All amounts are in US dollars, unless otherwise indicated.

Measured and indicated resources are quoted inclusive of proven and probable reserves for all sites and projects.

IAMGOLD Corporation announces its updated Mineral Reserves and Mineral Resources statement as of December 31, 2023 prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). A summary table of the updated Mineral Resources and Reserves for the Company’s current assets, including attributable ounces accounting for ownership interest, can be found at the end of this news release.

Highlights

- Updated Gosselin Mineral Resource estimate (100% basis) of 4.4 million Indicated gold ounces in 161.3 million tonnes (“Mt”) at 0.85 grams per tonne gold (“g/t Au”), and 3.0 million Inferred ounces (123.9 Mt at 0.75 g/t Au). This represents an estimated increase of 1.1 million ounces in Indicated and 1.3 million ounces in Inferred, representing a 32% and 74% increase respectively. On an attributable basis (60.3%), the Gosselin Mineral Resource estimate is 2.7 million ounces Indicated and 1.8 million ounces Inferred.

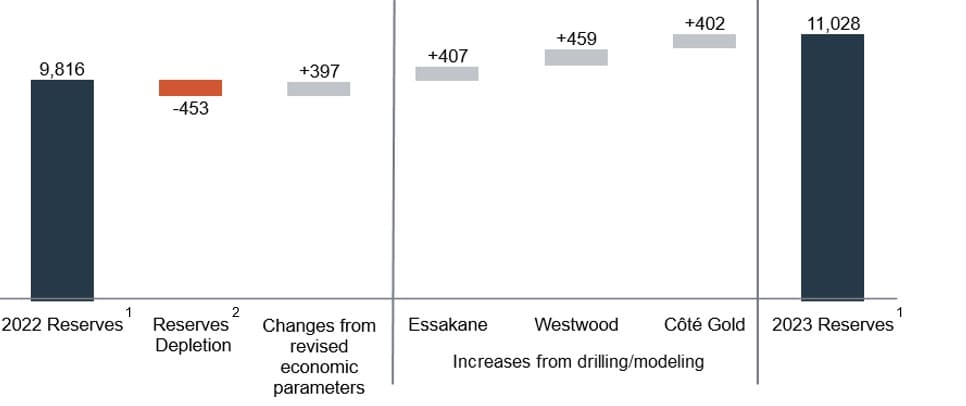

- Proven and Probable (“P&P”) Mineral Reserves (100% basis) of current assets increased 12% to 11 million ounces of gold in 302 Mt at 1.14 g/t Au (7.8 million ounces attributable).

– The Westwood Mine Complex (“Westwood”) Mineral Reserves increased 109% to 1.2 million ounces (5.3 Mt at 7.14 g/t Au), as underground rehabilitation efforts over the course of the year allowed for the resumption of mining activities in previously closed zones.

- Measured and Indicated (“M&I”) Mineral Resources (100% basis) of current assets increased 16% to 25.9 million ounces of gold in 811.7 Mt at 0.99 g/t Au (18.3 million ounces attributable).

– Côté Gold Project (“Côté Gold” or “Côté”) M&I Mineral Resources (100% basis) increased 1.9 million ounces or 18% to 12.1 million ounces in 444.8 Mt at 0.84 g/t Au (7.3 million ounce attributable).

- Gold price assumptions for Mineral Reserves were updated to $1,400 per ounce from $1,300 per ounce; and for Mineral Resources to $1,700 per ounce from $1,500 per ounce.

“The IAMGOLD exploration and operating teams have done an exceptional job over the past year, ensuring that we have replaced more than we mined during a period when our focus and capital was directed towards the upcoming ramp up of Côté Gold”

“At Essakane our teams continue to uncover additional value while managing the safety constraints of our operating footprint, while at Westwood the growth in our reserves is a direct result of the tireless efforts of our teams and successes in the extensive redevelopment and rehabilitation of the mine.”

“The updated resource at Gosselin is very exciting as the value of this deposit to the Côté project is clear. Gosselin is a large-scale deposit sitting immediately adjacent to Côté, that when combined have an estimated Measured and Indicated Mineral Resource of 16.5 million ounces with an additional 4.2 million ounces of Inferred, putting the project in exclusive company of large-scale Canadian assets. This year we look forward to the continued drilling of Gosselin, targeting the potential connecting extensions of the breccias between the resource pits, as well drilling beneath the mineralized envelopes to test the depth extensions and give some insights into the ultimate potential of these highly prospective deposits.”

