Source: IronRidge Resources Press Release

Multiple New High-Grade Drilling Intersections New Pegmatite Targets Defined Ewoyaa and Abonko Lithium Pegmatite Project Ghana, West Africa

Commenting on the Company’s latest progress, Vincent Mascolo, CEO & Managing Director of IronRidge, said:

“Drilling results continue to confirm that Ewoyaa is a significant discovery, which is high-grade and spodumene dominant; the preferred feedstock for end users.

“Located within 100km trucking distance of an operating deep-sea port and within 1km of a bitumen highway, Ewoyaa is well positioned to benefit from existing infrastructure.

“In addition, the project is situated in the favourable, pro-mining jurisdiction of Ghana, which is ideal for the future development of the Cape Coast Lithium Portfolio.

“Confirmation of grade and continuity of mineralisation between 50m spaced cross-sections within the Central Zone of the main Ewoyaa deposit is very positive and bodes well for future resource estimation, as well as simplicity of mine design and process flow-sheet.

“Ongoing mineralisation discovery within the immediate project area, including new pegmatites at Ewoyaa and Abonko and step out drilling extending the known high-grade mineralisation at Ewoyaa an additional 250m of strike is highly encouraging.

“The recently discovered high-grade spodumene dominant pegmatites at Abonko, and around Ewoyaa, is significant as it adds further resource scale potential.

“Field teams have finalised metallurgical sampling, with 427kg of diamond drill core being dispatched to Nagrom laboratory in Perth for preliminary metallurgical test-work with initial results expected in the coming months.

“Concurrently, field teams are continuing regional pitting programmes around the Ewoyaa-Abonko pegmatite cluster which continues to deliver new pegmatite discoveries for future drill testing, as well as successfully completing a Ground Penetrating Radar (‘GPR’) survey to target pegmatites at depth.”

Second Phase Drilling Results:

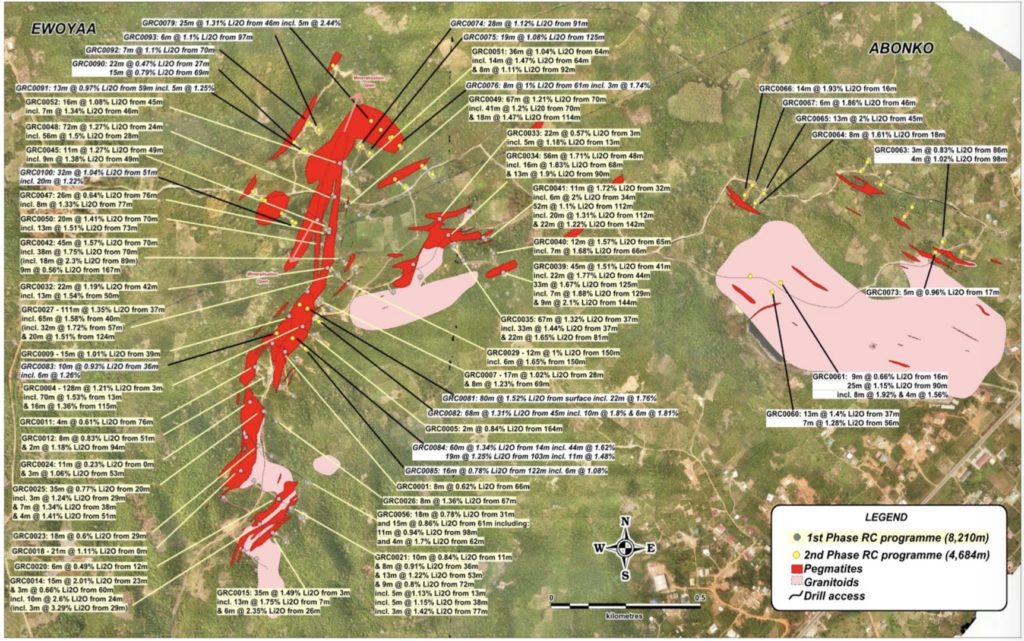

Final assay results have been received for the second phase RC drill programme completed during December 2018. A total of 44 drill holes for 4,684m of RC drilling was completed at Ewoyaa and Abonko.

