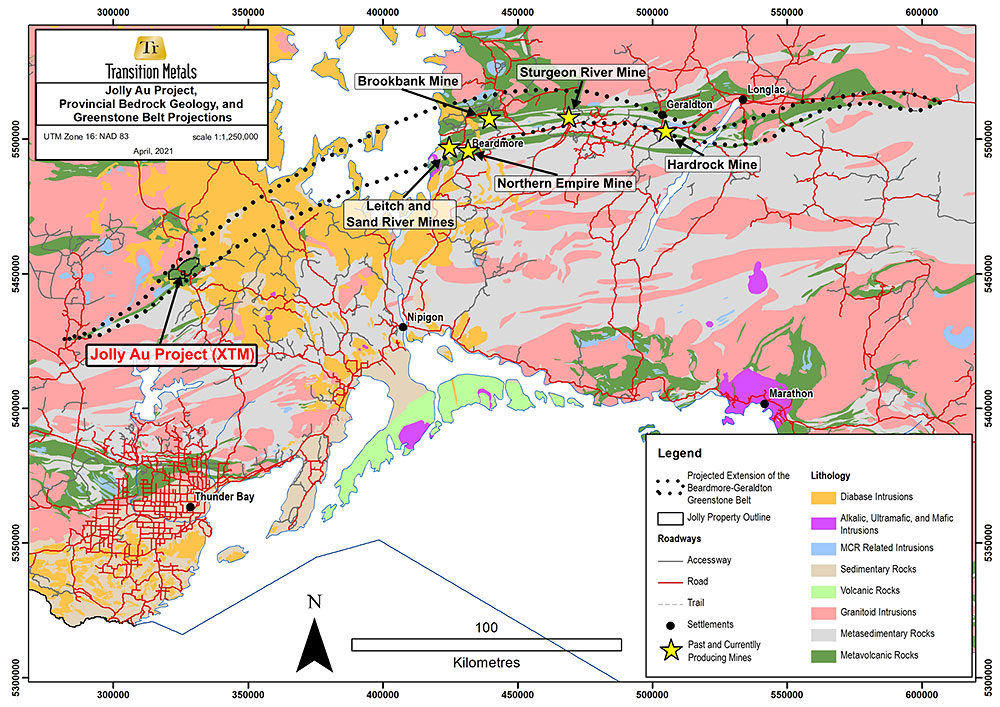

Transition Metals Corp. is pleased to provide an interpretation of results from field work completed at the Company’s 100% owned and optioned Jolly Gold Property, located a one hour drive north of Thunder Bay, Ontario (Figure 1). Work completed in 2021 and 2022 has identified a large gold exploration target, which demonstrates the potential for a camp scale extension to this highly prospective mineralized region west of Lake Nipigon.

“The data highlights a compelling new gold target at Jolly” stated CEO Scott McLean. “The gold values we have exposed in outcrop occur within a 4 km long trend of elevated gold pathfinder elements in soils occurring in favourable geology between two major fault systems. This is a classic setting for the formation of large gold systems in Archean greenstone settings and is similar to what is observed in the Beardmore-Geraldton Gold Camp on the east side of Lake Nipigon”.

CEO Scott McLean

Work completed by Transition in 2021 and 2022 included; the completion of a high-resolution airborne magnetic survey, property scale orientation mapping and prospecting, the completion of a 1,159 sample MMI soil survey covering approximately a third of the property and the mechanical excavation and detailed structural mapping and sampling of 4 trenches.