Renaud Adams, President and Chief Executive Officer of IAMGOLD

Mineral Reserves

| TABLE 1: MINERAL RESERVES (@100%) SUMMARY | |||||||||

| 20222 | 2023 | %▲ | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000s) | (g/t) | (000s) | (000s) | (g/t) | (000s) | (000s) | (g/t) | (000s) | |

| Essakane3 | |||||||||

| Proven (stockpile) | 21,413 | 0.67 | 464 | 20,047 | 0.65 | 417 | -6% | -3% | -10% |

| Probable (open pit) | 31,858 | 1.56 | 1,597 | 42,123 | 1.32 | 1,787 | 32% | -15% | 12% |

| Total | 53,270 | 1.20 | 2,061 | 62,170 | 1.10 | 2,204 | 17% | -8% | 7% |

| Westwood4 | |||||||||

| Proven (underground) | 112 | 11.26 | 41 | 382 | 10.40 | 128 | 240% | -8% | 214% |

| Probable (underground) | 1361 | 10.83 | 474 | 2,982 | 10.65 | 1,021 | 119% | -2% | 116% |

| Subtotal | 1473 | 10.86 | 514 | 3,364 | 10.62 | 1,149 | 128% | -2% | 123% |

| Proven (Grand Duc) | 16 | 1.14 | 1 | 465 | 0.69 | 10 | 2807% | -39% | 900% |

| Probable (Grand Duc) | 1711 | 1.22 | 67 | 1460 | 1.17 | 55 | -15% | -4% | -18% |

| Subtotal | 1727 | 1.22 | 68 | 1,925 | 1.05 | 65 | 11% | -13% | -3% |

| Total | 3,200 | 5.66 | 582 | 5,289 | 7.14 | 1,214 | 65% | 26% | 109% |

| Côté Gold3 | |||||||||

| Proven | 130,988 | 1.01 | 4,260 | 132,202 | 1.09 | 4,620 | 1% | 8% | 8% |

| Probable | 102,343 | 0.89 | 2,914 | 102,442 | 0.91 | 2,990 | 0% | 2% | 3% |

| Total | 233,331 | 0.96 | 7,174 | 234,644 | 1.01 | 7,610 | 1% | 5% | 6% |

| Total P&P Reserves1 | 289,801 | 1.05 | 9,817 | 302,104 | 1.14 | 11,028 | 4% | 9% | 12% |

1. Figures may not add due to rounding.

2. 2022 Mineral Reserves estimated as of December 31, 2022, using a gold price of $1,300 per ounce for Essakane, Westwood and Cote Gold; and $1,350 per ounce for the Grand Duc satellite pit at Westwood.

3. 2023 Mineral Reserves estimated as of December 31, 2023, using a gold price of $1,400 per ounce for Essakane and Côté Gold.

4. Westwood (underground) Mineral Reserves have been estimated as of December 31, 2023 using a $1300 per ounce gold price and a 6.41g/t Au cut-off grade, The Grand Duc Mineral Reserves estimate is included in the Westwood Reserves estimate and have been estimated as of December 31, 2023 using a gold price of $1600 per ounce.

Proven and Probable Mineral Reserves, on a 100% basis for current assets, were estimated at 11.0 million ounces of gold (7.8 million ounces attributable) as of December 31, 2023, which was a 12% increase or 1.2 million ounces, from the year prior. Mineral Reserves at Essakane and Westwood increased 143,000 ounces and 632,000 ounces, respectively, for a combined 775,000 ounces, more than offsetting reserve depletion from mining of 453,000 ounces last year on a 100% basis.

1. Mineral Reserves on a 100% basis. Figures may not add due to rounding.

2. Reserve depletion from mining is a subset of depletion from operations based on total material fed to the mill in 2023, containing Mineral Reserves and Resources, of an estimated 559,000 ounces (11.3 Mt @ 1.26 g/t Au from Essakane and 1.0 Mt @ 3.03 g/t Au from Westwood).

Essakane P&P Mineral Reserves, on a 100% basis, increased an estimated 7% from the year prior, to 2.2 million ounces (2.0 million ounces attributable) at an average grade of 1.10 g/t Au. Probable Mineral Reserves (open pit) were estimated, on a 100% basis, at 1.8 million ounces (1.6 million ounces attributable) at an average grade of 1.32 g/t Au. On December 18, 2023, IAMGOLD announced an updated Mineral Resource and Reserve estimate for Essakane that was prepared in accordance with the disclosure requirements of NI 43-101 and had an effective date of September 30, 2023. Relative to this date, Essakane P&P Mineral Reserves decreased 144,000 ounces reflective of operating activities conducted in the fourth quarter.