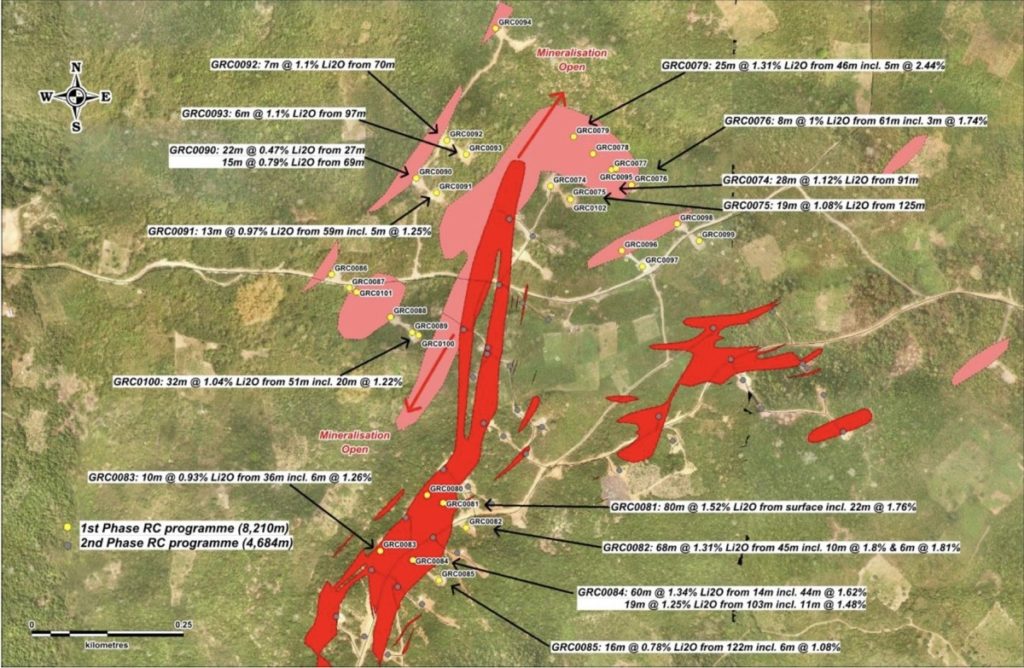

Drilling was designed to test mineralisation continuity within the known Ewoyaa deposit footprint for resource estimation, also testing strike extensions at Ewoyaa where mineralisation was/is still open and to test newly defined targets at Abonko and peripheral to Ewoyaa where mapping and pitting had defined pegmatite targets (refer Figure 1).

Infill Resource Drilling:

Drilling intersected multiple spodumene mineralised pegmatite intervals across the Ewoyaa and Abonko target areas with all intersections listed in Table 1 (minimum 3m intersection length, 0.4% Li2O cut-off to pegmatite contact and a maximum 4m internal dilution) and on Figure 2 and Figure 3. All drilling results to date are shown on Figure 6.

Broad, high-grade spodumene dominant pegmatites were intersected within two resource infill sections within the central zone of the Ewoyaa project. High-grade results demonstrate good continuity between previously announced results (refer RNS of 8 October 2018) and confirm broad, spodumene dominant pegmatite intersections (refer Figure 2) including highlights:

• GRC0081: 80m @ 1.52% Li2O from surface, including 22m @ 1.76% Li2O from 52m

• GRC0082: 68m @ 1.31% Li2O from 45m, including 10m @ 1.8% Li2O from 64m & 6m @ 1.81% Li2O

from 85m

• GRC0084: 60m @ 1.34% Li2O from 14m, including 44m @ 1.62% Li2O from 16m

• GRC0084: 19m @ 1.25% Li2O from 103m, including 11m @ 1.48% Li2O from 103m

Extensional Drilling:

Step out extensional drilling at the Ewoyaa North zone increased mineralised strike a further 250m with mineralisation remaining open in a north-east and south-west direction. Multiple spodumene dominant lithium pegmatite intersections (refer Figure 2) were returned including highlights:

• GRC0100: 32m @ 1.04% Li2O from 51m, including 20m @ 1.22% Li2O from 61m

• GRC0079: 25m @ 1.31% Li2O from 46m, including 5m @ 2.44% Li2O from 51m

• GRC0074: 28m @ 1.12% Li2O from 91m

• GRC0075: 19m @ 1.08% Li2O from 125m

Exploration Drilling:

Exploration drilling of new pegmatite targets defined in pitting peripheral to the Ewoyaa deposit (refer RNS of 10 December 2018) returned mixed results with new weathered and spodumene lithium pegmatites intersected in 40% of holes drilled (refer Figure 2). Importantly, new spodumene pegmatite trends were intersected outside of the known main Ewoyaa deposit, demonstrating the potential for additional resource upside within the immediate project area, and in addition with the Abonko target. Highlights from the Ewoyaa exploration drilling include:

• GRC0091: 13m @ 0.97% Li2O from 59m, including 5m @ 1.25% Li2O from 59m

• GRC0090: 15m @ 0.79% Li2O from 69m

• GRC0090: 22m @ 0.47% Li2O from 27m

• GRC0076: 8m @ 1% Li2O from 61m

• GRC0092: 7m @ 1.1% Li2O from 70m

• GRC0093: 6m @ 1% Li2O from 97m

• GRC0077: weathered pegmatite from 0m to 44m

• GRC0078: weathered pegmatite from 0m to 20m

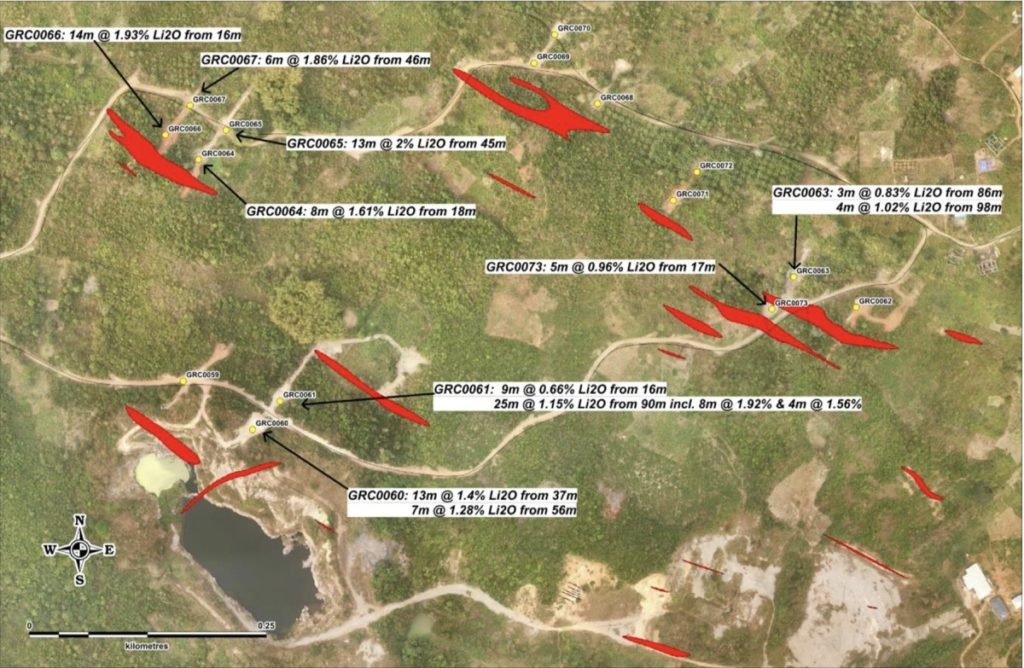

Exploration drilling of pegmatite targets defined at Abonko intersected high-grade, spodumene dominant pegmatite intervals within three of the five targets tested (refer Figure 3). Intervals are narrower but generally higher grade and visually coarser grained spodumene in RC drill chips and outcrop, than those intersected in Ewoyaa, and will likely form valuable high-grade satellite deposits to the main Ewoyaa deposit. Highlights from the Abonko exploration drilling include:

• GRC0061: 25m @ 1.15% Li2O from 90m, including 8m @ 1.92% Li2O from 98m and 4m @ 1.56% Li2O from 110m

