We recently attended the Australian Mining Leaders Forum at the prestigious Royal Society in London. One of the talks in particular stood out for us as we look at where the mining industry is heading in the future.

Jonathan Lee, a director of energy Resources at PWC, the professional services firm, gave a talk entitled ‘Mine 2019: Resourcing the future by building on strong fundamentals. The key themes of which were derived from PWCs annual mining review, Mine 2019.

Mine 2019 is based on PWC’s assessment of the world’s 40 largest mining companies. Whilst more often we’re looking at smaller mining companies here at MiningIR, it’s good to have an overarching look at the industry, to pick up on trends, and to watch as some of those changes in mining cascade down from the world leaders to even the smallest players.

If you haven’t read it already, Mine 2019 is available for download from PWC here https://www.pwc.com/gx/en/energy-utilities-mining/publications/pdf/mine-report-2019.pdf

Mining playing catch-up

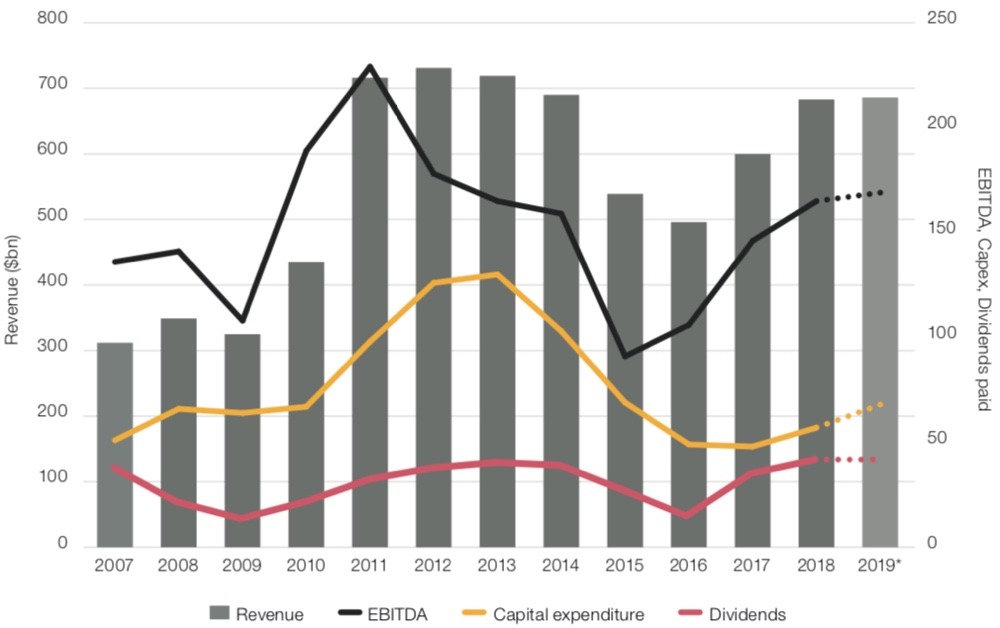

Source: Annual reports, PwC analysis

PWC’s report highlights the fact that despite recent performance at the top end of the mining industry, which they’ve defined as an increase in production, improved cash flow, reduced debt, improved returns to shareholders whilst also increasing capital expenditure for the first time in five years. All while supplying the raw materials that power global economic growth. So is all is golden in the world of mining?

Not quite. It seems investors have concerns about mining, particularly in the areas of safety, the environment, technology and consumer engagement. Whilst environmental awareness is clearly high on the consumer agenda, it is perhaps ironic that many of those pressing for changes in energy production and consumer behaviour to steer us towards a ‘lower carbon future’ are failing to make the link with the critical role mining has to play in that future.

Some miners in this top 40 bracket have adopted very clear climate change strategies, which others have yet to make a move. Whilst copper and battery metals like lithium and nickel are getting. A lot of the headlines at the moment, the PWC report points out that coal still contributes 38% towards global electricity production.