Westwood Mineral Reserves, including the Grand Duc open pit, increased 109% from 582,000 ounces to 1.2 million ounces, net of depletion, with grades increasing 26% to 7.14 g/t Au. Excluding Grand Duc, underground Mineral Reserves were estimated at 1.1 million ounces at an average grade of 10.6 g/t Au. The increase in Mineral Reserves was driven by the rehabilitation efforts over the course of the year which allowed for the resumption of mining activities in previously closed zones. The Company plans to file an updated NI 43-101 technical report in the second half of the year detailing the results of certain mine optimization efforts and strategic assessments of the Westwood Complex.

Côté Gold Mineral Reserves, on a 100% basis, increased 6%, or 436,000 ounces, to 7.6 million ounces, with grades increasing 5% to 1.01 g/t Au. On an attributable basis of 60.3% ownership in the joint venture with Sumitomo Metals Mining Co. Ltd. (“Sumitomo”), Côté Gold Mineral Reserves were estimated at 4.6 million ounces. The increase in ounces was driven by the increased grade of Proven Mineral Reserves to 1.09 g/t Au based on an increase in stockpiled inventory and the ongoing grade control drilling program, with minimal impact from the gold price assumption increase to $1,400 per ounce as the tailings management facility is the primary constraint on the Mineral Reserves estimate.

A $1,400 per ounce gold price assumption was used in the 2023 Mineral Reserve estimate as of December 31, 2023 for Essakane and Côté Gold, an increase from the prior year assumption of $1,300 per ounce. The Westwood underground Mineral Reserve gold price assumption was unchanged at $1,300 per ounce.

Mineral Resources

Measured and Indicated Mineral Resources (inclusive of Mineral Reserves and on a 100% basis) for IAMGOLD’s current assets increased 16% or 3.6 million ounces, to a total of 25.9 million ounces as of December 31, 2023 (18.3 million ounces attributable). M&I Mineral Resource average grades remained essentially flat year over year at 0.99 g/t Au. The increase in total ounces can be primarily attributed to the increase in M&I Mineral Resources at Côté Gold and Gosselin.

Global Inferred Mineral Resources (on a 100% basis) declined 10%, or 1.1 million ounces, to a total of 10.1 million ounces as of December 31, 2023 (7.4 million ounces attributable). The decline in ounces is primarily associated with the upgrading of resource classification to M&I at Côté Gold, which offset increases at Gosselin, Nelligan and Essakane. Inferred Mineral Resources have a great amount of uncertainty as to their grade and quantity because they are based on limited geological evidence. It cannot be assumed that all or part of the Inferred Mineral Resources will ever be upgraded to a higher category or converted to Mineral Reserves.

The Company assumed a gold price of $1,700 per ounce for estimating Mineral Resources as of December 31, 2023 at Essakane, Côté Gold, Gosselin, Nelligan and Gossey. Westwood Mineral Resources were estimated using a $1,600 per ounce gold price. Monster Lake and Diakha-Siribaya Mineral Resources were estimated using a $1,500 per ounce gold price, unchanged from the prior year.

| TABLE 2: MINERAL RESOURCES (@100%) SUMMARY1 | |||||||||

| 20222 | 20233 | %▲ | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000s) | (g/t) | (000s) | (000s) | (g/t) | (000s) | (000s) | (g/t) | (000s) | |

| OPERATIONS | |||||||||

| Essakane | |||||||||

| Measured | 34,282 | 0.55 | 607 | 21,379 | 0.64 | 439 | -38% | 16% | -28% |

| Indicated | 52,945 | 1.32 | 2,247 | 65,702 | 1.40 | 2,951 | 24% | 6% | 31% |

| Total M&I | 87,227 | 1.02 | 2,854 | 87,081 | 1.21 | 3,390 | 0% | 19% | 19% |

| Inferred | 2,318 | 1.44 | 107 | 8,344 | 1.46 | 392 | 260% | 1% | 265% |

| Westwood4 | |||||||||

| Measured | 791 | 9.29 | 236 | 1,158 | 7.85 | 292 | 46% | -15% | 24% |

| Indicated | 7,213 | 8.83 | 2,047 | 7,257 | 9.14 | 2,133 | 1% | 4% | 4% |

| Total M&I | 8,003 | 8.87 | 2,283 | 8,415 | 8.96 | 2,425 | 5% | 1% | 6% |

| Inferred | 2,699 | 12.34 | 1,071 | 1,465 | 15.78 | 743 | -46% | 28% | -31% |

| Côté Gold | |||||||||

| Measured | 152,534 | 0.96 | 4,726 | 167,040 | 0.96 | 5,160 | 10% | 0% | 9% |

| Indicated | 213,382 | 0.80 | 5,480 | 277,733 | 0.77 | 6,907 | 30% | -3% | 26% |

