- Copper prices are projected by RBC Capital Markets to increase from the current rate of US$3.82/lb to US$4.50/lb between 2025 and 2027.

- To address an anticipated deficit of 10 million metric tons (Mt) by 2035, it would require an investment of US$200 billion to construct the necessary mines.

- When copper is priced at US$4.50/lb, miners will enjoy a higher free cash flow (FCF) yield compared to any sector in the S&P 500, except for the energy sector.

RBC Capital Markets forecasts a deficit of 10 million metric tons (Mt) by 2035, which is equivalent to more than a third of the current market. If this funding is not allocated, the minimum internal rate of return (IRR) of 15% required to justify mining investments would not be met unless copper prices exceed US$4 per pound.

Which can drive higher copper prices, but there is a sweet spot

According to RBC Capital Markets analyst Sam Crittenden, copper prices are expected to increase from the current rate of US$3.82/lb to US$4.50/lb between 2025 and 2027. However, in order to prevent a significant copper deficit caused by rising demand from the energy transition, miners will need to secure over US$200 billion within the next ten years.

The current price of copper stands at only US$3.82/lb due to the underperformance of China’s post-Covid economy, failing to meet market expectations at the beginning of 2023. Consequently, this may discourage investments in copper supply at a time when demand is projected to grow at a rate significantly higher than historical norms.

RBC Capital Markets, Sam Crittenden said, “You have probably heard by now that the energy transition will require a lot of copper. An additional 1%/year on our estimates which doesn’t sound like much but would be the equivalent of one large-scale copper mine coming online every year,” analysts led by Sam Crittenden said in a note this week.

“We can debate demand projections, but it’s always been a supply story with an aging supply base, declining grades, and quality projects becoming more scarce and harder to build for ESG reasons.”

“We think this potential supply deficit is filled partially by increased scrap and substitution/thrifting of copper but largely through a supply response from the copper mining industry which likely requires a period of high copper prices,” Crittenden and Co. said.

RBC Capital Markets, Sam Crittenden

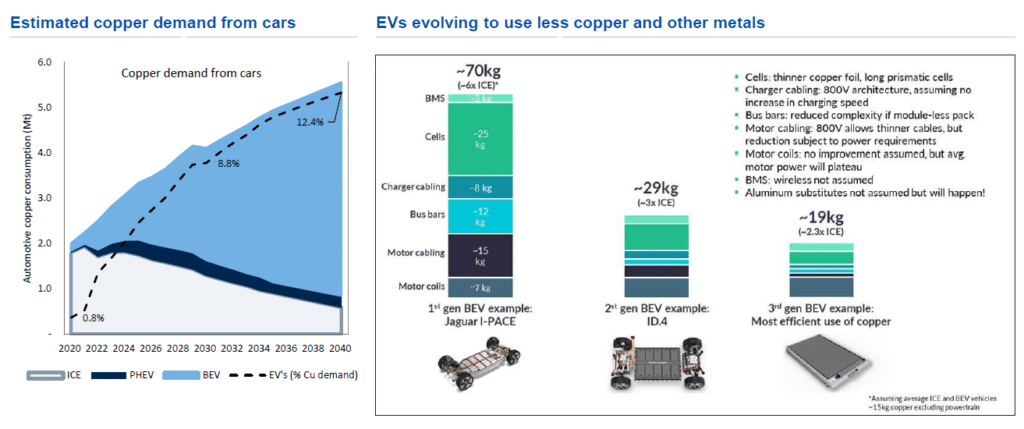

RBC suggests that copper consumption has been increasing by an average of 2.5% per annum over the past four decades. However, it is anticipated to ramp up to 2.8% per annum due to additional demand from electric vehicles (EVs), renewable energy, and the expansion of the global electrical grid.

Currently, copper mines generate a free cash flow (FCF) yield of less than 4%, which is below the S&P 500 average. If copper prices remain at US$3.50/lb, the FCF yield drops to less than 2%, surpassing only negative-yielding utilities. However, if copper prices rise to US$4.50/lb, the FCF yield increases to 8%, approximately double the S&P 500 average, trailing only the energy sector.

“There are only a handful of companies with the type of scale that would be of interest to the large global miners; however, we could see more consolidation in the mid and small-cap space,” RBC reckons.

RBC Capital Markets, Sam Crittenden

A significant challenge lies in the scarcity of high-quality copper projects available. Consequently, mergers and acquisitions (M&A) activity is likely to persist in the industry. Recent examples include BHP’s (ASX:BHP) $9.6 billion acquisition of OZ Minerals, Rio Tinto’s (ASX:RIO) minority buyout of Turquoise Hill and its stake in Oyu Tolgoi, Glencore’s hostile bidding for Canada’s Teck, and project-level purchases like Sandfire’s (ASX:SFR) acquisition of MATSA and South32’s (ASX:S32) purchase of a 45% stake in the Sierra Gorda mine in Chile.