Discussion of Results

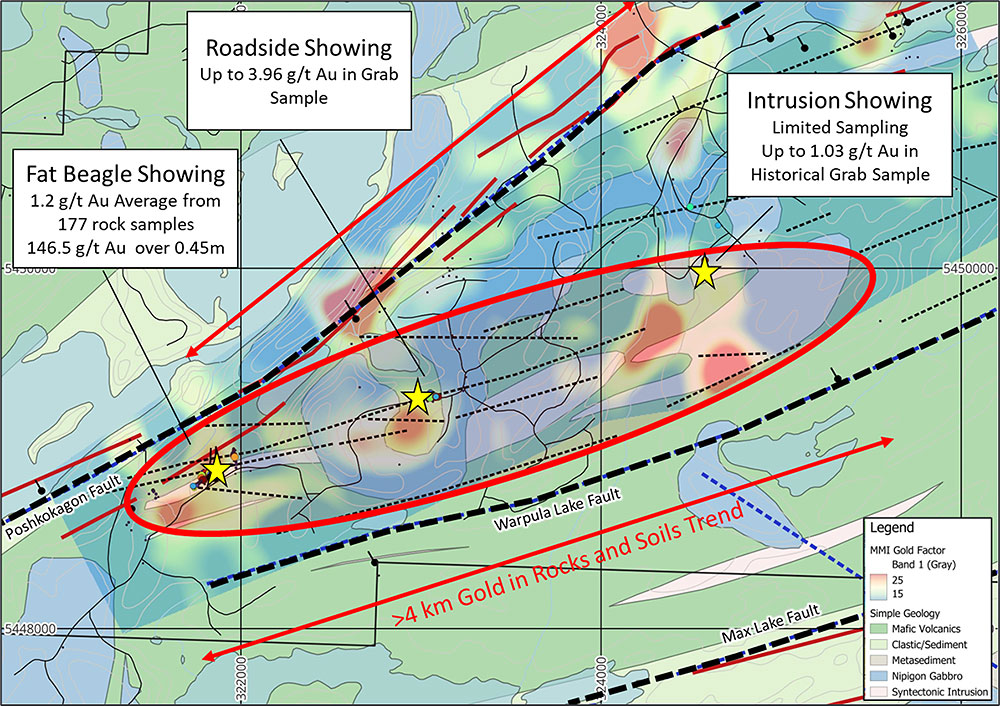

The airborne magnetic survey highlighted three major northeast trending fault systems transecting the property, trends of iron formation as well as a network of east by northeast cross structures parallel to those hosting gold at known showings between the Poshkokagan and Warpula Lake fault systems.

The MMI sampling highlights a 4-kilometer trend of elevated gold pathfinder elements in soil developed with gold values up to 50 times background (Figure 2). This soil trend appears to follow and underlying cluster of syntectonic intrusions.

Channel sampling in the vicinity of the Fat Beagle showing (located within this trend) exposed two zones of gold mineralization associated with east-west shearing. The Fat Beagle north showing consists of a 5 metre wide zone of veining exposed along strike in trench for 15 metres. The average of 29 samples cut across this shear zone representing 17.08 metres of select channel sampling returned an average grade of 5.23 g/t Au with the highest interval being 146.7 g/t Au over 0.45 metres. At the Roadside showing 1.2 kilometres along strike to the to the east, a much broader zone of elevated gold, copper and tungsten was exposed. Across 5-10 metre wide EW shear zone exposed along strike over 40 metres, 12 samples representing 8.94 m of select channel sampling returned an average of 0.28 g/t Au.

