MAX RESOURCE CORP. is pleased to report initial results of the high-resolution ground Induced Polarization (“IP”) survey. The IP chargeability correlates with the two URU-Central copper-silver rich discoveries and extends at least 200m below surface. The IP is to be integrated into a detailed geological and structural three-dimensional model for the upcoming drill program (refer to Figure 2 and 3D video below).

First URU-Central discovery, URU-C returned chip channel widths of [email protected]% copper + 115 g/t silver (new results) and [email protected]% copper + 146 g/t silver at the lower levels of the prospect. The upper level (+190m vertically above) is +290m along strike and returned 4.9% copper + 41 g/t silver along a 52m ridgeline, true width yet to be determined (new results).

The second discovery, URU-CE is located 750m to the east of URU-C, consisting of substantial sized outcrops with visible copper mineralization +15m wide, trending SSW for +250m of strike, open in all directions (refer to Figures 3 and 4 video).

The Company’s wholly owned URU-Central forms part of the 20-km-long URU district, located along the southern portion of the CESAR North 90-km-long copper-silver belt.

“The initial IP survey has achieved the objectives of defining the vertical dimensions of the primary chalcocite-bearing mineralized body at the two URU-Central discoveries. Max is preparing drill sites and planning to mobilize the diamond core drill rig late next month, initiating the first ever drilling program targeting copper-silver mineralization on its URU mining concessions,” commented Max CEO, Brett Matich.

“Concurrently, Max continues its regional exploration programs along the 90-km-long CESAR copper-silver belt, utilizing its approximately $20 million treasury,” he concluded.

Initial results show the primary chalcocite mineralization extends from surface and displays a clearly defined chargeability contrast with the known unmineralized barren wall rocks. The IP results indicate that the defined surface mineralization appears to continue both along strike and at least 200m vertically at the two parallel discoveries (URU-C and URU-CE).

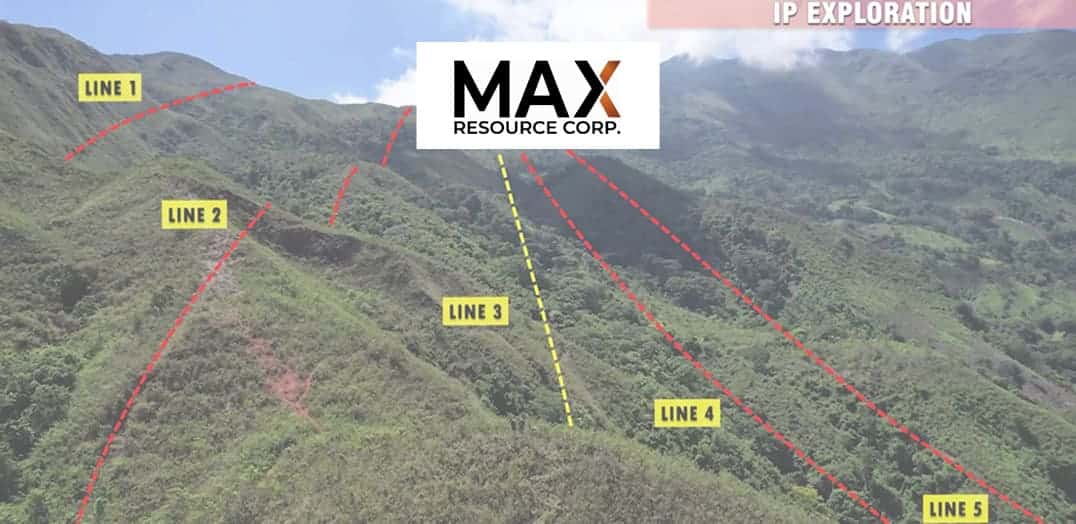

The high-resolution IP survey generates three-dimensional chargeability and resistivity data to vertical depths of 200m. The initial ongoing 4-line-km survey was conducted over four lines spaced at 100m and with IP stations every 50m and confirmed strong correlation between surface copper-silver rich rock geochemistry and IP chargeability zones.

Cesar Copper Silver Project

CESAR lies along the copper-silver rich 200-kilometre-long Cesar Basin in Northeastern Colombia. This region provides access to major infrastructure resulting from oil & gas and mining operations, including Cerrejón, the largest coal mine in South America, held by global miner Glencore. Max’s mining concessions collectively expanse over 212-km².

Max is proactive, with the corporate goal of moving the Cesar basin towards the mining of copper, the key metal for the Colombia’s transition to clean energy.

Max executed a 2-year co-operation agreement with Endeavour Silver Corp. (TSX: EDR, NYSE: EXK), which assists Max to significantly expand its 100% owned landholdings at CESAR, Endeavour will hold underlying 0.5% NSR.

Max is focusing on three major copper-silver districts individually located along the CESAR 90-kilometre-long belt, with the objective of expanding the zones and defining drill targets:

- The 32-km long AM district with highlight values of 34.4% copper and 305 g/t silver

- The Conejo district, averages 4.9% copper (2% cut-off) over 3.7-km

- The 20-km long URU district returned [email protected]% copper+143 g/t silver and [email protected]% copper+146 g/t silver

Geologically, Max interprets the sediment-hosted copper-silver mineralization in the Cesar basin to be analogous to both the Central African Copper Belt (CACB) in the south and the Kupferschiefer deposits in Poland of the CESAR copper-silver belt. Almost 50% of the copper known to exist in sediment-hosted deposits is contained in the CACB, including Ivanhoe Mines Ltd (TSX: IVN) 95-billion-pound Kamoa-Kakula discovery in the Congo.

Kupferschiefer, the world’s largest silver producer and Europe’s largest copper source, is a mining orebody ranging from 0.5 to 5.5m thick at depths of 500m, grading 1.49% copper and 48.6 g/t silver. The silver yield is almost twice the production of the world’s second largest silver mine.

Source: Central African Belt Descriptive models, grade-tonnage relations, and databases for the assessment of sediment-hosted copper deposits with emphasis on deposits in the Central Africa Copperbelt, Democratic Republic of the Congo and Zambia by USGS 2010. Kamoa-Kakula by OreWin March 2020. World Silver Survey 2020 and Kupferschiefer Deposits & Prospects in SW Poland, September 27, 2019. Max cautions investors that the presence of copper mineralization of the Central African Copper Belt and the Polish Kupferschiefer are not necessarily indicative of similar mineralization at CESAR.

Qualified Person

The Company’s disclosure of a technical or scientific nature in this news release was reviewed and approved by Tim Henneberry, P Geo (British Columbia), a member of the Max Resource Advisory Board, who serves as a qualified person under the definition of National Instrument 43:101.

About Max Resource Corp.

Max Resource Corp. (TSXV: MAX) is a mineral exploration company advancing the newly discovered district-scale Cesar copper-silver project. The wholly owned Cesar project sits along the Colombian portion of the world’s largest producing copper belt (Andean belt), with world class infrastructure and the presence of global majors (Glencore and Chevron).

In addition, Max controls the RT Gold project (100% earn-in) in Peru, encompassing a bulk tonnage primary gold porphyry zone, and 3-km to the NW, a gold bearing massive sulphide zone. Historic drilling in 2001, returned values ranging 3.1 to 118.1 g/t gold over core lengths ranging from 2.2 to 36.0-metres.

Source: NI 43:101 Geological Report Rio Tabaconas Gold Project for Golden Alliance Resources Corp. by George Sivertz, Oct.3, 2011

For more information visit: https://www.maxresource.com/

For additional information on Max Resources contact Tim McNulty at +1 (604) 290-8100 or by email [email protected] or Rahim Lakha at [email protected]