• GRC0066: 14m @ 1.93% Li2O from 16m

• GRC0065: 13m @ 2% Li2O from 45m

• GRC0060: 13m @ 1.4% Li2O from 37m

• GRC0064: 8m @ 1.61% Li2O from 18m

• GRC0067: 6m @ 1.86% Li2O from 46m

Regional Exploration Ongoing:

Regional exploration pitting has continued concurrent with the drilling programme. Pitting has focussed around the Ewoyaa pegmatite footprint as a high priority zone to discover additional satellite spodumene pegmatites. Pitting remains ongoing and infill pitting is underway to better define the newly discovered pegmatite targets. Three high-priority pegmatite targets have been discovered 200m to 500m west of Ewoyaa with the highest priority pegmatite target covering a 500m x 100m area (refer Figure 4).

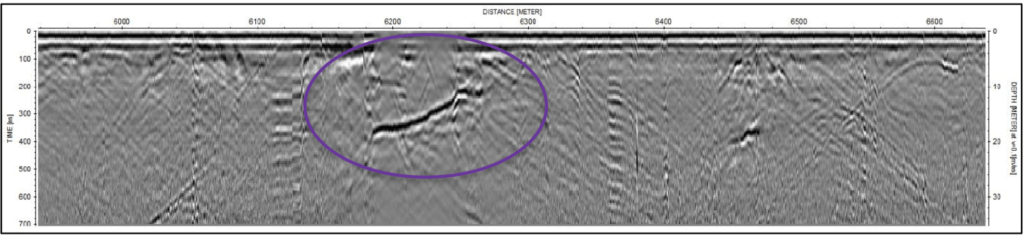

Concurrently Ground Penetrating Radar (‘GPR’) has been trialled to assess its use as an exploration tool to seethrough weathered cover to define new pegmatite targets as well as better define dips of pegmatite targets defined in pitting prior to drill testing. The trial has proved successful in that GPR can be used to map depth of weathering over the Ewoyaa deposit to assist in geological modelling, as well as defining direct geophysical‘reflector’ targets which may represent pegmatites to depths up to 30m below surface in some instances (referFigure 5).

Metallurgical sampling of the completed diamond drill holes (refer RNS 31 January 2019) has been completed and 427kg of diamond drill core currently being air freighted to Nagrom laboratory in Perth, Western Australia for preliminary metallurgical test-work. Results from the initial test-work are expected in the coming months.

The Board is pleased with the progress that the Company has made to date and looks forward to keeping shareholders updated as further news becomes available.

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of Regulation (EU) No 596/2014 until the release of this announcement.

For any further information please contact:

IronRidge Resources Limited

For any further information please contact:

IronRidge Resources Limited

Vincent Mascolo (Chief Executive Officer) Karl Schlobohm (Company Secretary) – Tel: +61 7 3303 0610

SP Angel Corporate Finance LLP

Nominated Adviser and Broker

Jeff Keating

Charlie Bouverat – Tel: +44 (0)20 3470 0470

Yellow Jersey PR Limited

Felicity Winkles Harriet Jackson – Tel: +44 (0) 7544 275882

Competent Person Statement:

Information in this report relating to the exploration results is based on data reviewed by Mr Lennard Kolff (MEcon. Geol., BSc. Hons ARSM), Chief Geologist of the Company. Mr Kolff is a Member of the Australian Institute of Geoscientists who has in excess of 20 years’ experience in mineral exploration and is a Qualified Person under the AIM Rules. Mr Kolff consents to the inclusion of the information in the form and context in which it appears.

IronRidge Resources is an AIM-listed, Africa focussed minerals exploration company with a lithium pegmatite discovery in Ghana, extensive grassroots gold portfolio in Cote d’Ivoire and a potential new gold province discovery in Chad. The Company holds legacy iron ore assets in Gabon and a bauxite resource in Australia. IronRidge’s strategy is to create and sustain shareholder value through the discovery and development of significant and globally demanded commodities.