| Showing | Channel | Length | Au ppm | Ag ppm | Bi ppm | Cu ppm | Te ppm |

| Fat Beagle North | 13 | 0.95 | 68.90 | 1.08 | 460.87 | 354.97 | 89.32 |

| including | 13 | 0.41 | 146.50 | 1.68 | 275.00 | 268.00 | 117.00 |

| Fat Beagle North | 14 | 0.6 | 24.40 | 0.47 | 80.30 | 195.00 | 36.10 |

| Fat Beagle North | 9 | 0.80 | 0.87 | 0.11 | 7.27 | 330.50 | 2.72 |

| Fat Beagle North | 16 | 1.18 | 1.16 | 0.21 | 11.17 | 512.05 | 3.74 |

| Fat Beagle South | 31 | 1.25 | 0.50 | 0.31 | 193.52 | 754.26 | 3.92 |

| Fat Beagle South | 34 | 1.87 | 1.08 | 0.29 | 71.92 | 327.30 | 0.82 |

| Fat Beagle South | 36 | 1.81 | 0.37 | 0.10 | 9.61 | 224.08 | 0.25 |

| Fat Beagle South | 32 | 1.08 | 0.99 | 0.13 | 33.87 | 207.35 | 1.58 |

| Fat Beagle | 9 | 0.89 | 0.44 | 0.09 | 6.49 | 363.00 | 3.36 |

| Fat Beagle | 21 | 0.85 | 0.38 | 0.05 | 4.32 | 118.00 | 2.86 |

| Roadside | 20 | 3.15 | 0.21 | 1.04 | 8.30 | 726.64 | 3.31 |

| Roadside | 22 | 2.12 | 0.43 | 0.94 | 17.39 | 1374.12 | 5.30 |

| Roadside | 23 | 0.75 | 0.35 | 1.48 | 87.50 | 1455.00 | 23.60 |

| Roadside | 24 | 0.60 | 0.48 | 0.88 | 1.59 | 1245.00 | 0.69 |

*MMI Gold Factor highlights elevated cumulative response ratios for gold pathfinder elements including Ag, As, Au, Bi, Hg, Sb, Te, and W

About the Jolly Gold Property

The property, which comprises an area of 4,560 hectares, covers an assemblage of meta-volcanic and meta-sedimentary rocks of the Eastern Wabigoon sub-province. It is bisected by the regionally-significant, northeast-trending Poshkokagan River Fault, and bound to the south by the northeast-trending Max Lake Fault interpreted westerly extensions to the southern bounding structures of the Beardmore-Geraldton Greenstone Belt (BGB)-and the Quetico terrain defined on the east side of Lake Nipigon. Gold deposits elsewhere in the BGB, such as the 6.9 Moz Hardrock deposit¹ under development by Greenstone Gold near Geraldton, are considered classic examples of epigenetic, non-stratiform, banded iron formation-hosted gold deposits. Other notable deposits within the BGB include the shear and basalt hosted Brookbank mine (0.6 Moz M&I)¹, the turbiditic sandstone and quartz-carbonate vein hosted Sand River and Leitch Mines (past production of 0.9 Moz)², the Northern Empire Mine, and Sturgeon River Mine.

¹ Equinox news release, October 27, 2021 – reference to Gignac et al. 2020. NI 43-101 Technical Report Hardrock Project Ontario, Canada – Premier Gold Mines Limited, Sedar Jan. 26, 2021.

² Mason J.K., & White G.D., 1986. Gold occurrences, prospects, and deposits of the Beardmore-Geraldton area, districts of Thunder Bay and Cochrane; Ontario Geological Survey, OFR5630, 713 p.

Qualified Person

The technical elements of this press release have been reviewed and approved by Mr. Greg Collins, P.Geo. (PGO), a Qualified Person as defined under National Instrument 43-101. Analytical work associated with the MMI Survey performed was conducted at SGS Canada Inc., an independent, accredited laboratory with analyses completed in Burnaby, B.C. The quality system used by SGS Canada Inc. meets all requirements of International Standards ISO/IEC 17025:2017.

About Transition Metals Corp

Transition Metals Corp. (XTM-TSX.V) is a Canadian-based, multi-commodity explorer. Its award-winning team of geoscientists has extensive exploration experience which actively develops and tests new ideas for discovering mineralization in places that others have not looked, often allowing the company to acquire properties inexpensively. Joint venture partners earn an interest in the projects by funding a portion of higher-risk drilling and exploration, allowing Transition to conserve capital and minimize shareholder’s equity dilution.

Cautionary Note on Forward-Looking Information

Except for statements of historical fact contained herein, the information in this news release constitutes “forward-looking information” within the meaning of Canadian securities law. Such forward-looking information may be identified by words such as “plans”, “proposes”, “estimates”, “intends”, “expects”, “believes”, “may”, “will” and include without limitation, statements regarding estimated capital and operating costs, expected production timeline, benefits of updated development plans, foreign exchange assumptions and regulatory approvals. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from such statements. Factors that could cause actual results to differ materially include, among others, metal prices, competition, risks inherent in the mining industry, and regulatory risks. Most of these factors are outside the control of the Company. Investors are cautioned not to put undue reliance on forward-looking information. Except as otherwise required by applicable securities statutes or regulation, the Company expressly disclaims any intent or obligation to update publicly forward-looking information, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Further information is available at www.transitionmetalscorp.com or by contacting:

Scott McLean

President and CEO

Transition Metals Corp.

Tel: (705) 669-1777