At the large-cap level, RBC identifies First Quantum Minerals, Lundin Mining, and Ivanhoe Mines as potential targets for takeover. Additionally, RBC highlights the outperformance of various international copper juniors, including Filo Mining and Arizona Sonoran backed by BHP and Rio, Solaris Resources focused on Ecuador, and oxide explorer Marimaca Copper.

Elon Musk has made bold claims that there will be enough copper for Tesla’s EVs, despite concerns that the metal-intensive nature of the technology will necessitate a substantial increase in mining to meet the order volumes of major original equipment manufacturers (OEMs). RBC acknowledges the possibility of EV designs becoming less copper-intensive but notes that they are still more reliant on copper compared to internal combustion engine vehicles. RBC estimates that the 70kg of copper in first-generation BEVs could potentially decrease to 19kg (2.3 times that of ICEs) by the third generation.

Disclaimer

RBC Capital Markets is the business name used by certain branches and subsidiaries of the Royal Bank of Canada, including RBC Dominion Securities Inc., RBC Capital Markets, LLC, RBC Europe Limited,

RBC Capital Markets (Europe) GmbH, Royal Bank of Canada, Hong Kong Branch, Royal Bank of Canada, Singapore Branch and Royal Bank of Canada, Sydney Branch. The information contained in this report

has been compiled by RBC Capital Markets from sources believed to be reliable, but no representation or warranty, express or implied, is made by Royal Bank of Canada, RBC Capital Markets, its affiliates or

any other person as to its accuracy, completeness or correctness. All opinions and estimates contained in this report constitute RBC Capital Markets’ judgement as of the date of this report, are subject to change

without notice and are provided in good faith but without legal responsibility. Nothing in this report constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation to clients and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The investments or services contained in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about the suitability of such investments or services. This report is not an offer to sell or a solicitation of an offer to buy any securities. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. RBC Capital Markets research analyst compensation is based in part on the overall profitability of RBC Capital Markets, which includes profits attributable to investment banking revenues. Every province in Canada, state in the U.S., and most countries throughout the world have their own laws regulating the types of securities and other investment products which may be offered to their residents, as well as the process for doing so. As a result, the securities discussed in this report may not be eligible for sale in some jurisdictions. RBC Capital Markets may be restricted from publishing research reports, from time to time, due to regulatory restrictions and/ or internal compliance policies. If this is the case, the latest published research reports available to clients may not reflect recent material changes in the applicable industry and/or applicable subject companies. RBC Capital Markets research reports are current only as of the date set forth on the research reports. This report is not, and under no circumstances should be construed as, a solicitation to act as securities broker or dealer in any jurisdiction by any person or company that is not legally permitted to carry on the business of a securities broker or dealer in that jurisdiction. To the full extent permitted by law neither RBC Capital Markets nor any of its affiliates, nor any other person, accepts any liability whatsoever for any direct, indirect or consequential loss arising from, or in connection with, any use of this report or the information contained herein. No matter contained in this document may be reproduced or copied by any means without the prior written consent of RBC Capital Markets in each instance.

Additional information is available on request.

To U.S. Residents: This publication has been approved by RBC Capital Markets, LLC (member FINRA, NYSE, SIPC), which is a U.S. registered broker-dealer and which accepts responsibility for this report and

its dissemination in the United States. Any U.S. recipient of this report that is not a registered broker-dealer or a bank acting in a broker or dealer capacity and that wishes further information regarding, or to effect any transaction in, any of the securities discussed in this report, should contact and place orders with RBC Capital Markets, LLC.

To Canadian Residents: This publication has been approved by RBC Dominion Securities Inc. (member IIROC). Any Canadian recipient of this report that is not a Designated Institution in Ontario, an

Accredited Investor in British Columbia or Alberta or a Sophisticated Purchaser in Quebec (or similar permitted purchaser in any other province) and that wishes further information regarding, or to effect any

transaction in, any of the securities discussed in this report should contact and place orders with RBC Dominion Securities Inc., which, without in any way limiting the foregoing, accepts responsibility for this

report and its dissemination in Canada.

To U.K. Residents: This publication has been approved by RBC Europe Limited (‘RBCEL’) which is authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority (‘FCA’) and the Prudential Regulation Authority, in connection with its distribution in the United Kingdom. This material is not for general distribution in the United Kingdom to retail clients, as defined under the rules of the FCA. RBCEL accepts responsibility for this report and its dissemination in the United Kingdom.