Written by James Hyland

WASHINGTON, USA, (MiningIR) — The recent legislative push by the United States Congress to prohibit Russian uranium imports marks a pivotal shift in the nation’s energy and geopolitical landscapes. This decision not only underscores the growing urgency to secure domestic energy resources but also highlights the strategic importance of nuclear power in achieving long-term energy independence and sustainability.

The Legislative Framework

In a bipartisan effort, US lawmakers have moved decisively to sever ties with Russian uranium, a critical component for many of America’s nuclear reactors. This legislation, spearheaded by prominent senators, aims to curtail the American nuclear industry’s dependence on Russian resources, which have become increasingly contentious due to geopolitical tensions. The bill not only bans the import of Russian uranium but also sets the stage for a revitalized exploration and mining sector within the United States .

Implications for the US Nuclear Sector

The ban arrives at a time when nuclear energy is regaining favor globally, as evidenced by the discussions at last year’s COP28 in Dubai. The conference, which saw unprecedented focus on nuclear solutions, concluded with a significant declaration from 22 countries, including Canada. These nations committed to tripling their nuclear energy capacity by 2050, recognizing nuclear power as a key player in the global transition to cleaner energy .

Benefits to US Companies and Exploration Efforts

For companies like Atomic Minerals Corp. (TSX.V: ATOM), which are engaged in the exploration and development of uranium within the United States, the legislative changes could not be more timely. With Russian imports off the table, the spotlight turns to domestic sources, potentially leading to increased investments, enhanced exploration efforts, and greater overall sector growth.

Strengthening Energy Security

The transition away from Russian uranium aligns with broader national security and energy independence goals. By investing in domestic uranium mining, the US not only diminishes its vulnerability to foreign market fluctuations but also bolsters its standing in the global nuclear energy arena .

“America’s dangerous reliance on Russian enriched uranium must come to an end—our national security depends on it,” said Senator Jim Risch. “With the passage of our legislation, America is taking an important step to spur uranium conversion and enrichment in the U.S., support advanced nuclear development and energy independence, and end Russian control of the global nuclear fuel supply chain.”

Senator Jim Risch (R-Idaho)

The acknowledgment of nuclear energy’s role in sustainable development at COP28 reflects a wider acceptance of its importance in achieving carbon neutrality. As nuclear power offers a consistent and reliable energy supply unlike many other renewable sources, which can be intermittent, it is pivotal for countries aiming to reduce their carbon footprints without sacrificing energy security or economic stability .

Future Prospects for US Uranium

The future of US uranium looks promising. With the legislative framework in place to support domestic exploration and the global momentum towards nuclear energy, companies operating in the uranium sector, such as Atomic Minerals Corp., are well-positioned to capitalize on these developments. The increased demand for nuclear energy, driven by both environmental imperatives and energy security concerns, is likely to spur further exploration and might significantly boost the US uranium mining industry.

“I have fought for years to end America’s reliance on Russian nuclear fuel. Our efforts have finally paid off with passage of our bill to ban these imports once and for all,” said Barrasso. “Wyoming has the uranium to replace Russian imports, and we’re ready to use it. Our bipartisan legislation will help defund Russia’s war machine, revive American uranium production, and jumpstart investments in America’s nuclear fuel supply chain. This is a tremendous victory. I’m grateful to members of both parties for helping get this over the finish line.”

Senator John Barrasso (R-Wyo.)

The US Congressional ban on Russian uranium imports is a defining moment for the American nuclear industry. It not only serves the immediate needs of energy security and economic sovereignty but also aligns with global efforts to promote cleaner energy sources. As the country moves forward, the role of domestic uranium mining will be crucial in ensuring the success of its nuclear energy strategy, offering substantial benefits to companies invested in this critical resource.

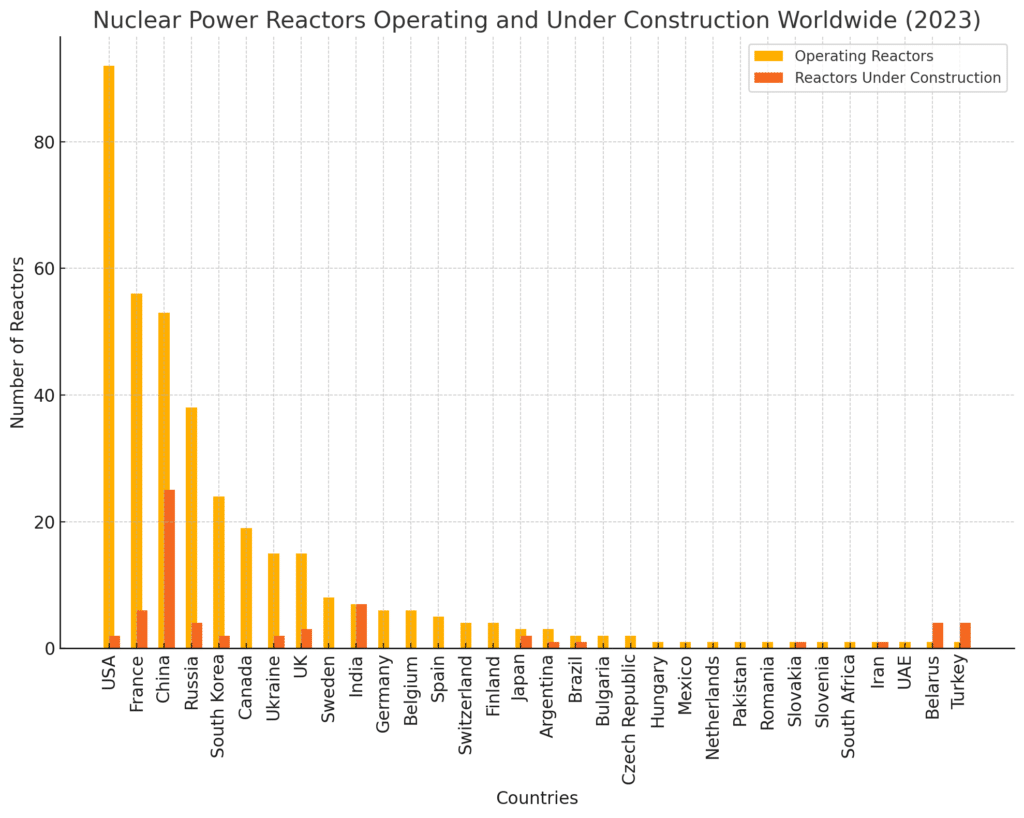

Currently, the global landscape of nuclear power includes approximately 500 commercial nuclear reactors either operational or under construction. These reactors represent a significant part of the world’s clean energy infrastructure, aimed at reducing reliance on fossil fuels and enhancing energy security. This significant number underscores the global demand for uranium, emphasizing the need for enhanced domestic uranium mining in the USA following the ban on Russian imports. This strategic move aims to secure a reliable uranium supply for the burgeoning nuclear energy sector, ensuring the United States remains competitive and self-reliant in the face of changing global energy dynamics.

In an era where energy independence and environmental sustainability go hand in hand, the US’s pivot to its uranium reserves might just be the key to a secure, prosperous, and clean energy future.

Disclosure: James Hyland is a director of Atomic Minerals Corp., a company mentioned in this article.