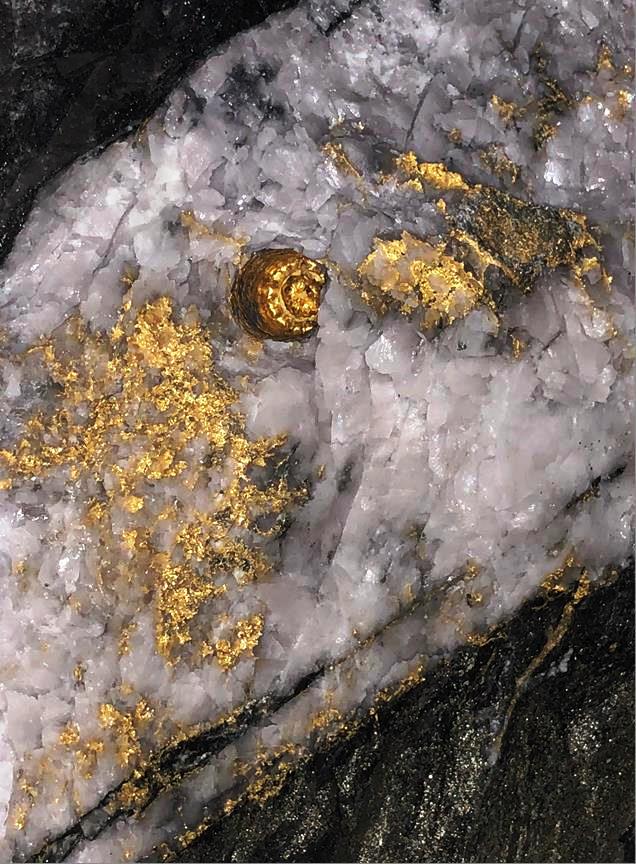

The Canadian Miner, famous for their Father’s Day vein discovery at their Beta Hunt mine, announced strong Q4 results for 2018 largely thanks to the increase in grade across 2018.

Highlights

- 195% increase in mined grade for Q4 2018 compared to Q4 2017 – up to 7.28 g/t from 2.47 g/t

- Average grade across 2018 was up 106% to 4.48 g/t from 2.17 g/t for 2017

- Working capital deficit reduced by $8.4 million during three months ending December 31st2018

- Adjusted EBITDA up to $15.9 million during Q4 of 2018, an increase of $17.5 million from Q4 2017

- Full year Adjusted EBITDA up to $27.3 million compared to $(0.4) million for 2017

Speaking about the results, Mark Selby, President and CEO, commented, “RNC generated more than $27 million Adjusted EBITDA in 2018, with $16 million of that coming in a record fourth quarter. Beta Hunt AISC costs per ounce in the quarter declined to US$698 reflecting increased sales of coarse gold from our Father’s Day Vein discovery – demonstrating the mine’s cash flow potential”.

Missed our interview with Mark Selby at Mines and Money London? Watch it here…

Record annual gold production

Gold mined production for the 2018 year totalled 73,801 ounces compared to 37,027 ounces in 2017, which was an annual gold mined production record for Beta Hunt. Fourth quarter 2018 gold production of 15,341 mined gold ounces represented a 21% increase versus fourth quarter of 2017. High-grade specimen and coarse gold production led to a 195% increase in mined grade for the quarter to 7.28 g/t, as compared to 2.47 g/t in fourth quarter of 2017. The gold mined grade for 2018 was 4.48 g/t, an increase of 106% over the mined grade of 2.17 g/t for 2017.

Exploration:

Looking to the future expansion of the Beta Hunt Mine, Selby commented: “Our 40,000 metre exploration program to unlock Beta Hunt’s exploration potential began during the quarter, delivering both multiple high grade gold intersections and thick gold mineralization intersections.”

Initial results from the 40,000 metre drill program that was initiated in the fourth quarter of 2018 have been positive. Highlights from assays received to-date include (all drill intervals quoted are true thicknesses):

- 1,017 g/t over 2.00 m, including 7,621 g/t over 0.27 m in hole WFN-029

- 395.9 g/t over 4.75 m, including 2,210 g/t over 0.85 m in hole WFN-063

- 468 g/t over 0.21 m in hole AZ13-156

- 119 g/t over 6.40 m, including 1,406 g/t over 0.50 m in hole AZ15-013

Balance sheet

During the three months ended December 31, 2018, RNC’s working capital deficit was reduced by $8.4 million, including a $4.6 million reduction in accounts payable and accrued liabilities. The cash and cash equivalents balance, plus value of gold specimens held for sale, as of December 31, 2018 was $5.2 million at contained gold value (without premium which RNC expects to realize).

Adjusted EBITDA

Adjusted earnings before interest, tax, depreciation and amortization (Adjusted EBITDA) improved to $15.9 million in the fourth quarter of 2018, a $17.5 million increase from the comparable quarter of 2017, reflecting the impact of higher sales and revenue and lower production costs. For the full year Adjusted EBITDA improved to $27.3 million, compared to $(0.4) million in 2017. A definition and reconciliation of Adjusted EBITDA is included in the Non-IFRS Measures section of RNC’s MD&A dated March 27, 2019.

Production unit costs

All-in sustaining costs (AISC) were US$698 per ounce sold for the fourth quarter of 2018, a 56% improvement on the US$1,579 per ounce sold in the prior year comparative period. 2018 fourth quarter cash operating costs were US$459 per ounce sold, a 69% improvement over 2017. Mining cash costs were reduced to US$345 per ounce mined, 61% lower than the fourth quarter of 2017.

Dumont Nickel-Cobalt Project

Dumont remains one of the world’s premier battery metals projects containing the world’s largest undeveloped reserves of nickel and second largest undeveloped reserves of cobalt. As one of the only large-scale fully permitted, shovel-ready nickel-cobalt projects globally, Dumont is ideally positioned to deliver the nickel and cobalt required to meet the massive demand growth expected from both the stainless-steel market and the electric vehicle market in the coming decade.

Commenting on the Dumont Project, Mark Selby stated: “Our Dumont feasibility update is progressing well, and I look forward to its upcoming release given the increasing market interest in nickel and its critical role in the electric vehicle revolution.”

The results of the updated feasibility study are expected to be announced in the second quarter of 2019.

About RNC Minerals

Get more information RNC Minerals from their website.

RNC has a 100% interest in the producing Beta Hunt gold mine located in Western Australia where a significant high grade gold discovery – “Father’s Day Vein” – was recently made. RNC is currently completing a 40,000 metre drill program, the results of which will be incorporated into an updated NI 43-101 compliant Mineral Resource Estimate and mine plan targeted for Q2 2019. Beta Hunt gold resource potential is underpinned by multiple gold shears with gold intersections across a 4km strike length which remain open in multiple directions adjacent to an existing 5km ramp network. RNC also has a 28% interest in a nickel joint venture that owns the Dumont Nickel-Cobalt Project located in the Abitibi region of Quebec which contains the second largest nickel reserve and eighth largest cobalt reserve in the world. RNC owns a 33% interest in Orford Mining Corporation, a mineral explorer focused on highly prospective and underexplored areas of Northern Quebec. RNC has a strong management team and Board with over 100 years of mining experience. RNC’s common shares trade on the TSX under the symbol RNX. RNC shares also trade on the OTCQX market under the symbol RNKLF.