European Metals Holdings, the Australian and UK listed lithium/tin mineral exploration and development company, has updated the financial plan for the production of battery-grade lithium hydroxide from their Cinovec Lithium/tin project in the Czech Republic.

The Cinovec Project hosts a JORC 2012-compliant global Resource of 695.9 Mt in the Indicated and Inferred categories. The highlights from the latest update, compared to their previous PFS in 2017, include:

• Net estimated overall cost of production post credits: $3,435 / tonne LiOH.H2O

• Project Net Present Value (“NPV”) increases 105% to: $1.108B (post tax, 8%)

• Internal Rate of Return (“IRR”) increased 37% to 28.8% (post tax)

• Total Capital Cost: $482.6M

• Annual production of Battery Grade Lithium Hydroxide: 25,267 tonnes

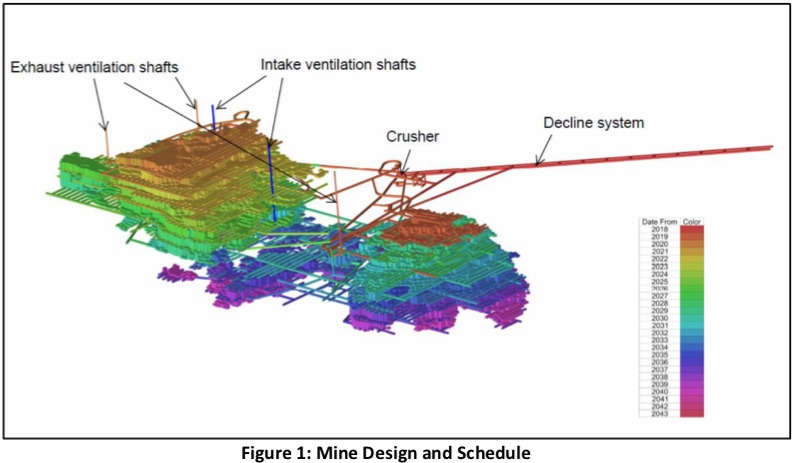

• Studies are based on only 9.3% of reported Indicated Mineral Resource and a mine life of 21 years processing an average of 1.68 Mtpa ore

The process used to produce lithium hydroxide allows for the staging of lithium carbonate and then lithium hydroxide production to minimize capital and startup risk and enables the production of either battery grade lithium hydroxide or carbonate as markets and customers demand.

European Metals MD Keith Coughlan said that they have confirmed the ability to produce lithium products in line with market requirements from what is now Europe’s largest lithium resource. “Cinovec is strategically located in central Europe in close proximity to the continent’s vehicle manufacturers. With increasing demand for Electric Vehicles and the expected demands of grid storage capacity, the project is very well placed to supply the European lithium market for many decades.”

European Metals states that the Cinovec project can achieve the low estimated cost of production ( $3,435/t LiOH.H2O) due to:

• By-product credits from the recovery of tin, tungsten, potash and sodium sulphate;

• The ore is amenable to single-stage crushing and single-stage coarse SAG milling, reducing capital and operating costs and complexity;

• Paramagnetic properties of zinnwaldite allow the use of low cost wet magnetic processing to produce a lithium concentrate for further processing at relatively high recoveries;

• Relatively low temperature roasting at atmospheric pressure utilizing conventional technologies, reagent recycling and the use of waste gypsum; and

• Low cost access to extensive existing infrastructure and grid power.