| Total M&I | 365,916 | 0.87 | 10,206 | 444,773 | 0.84 | 12,067 | 22% | -3% | 18% |

| Inferred | 189,108 | 0.63 | 3,813 | 60,591 | 0.61 | 1,184 | -68% | -3% | -69% |

| DEVELOPMENT & EXP | |||||||||

| Gosselin | |||||||||

| Indicated | 124,500 | 0.84 | 3,350 | 161,300 | 0.85 | 4,420 | 30% | 2% | 32% |

| Inferred | 72,900 | 0.73 | 1,710 | 123,900 | 0.75 | 2,980 | 70% | 3% | 74% |

| Nelligan7 | |||||||||

| Indicated | 73,500 | 0.84 | 1,991 | 74,500 | 0.84 | 2,006 | 1% | 0% | 1% |

| Inferred | 129,500 | 0.87 | 3,600 | 142,600 | 0.85 | 3,889 | 10% | -2% | 8% |

| Monster Lake5 | |||||||||

| Inferred | 1,110 | 12.14 | 433 | 1,110 | 12.14 | 433 | 0% | 0% | 0% |

| Gossey | |||||||||

| Indicated | 10,454 | 0.87 | 291 | 7,690 | 0.91 | 224 | -26% | 4% | -23% |

| Inferred | 2,939 | 0.91 | 85 | 1,520 | 1.04 | 51 | -48% | 15% | -40% |

| Diakha-Siribaya6 | |||||||||

| Indicated | 27,937 | 1.48 | 1,325 | 27,937 | 1.48 | 1,325 | 0% | 0% | 0% |

| Inferred | 8,468 | 1.53 | 417 | 8,468 | 1.53 | 417 | 0% | 0% | 0% |

| Total M&I Resources1 | 697,538 | 0.99 | 22,300 | 811,696 | 0.99 | 25,858 | 16% | 0% | 16% |

| Total Inferred Resources1 | 409,041 | 0.85 | 11,237 | 347,997 | 0.90 | 10,090 | -15% | 6% | -10% |

1. Figures may not add due to rounding.

2. Mineral Resources estimated as of December 31, 2022, using a gold price of $1,500 per ounce for the Essakane, Westwood (including Grand Duc satellite pit), Côté Gold, Gosselin, Nelligan, Monster Lake, Gossey, and Diakha-Siribaya Gold Project.

3. 2023 Mineral Resources estimated as of December 31, 2023, using a gold price of $1,700 per ounce for Essakane, Côté Gold, Gosselin, Nelligan and Gossey; and have been estimated in accordance with NI 43-101.

4. Westwood Mineral Resources have been estimated as of December 31, 2023 using a 6.30 g/t Au cut-off grade over a minimum width of 2.4 metres, using a $1,600 per ounce gold price and have been estimated in accordance with NI 43-101. The Grand Duc Mineral Resources and Reserves estimate is included in the Westwood Mineral Resources and Reserves estimates. The Grand Duc Mineral Resources have been estimated as of December 31, 2023 using a gold price of $1,700 per ounce and have been estimated in accordance with NI 43-101.

5. Monster Lake Mineral Resources have been estimated as of December 31, 2023 using a $1,500 per ounce gold price and have been estimated in accordance with NI 43-101.

6. Diakha-Siribaya Mineral Resources have been estimated as of December 31, 2023 using a $1,500 per ounce gold price and have been estimated in accordance with NI 43-101. On December 20, 2022, IAMGOLD announced that it had entered into definitive agreements to sell the Company’s interests in Diakha-Siribaya. This sale is expected to close in 2024.

7. Nelligan 2022 Mineral Resource estimate announced on January 12, 2023 was amended prior to filing of the Technical Report on February 23, 2023. The changes resulted to a 21,000 ounce increase in estimated Indicated Mineral Resources and 362,000 ounce increase to Inferred Mineral Resources due to amendments made to the mining cost applied to waste material and to the percentage of payable metal applied relative to the Mineral Resource Estimate reported on January 12, 2023.