A clear investment message

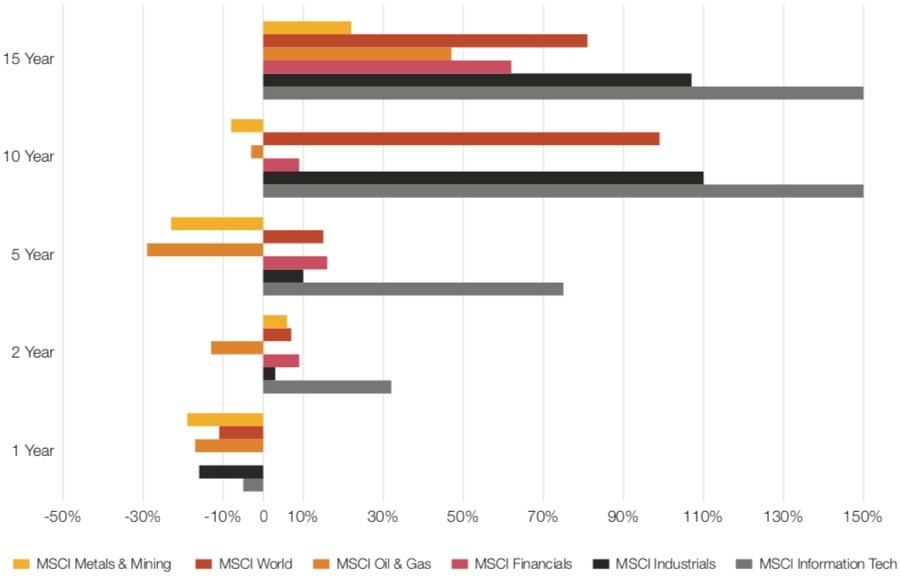

Despite some of the more upbeat metrics in the last couple of years, PWC are seeing mining struggling to hold its own against global market indices, as investors seem to be unwilling to invest at historic price and dividend yield levels.

*Annual capital growth (31-Dec over 1-Jan) plus dividend yield

Source: S&P Capital IQ

When compared to other sectors, especially over the longer 15 year term, it appears mining is struggling to make the investment message clear.

PWC see now as the right time for the world’s leading mining companies to address these issues with ‘brand mining’, underpinned by strong balance sheets and cash flow. They see the future success of mining as not just being dependent on overcoming regulatory or trade issues and the changes that come in an ever-evolving world, but the willingness to go out there and market the fact that the raw materials which we rely on, and the power that supplies our world, be it coal, lithium or rare earths to build solar cells or the generator in a wind turbine, comes from mining.

The mining recipe for success

PWC have identified three key areas which mining needs to address in order to restore faith in the mining industry – they’re using the term ‘a chance to fix brand mining’.

1 – Action and words needed on carbon and low carbon economy.

Whilst many of the top 40 miners are performing well in terms of sustainability reporting, many stakeholders are demanding more in order for trust to be regained and increased. Direct, measurable and visible progress is needed. Areas such as reducing groundwater consumption, use of solar power for processing or improving internal efficiencies have all helped, with many of the larger miners targeting a reduction in greenhouse gas emissions of between 3-5% by 2020. As laudable as these moves are, other sectors are doing more. For example, next door in the oil and gas world Shell and BP have set clear reduction targets, linked executive pay to their carbon footprint and invested up to 8% of capex in green technology during the 2018 financial year.

Miners therefore should consider the impact of their activities as well as the uses of their products downstream.

2 – Accelerate and widen technology adoption

Whilst automation and digitisation play an increasing role within the mining industry, compared to other industries mining is still relatively technologically immature. Mining should be looking to other industries and see how the changes they’ve made could be adapted and applied to mining in all areas, including sustainability, safety and changing consumer sentiment. PWC’s own research shows that companies who can get this move to digital right will enjoy higher revenues and lower costs.

3 – Engage with consumers and let them know they NEED mining

Mining has so many consumer-focussed stories to tell, but so few of them are getting out in front of the global audience who rely on the end product of mining. Factor in the ways mining is responding to consumer concerns around, for example, sustainability, and there’s even more opportunity to talk.

PWC gave the examples of how Rio Tinto and Alcoa formed a new venture with Apple in order to create the world’s first carbon-free aluminium smelting process. RCS Global used blockchain technology to help to trace and validate ethically sourced cobalt.

As mining is required to ramp up production to maintain an economical supply of commodities in response to consumer demand, consumers often remain unaware that the commodities which supply the technology and products they consume come from mining. The opportunity is there for miners to highlight the critical role they role, after all, there is no alternative supply!

You can download and read the full report from PWC, which includes extensive coverage of the financial performance and other key metrics across the top 40 miners in the world, including a look at M&A activity, diversity, and a look at the performance of key commodities.