With European economies weak, the US mixed, Japan stuck in place, and many South American outlooks sliding, all eyes are on China. China’s economy has obviously slowed in recent years but it is now so massive that, as long as it maintains reasonable growth, it can be the engine that pulls the rest of the world along.

That’s why I think recent positive data from China are a good part of the reason risk appetite is returning. A spate of better-than-usual US data is also helping, of course, but I think the market needs to have reasonable confidence in China as a backstop to growth questions everywhere else.

And Q1 growth numbers from China help support that backstop. GDP growth clocked in a 6.4%, ahead of consensus expectation of 6.3%, while industrial output rose 8.5% year over year and retail sales climbed 8.7% since last March.

How much should we trust these numbers? As much as we trust anything from Beijing. That said, these numbers are fairly consistent with other data from the first quarter so they are reasonable.

The government gets direct credit for improving growth: a stimulus package totaling 2 trillion CNY at the start of 2019 to counter the gloomy economic data that weighed the second half of 2018 saw debt issuances and infrastructure projects everywhere, from municipal to federal levels. And those efforts created the boost to growth that we’re now seeing.

The question is how far Beijing will go. China needs to clean up its balance sheets, which are heavy with debts leaning on limited collateral. The ‘deleveraging’ effort that you’ve heard associated with China in recent years is exactly that: cleaning up a broadly over-leveraged, and in places downright shady, debt market.

But deleveraging means cutting back debt availability, which hurts growth. So Xi is trying to balance opposing goals: maintain good growth while cutting back on credit.

He walks a tightrope in many respects and a new decision out today highlights that balancing act once again. While supporting growth, Xi is also trying to improve environmental stewardship. One major plank in Beijing’s environmental plan has been limiting people’s ability to buy cars. For years now anyone living in a large city had to win a lottery for the right to buy a new vehicle.

That just changed. Today we got news that Xi has eliminated citizen car-buying restrictions. Car related stocks in China soared on the news but the impact is broader: while the decision will set the fight against smog back years, erasing those restrictions means easy GDP growth as pent-up demand flows into the car market.

The undeniable benefit of an all-controlling central government is the ability to push and pull whatever needed, whenever needed. A stimulus package like that would take months at best to get off the ground in a democratic country but in China it happens.

Xi is also incentivized to generate good numbers because evidence that his economy is doing just fine, thank you very much, gives leverage in the ongoing trade negotiations.

Circling back to my first thought: if China’s stimulus effort had failed to boost growth, things would have been fraught. Across the stock market, we need a China in reasonable shape. In the near term Chinese weakness would not have helped expedite the trade deal. And the outlook for commodities would have dimmed: with weak growth despite stimulus and no trade deal, there would be little reason to expect commodities to perform.

So China’s good numbers mattered. There wasn’t much reaction – markets were pretty flat today, the dollar was little changed, gold had a boring day – but I posit that there would have been significant negative reaction had China’s numbers disappointed.

In this deal-less limbo, investors are hoping for the best but are watching in case things go the other way. Good Chinese growth numbers carried the hope this time. If we want commodities – base metals in particular – to have their day in the sun, we need good growth data to continue. Add a trade deal in on top of that and voila we should have all the ingredients in place.

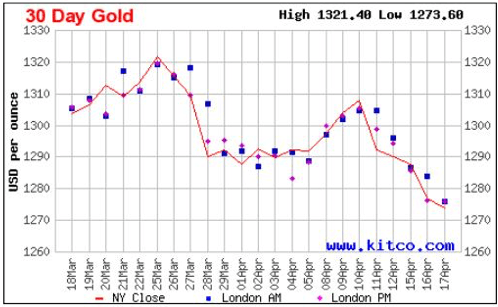

Of course, none of this is fantastic for gold. The yellow metal had a bad week, again breaking below US$1,300 per oz. but this time carrying on down.

| It makes sense from this perspective alone: |

With markets rising reliably, investors are getting their risk appetites back. So even though the most important gold price driver – real rates that are sideways to down – remains bullish, sentiment is overriding right now and gold is caught in the crossfire.

I never expect much from gold in May, June, and July. There’s a seasonality chart in the next article that shows how we shouldn’t expect much from the yellow metal until July. Of course that is based on average monthly price moves over decades; events can and often do disrupt the pattern. But if no major gold-related events arise – if interest rates remain unchanged, if the US dollar remains range bound, if stocks don’t do anything dramatic, if geopolitics is no more volatile than usual – then we shouldn’t expect anything more than sideways from gold until mid summer.

After that, we shall see. I remain convinced that we will either get a metals market, in the case of a trade deal, that evolves into a gold market in time or a gold market right away if negotiations fall apart. Would that we knew when that key factor would be decided. But we don’t, and while we wait we have to:

1.Pay attention to economic data. The bull stock market right now hinges on Chinese strength; the metals market to come requires reasonable strength around the world. If data starts to reliably weaken, it will be time to rotate away from base metals into gold alone.

2. Listen for trade deal news. So far we’ve gotten little more than a few Trump tweets but you can be sure the president’s team will prep the market if positive news is forthcoming.

3. Not hold your breath. As I said, no one knows when a deal will come together. Things will continue to muddle along in the interim, with fundamental tightness apparent to those paying S&P 500 4 attention (as I outlined last week when I discussed copper, zinc, and iron ore all rising despite all the economic uncertainty).

Gwen Preston is a renowned expert in the field of mining. She spent years as a mining journalist giving her a deep base of knowledge and a broad network of contacts. She understands which projects and pieces of news matter.

The team at MiningIR love her writing and her knowledge which is why we’re pleased to feature her on our site. Sign up for a free trial of her leading newsletter at www.resourcemaven.ca