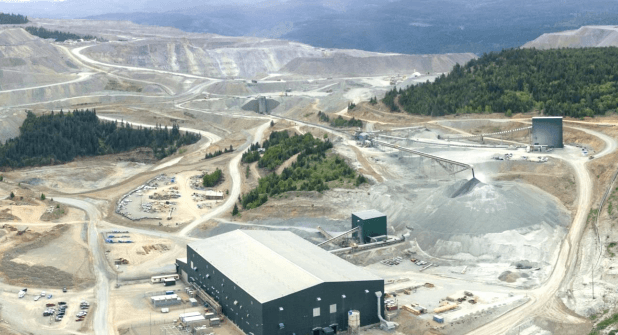

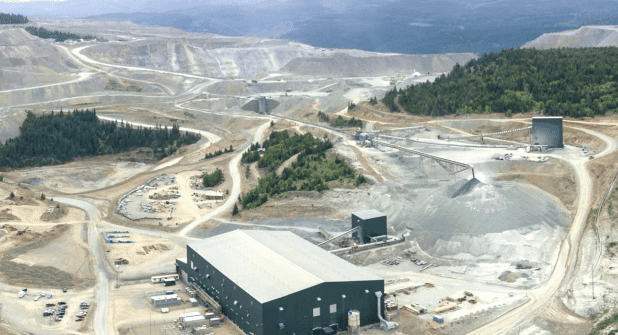

Copper Mountain’s flagship asset is the 75% owned Copper Mountain mine located in southern British Columbia near the town of Princeton. The Copper Mountain mine produces about 90 million pounds of copper equivalent per year with a large resource that remains open laterally and at depth.

Copper Mountain’s flagship asset is the 75% owned Copper Mountain mine located in southern British Columbia near the town of Princeton. The Copper Mountain mine produces about 90 million pounds of copper equivalent per year with a large resource that remains open laterally and at depth.

Copper Mountain also has the permitted, development stage Eva Copper Project in Queensland, Australia and an extensive 4,000 km2 highly prospective land package in the Mount Isa area.

Copper Mountain Mining Corporation (TSX:CMMC | ASX:C6C) have announced Q3 2018 production results for its Copper Mountain Mine, located in southern British Columbia.

All results are reported on a 100% basis. Production for the third quarter 2018 was 18.3 million pounds of copper, 7,500 ounces of gold and 64,900 ounces of silver, which was in line with expectations. The Company guided that third quarter 2018 copper production would be approximately 10% lower than the second quarter due to lower copper grades being mined. Actual copper production was 8.5% lower than the second quarter. Fourth quarter copper production is expected to be the strongest quarter of 2018.

The Company remains on track to achieve 2018 annual production guidance of 80 million pounds of copper (+/-5%). Copper equivalent production was 22.0 million pounds and was down only 4.8% compared to the second quarter due to higher gold production as a result of increased gold grade and recovery after the installation of a flash flotation circuit in the concentrator.

The mine continued with the next pushback on Pit#2 west, which commenced in the second quarter. The strip ratio in the third quarter was 2.3 to 1, lower than the second quarter. Mill throughput averaged 41,300 tonnes per day, with copper recovery of 79.1% and average feed grade of 0.28% copper. Grade was lower in the third quarter but was as guided and in line with the mine plan.

Gil Clausen, Copper Mountain’s President and CEO commented:

“Copper Mountain Mine operated on plan and as expected this quarter. The fourth quarter will be our strongest quarter this year and we are on track to achieve our production guidance. Copper Mountain continues to demonstrate predictability and consistency.”

Q3 2018 Financial and Operating Results Conference Call and Webcast Copper Mountain will release Q3 2018 financial and operating results before the market opens on Wednesday, October 31, 2018.

The Company will hold a conference call on Wednesday, October 31, 2018 at 7:30 am (Pacific Standard Time) for management to discuss the Q3 2018 financial and operating results.

Live Dial-in information Toronto and international: 647-427-7450 North America (toll-free): 1-888-231-8191 To participate in the webcast live via computer CLICK HERE.

An archive of the audio webcast will also be available on the company’s website.

Updated from a formal October 17th 2018 news release from Copper Mountain. Responsibility for the data included remains with the author(s).

MiningIR.com hosts a variety of articles from a range of sources, our content, while interesting, should not be considered as formal financial advice. Always seek professional guidance and consult a range of sources before investing.

“Copper Mountain Mine operated on plan and as expected this quarter. The fourth quarter will be our strongest quarter this year and we are on track to achieve our production guidance. Copper Mountain continues to demonstrate predictability and consistency.”

“Copper Mountain Mine operated on plan and as expected this quarter. The fourth quarter will be our strongest quarter this year and we are on track to achieve our production guidance. Copper Mountain continues to demonstrate predictability and consistency.”