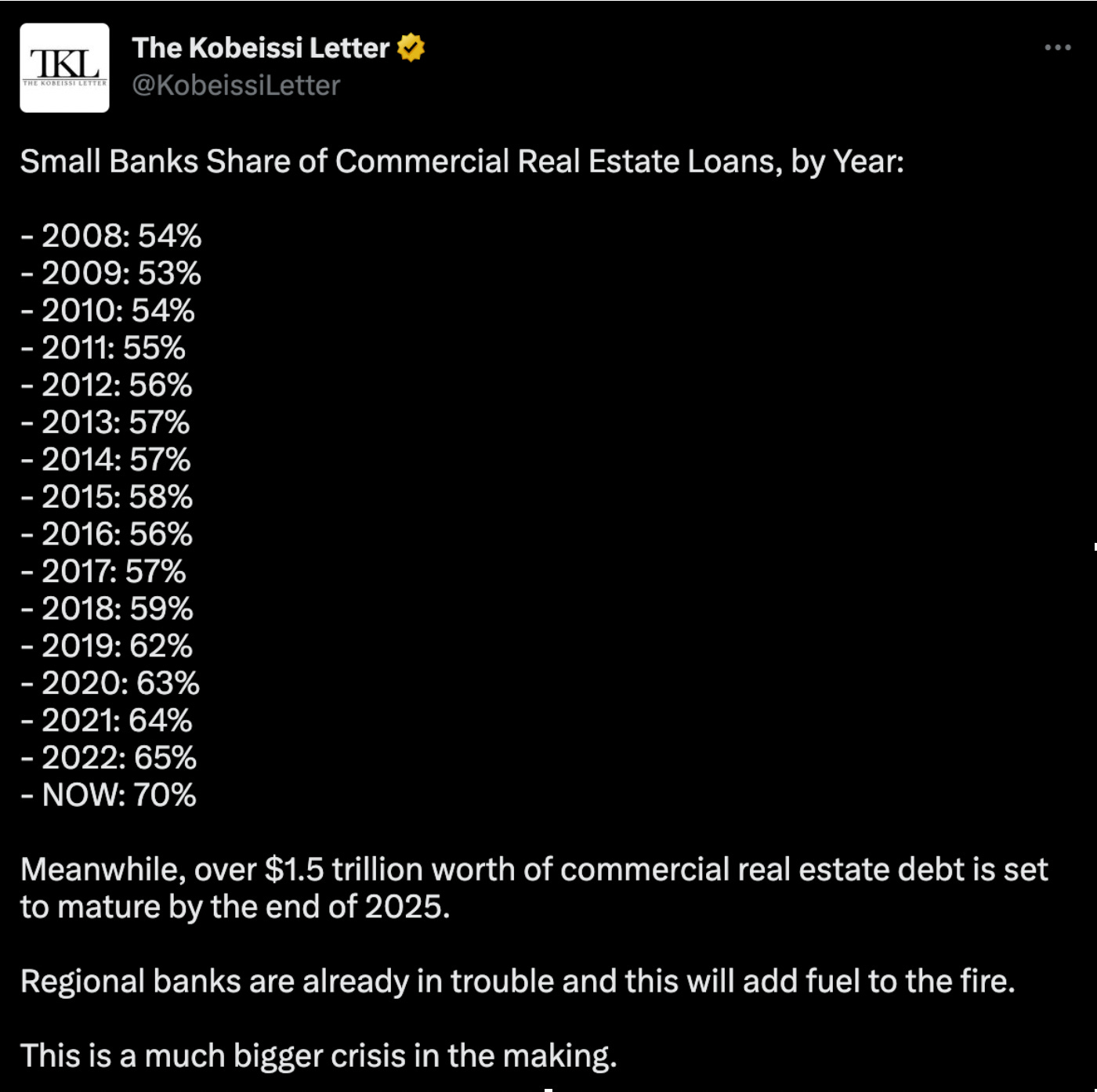

What’s next on their shopping list? As commercial real estate across the country collapses, a glance at the share of commercial real estate loans owned by small regional banks offers a clue:

Just as John Pierpont Morgan managed to secure an exemption from antitrust laws during the 1907 Knickerbocker crisis, today’s banks will receive more exemptions that excuse them from the “too big to fail” regulations implemented after the 2008 crisis.

The Federal Deposit Insurance Corporation (FDIC) stepped in to cover the $13 billion in First Republic losses, convincing J.P. Morgan to proceed with the acquisition. This move allowed the big bank to privatize gains and socialize losses – a business model that would make any entrepreneur envious.

The bank consolidations are interesting, but the more important question is, What happens next?

There has been ample discussion about the introduction of a central bank-issued digital currency. I don’t know the what or when behind this introduction, but I believe I understand the how.

Over the past five years, I’ve invested in two companies that focused on consolidating owner-operated businesses to enable the large-scale rollout of new tech products. The first step in rolling out a new tech platform at scale is to consolidate the client base. First, roll up the client base, and then roll out your software. This is a time-tested business model.

If the Fed wants to issue its own digital currency, it’s on the right track. Currently, they can reach 75% of all U.S. depositors through just 15 institutions.

But as Dan Goerlich, a partner at PwC who focuses on U.S. financial deals, recently stated, “There are a lot of signs pointing to the fact that the consolidation period has just begun” (May 02, 2023).

I won’t debate the dystopian and utopian possibilities of a central bank-issued digital currency. I don’t debate the ethics of the game; I do my best to understand the game so that I can play it as effectively as possible.

Jay martin is an investor, writer, podcaster, video host, CEO of Cambridge House and Host of the Vancouver Resource Investment Conference