Essakane M&I Mineral Resources, inclusive of Mineral Reserves and on a 100% basis, increased 19% to an estimated 3.4 million ounces (3.1 million ounces attributable) as of December 31, 2023, with grades increasing 19% to 1.21 g/t Au. Inferred Mineral Resources increased 265% or 285,000 ounces from the year prior with grades essentially remaining flat at an estimated 1.46 g/t Au. On December 18, 2023, IAMGOLD announced an updated Mineral Resource and Reserve estimate for Essakane that was prepared in accordance with the disclosure requirements of NI 43-101 and had an effective date of September 30, 2023. Relative to this date, Essakane M&I Mineral Resources decreased 127,000 ounces reflective of mining activities conducted in the fourth quarter, while Inferred Mineral Resources were estimated to be relatively unchanged.

Westwood M&I Mineral Resources, inclusive of Mineral Reserves, increased 6% to 2.4 million ounces as of December 31, 2023, with a modest increase in grades to 8.96 g/t Au. Inferred Mineral Resources declined 31% to 743,000 ounces as estimated grades increased 28% to 15.78 g/t Au.

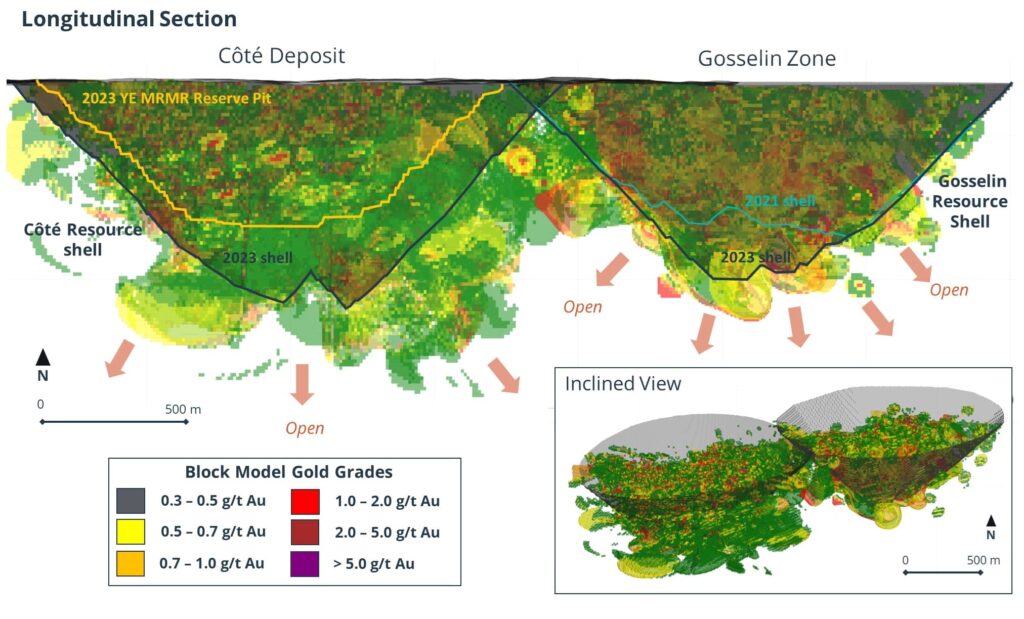

Côté Gold M&I Mineral Resources, inclusive of Mineral Reserves and on a 100% basis, increased 18% or 1.9 million ounces, to 12.1 million ounces (7.3 million ounces attributable), with grades decreasing only 3% to 0.84 g/t Au. Inferred Mineral Resources decreased 69% to 1.2 million ounces at estimated grades of 0.61 g/t Au as a result of the conversion of Inferred Mineral Resource to Indicated from the ongoing grade control drill programs.

Nelligan M&I Mineral Resources, on a 100% basis, remained relatively flat at an estimated 2 million ounces averaging 0.84 g/t Au. Inferred ounces increased 8% or 289,000 ounces to a total of an estimated 3.9 million ounces at average grades of 0.85 g/t Au. On February 13th, 2024, IAMGOLD announced the successful completion of the previously announced transaction with Vanstar Mining Resources Inc. (“Vanstar”), whereby IAMGOLD has acquired all of the issued and outstanding common shares of Vanstar pursuant to a court-approved plan of arrangement. As a result of the Arrangement, IAMGOLD now owns a 100% interest in the Nelligan Gold Project, located 60 kilometres southwest of Chibougamau, Quebec, Canada.