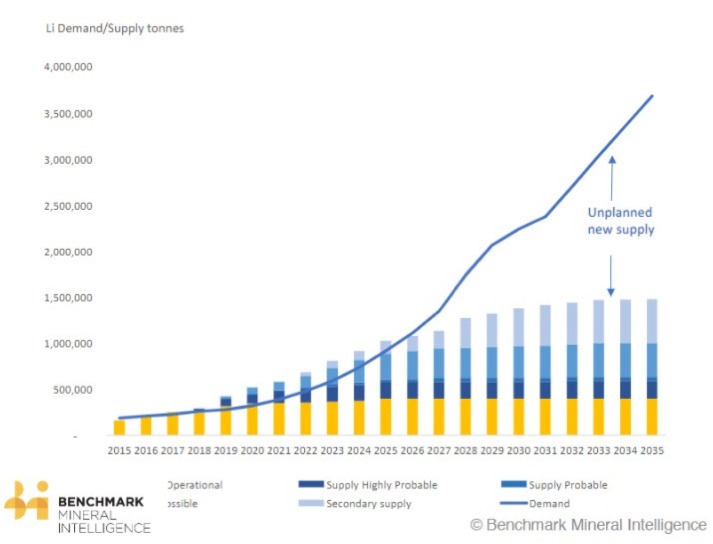

This announcement comes at a critical time when we’re seeing a widespread understanding that change IS actually happening, both in terms of the anticipated huge future demand for lithium for electric vehicles and the wider used of stored, ‘clean energy’. Yet for all the meteoric estimates of demand for lithium, going out only a few years we don’t seem to be very clear on where all that lithium is coming from.

Allied to that is the relative paucity of lithium deposits close to the European car industry. We saw VW make a huge strategic investment in European battery maker Northvolt announced last week, alongside Tesla making ‘we may go into mining’ noises too. Europe is perhaps being a bit late off the starting grid behind China and North America, but perhaps now we’ll see more moves of car manufacturers, and other producers of lithium based products, getting closer to their source material in order to secure demand?

Cinovec Lithium/Tin Project Overview

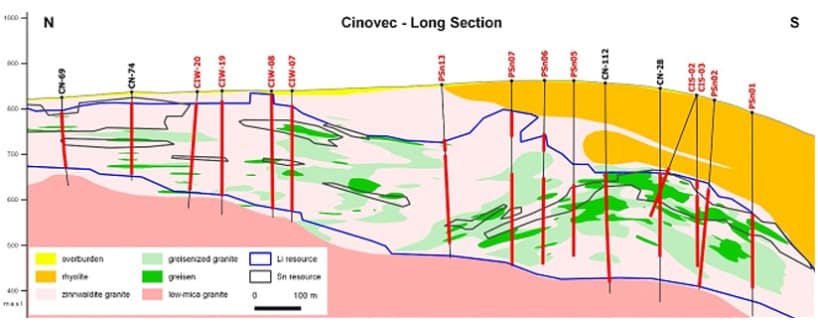

European Metals, through its wholly owned subsidiary, Geomet s.r.o., controls the mineral exploration licenses awarded by the Czech State over the Cinovec Lithium/Tin Project. Cinovec hosts a globally significant hard rock lithium deposit with a total Indicated Mineral Resource of 372.4Mt @ 0.45% Li2O and 0.04% Sn and an Inferred Mineral Resource of 323.5Mt @ 0.39% Li2O and 0.04% Sn containing a combined 7.18 million tonnes Lithium Carbonate Equivalent and 278kt of tin reported 28 November 2017 (Further Increase in Indicated Resource at Cinovec South). An initial Probable Ore Reserve of 34.5Mt @ 0.65% Li2O and 0.09% Sn reported 4 July 2017 (Cinovec Maiden Ore Reserve – Further Information) has been declared to cover the first 20 years mining at an output of 22,500tpa of lithium carbonate reported 11 July 2018 (Cinovec Production Modelled to Increase to 22,500tpa of Lithium Carbonate).

This makes Cinovec the largest lithium deposit in Europe, the fourth largest non-brine deposit in the world and a globally significant tin resource.

The deposit has previously had over 400,000 tonnes of ore mined as a trial sub-level open stope underground mining operation.

The economic viability of Cinovec has been enhanced by the recent strong increase in demand for lithium globally, and within Europe specifically.

Find out more at https://www.europeanmet.com