Ghana

The Company entered into earn-in arrangements with Obotan Minerals Limited, Merlink Resources Limited, Barari Developments Limited and Joy Transporters Limited of Ghana, West Africa, securing the first access rights to acquire the historical Egyasimanku Hill spodumene rich lithium deposit, estimated to be in the order of 1.48Mt at 1.67% Li2O and surrounding tenements. The portfolio covers some 684km2 with the newly discovered Ewoyaa project including drill intersections of 128m @ 1.21% Li2O from 3m and 111m @ 1.35% Li2O from 37m, and a further identified 20km strike of pegmatite vein swarms. The tenure package is also highly prospective for tin, tantalum, niobium, caesium and gold, which occur as accessory minerals within the pegmatites and host formations.

Chad

The Company entered into an agreement with Tekton Minerals Pte Ltd of Singapore concerning its portfolio covering 900km2 of highly prospective gold and other mineral projects in Chad, Central Africa. IronRidge acquired 100% of Tekton including its projects and team to advance the Dorothe, Echbara, Am Ouchar, Nabagay and Kalaka licenses, which host multiple, large scale gold projects. Trenching results at Dorothe, including 84m @ 1.66g/t Au (including 6m @ 5.49g/t & 8m @ 6.23g/t), 4m @ 18.77g/t Au (including 2m @ 36.2g/t), 32m @ 2.02g/t Au (including 18m @ 3.22g/t), 24m @ 2.53g/t Au (including 6m @ 4.1g/t (including 2m @ 6.2g/t) and 2m @ 6.14g/t), 14.12g/t Au over 4m, 34.1g/t over 2m and 63.2g/t over 1m, have defined significant gold mineralised quartz veining zones over a 3km by 1km area including the steep dipping ‘Main Vein’ and shallow dipping ‘Sheeted Vein’ zones.

Côte d’Ivoire

The Company entered into conditional joint venture arrangements in Côte d’Ivoire, West Africa; securing access rights to highly prospective gold mineralised structures and pegmatite occurrences covering a combined 3,584km2 and 1,172km2 area respectively. The projects are well located within access of an extensive bitumen road network and along strike from multi-million-ounce gold projects and mines.

Australia

Monogorilby is prospective for province scale titanium and bauxite, with an initial maiden resource of 54.9MT of premium DSO bauxite. Monogorilby is located in central Queensland, within a short trucking distance of the rail system leading north to the Port of Bundaberg. It is also located within close proximity of the active Queensland Rail network heading south towards the Port of Brisbane.

May Queen is located in Central Queensland within IRR’s wholly owned Monogorilby license package and is highly prospective for gold. Historic drilling completed during the 1980s intersected multiple high-grade gold intervals, including 2m @ 73.4 g/t Au (including 1m at 145g/t), 4m @ 38.8g/t Au (at end of hole) and 3m @ 18.9g/t Au, over an approximate 100m strike hosting numerous parallel vein systems, open to the north-west and south-east.

Wholly owned Quaggy contains highly anomalous platinum, palladium, nickel, cobalt and copper exploration targets and is located in Central Queensland, within a short trucking distance of the dormant rail system to the Port of Bundaberg. It is also located within close proximity of the active Queensland Rail network heading south towards the Port of Brisbane.

Gabon

Tchibanga is located in south-western Gabon, in the Nyanga Province, within 10-60km of the Atlantic coastline. This project comprises two exploration licenses, Tchibanga and Tchibanga Nord, which cover a combined area of 3,396km2 and include over 90km of prospective lithologies and the historic Mont Pele iron occurrence.

Belinga Sud is Located in the north east of Gabon in the Ogooue-Ivindo Province, approximately 400km east of the capital city of Libreville. IRR’s licence lies between the main Belinga Iron Ore Deposit, believed to be one of the world’s largest untapped reserves of iron ore with an estimated 1bt of iron ore at a grade >60% Fe, and the route of the Trans Gabonese railway, which currently carries manganese ore and timber from Franceville to the Port of Owendo in Libreville.

Corporate

IronRidge made its AIM debut in February 2015, successfully securing strategic alliances with three international companies: Assore Limited of South Africa, Sumitomo Corporation of Japan and DGR Global Limited of Australia. Assore is a high- grade iron, chrome and manganese mining specialist. Sumitomo Corporation is a global resources, mining marketing and trading conglomerate. DGR Global is a project generation and exploration specialist.