Gosselin

The Gosselin deposit, located immediately adjacent to the Côté Gold pit, returned an updated Mineral Resource estimate, on a 100% basis, as of December 31, 2023 of 4.4 million Indicated gold ounces in 161.3 Mt at 0.85 g/t Au (2.7 million ounces attributable), and 3.0 million Inferred ounces in 123.9 Mt at 0.75 g/t Au (1.8 million ounces attributable). This represents an estimated increase of 1.1 million ounces in Indicated and 1.3 million ounces in Inferred, representing a 32% and 74% increase respectively. Combining the Gosselin and Côté deposits together results in a total Measured and Indicated Mineral Resource estimate for the Côté Gold Project of 16.5 million ounces with an additional 4.2 million ounces of Inferred.

The Company announced a maiden Mineral Resource estimate for the Gosselin deposit in October 2021 which incorporated 163 diamond drill holes totalling 54,775 metres. The 2023 updated Mineral Resource estimate incorporated an additional 57 diamond drill holes totalling 34,790 metres. Drilling to date suggests the Gosselin deposit has the potential to approach similar dimensions as the adjacent Côté deposit. Drill intercepts obtained from the newly discovered West Breccia have significantly expanded this breccia body which now measures 250 metres by 170 metres and extends for a depth of approximately 400 metres. This has helped to highlight a highly prospective corridor at depth measuring up to 850 metres in strike length that remains to be tested between the Gosselin West Breccia and the Côté Deposit hydrothermal breccia. This represents a priority exploration opportunity to further expand the Gosselin resource below the 600 metre vertical depth extent of the current 2023 resources pit shell.

| Tonnes | Grade | Ounces | Attributable Ounces | |

| OPERATIONS | (000s) | (g/t Au) | (000s) | (000s) |

| Essakane, Burkina Faso4 | [90%] | |||

| Proven Mineral Reserves | 20,047 | 0.65 | 417 | 375 |

| Probable Mineral Reserves | 42,123 | 1.32 | 1,787 | 1,608 |

| Subtotal P&P | 62,170 | 1.1 | 2,204 | 1,984 |

| Measured Mineral Resources | 21,379 | 0.64 | 439 | 395 |

| Indicated Mineral Resources | 65,702 | 1.40 | 2,951 | 2,656 |

| Subtotal M&I (incl. of Reserves) | 87,081 | 1.21 | 3,390 | 3,051 |

| Inferred Mineral Resources | 8,344 | 1.46 | 392 | 353 |

| Westwood, Canada5 | [100%] | |||

| Proven Mineral Reserves | 847 | 5.07 | 138 | 138 |

| Probable Mineral Reserves | 4,443 | 7.53 | 1,076 | 1,076 |

| Subtotal P&P | 5,290 | 7.14 | 1,214 | 1,214 |

| Measured Mineral Resources | 1,158 | 7.85 | 292 | 292 |

| Indicated Mineral Resources | 7,257 | 9.14 | 2,133 | 2,133 |

| Subtotal M&I (incl. of Reserves) | 8,415 | 8.96 | 2,425 | 2,425 |

| Inferred Mineral Resources | 1,465 | 15.78 | 743 | 743 |

| Côté Gold, Canada7 | [60.3%] | |||

| Proven Mineral Reserves | 132,202 | 1.09 | 4,620 | 2,786 |

| Probable Mineral Reserves | 102,442 | 0.91 | 2,990 | 1,803 |

| Subtotal P&P | 234,644 | 1.01 | 7,610 | 4,589 |

| Measured Mineral Resources | 167,040 | 0.96 | 5,160 | 3,112 |

| Indicated Mineral Resources | 277,733 | 0.77 | 6,907 | 4,165 |

| Subtotal M&I (incl. of Reserves) | 444,773 | 0.84 | 12,067 | 7,276 |

| Inferred Mineral Resources | 60,591 | 0.61 | 1,184 | 714 |

| Gosselin, Canada8 | [60.3%] | |||

| Indicated Mineral Resources | 161,300 | 0.85 | 4,420 | 2,665 |

| Inferred Mineral Resources | 123,900 | 0.75 | 2,980 | 1,797 |

| Nelligan, Canada10, 12 | [75%] | |||

| Indicated Mineral Resources | 74,500 | 0.84 | 2,006 | 1,505 |

| Inferred Mineral Resources | 142,600 | 0.85 | 3,889 | 2,917 |

| Monster Lake, Canada9 | [100%] | |||

| Inferred Mineral Resources |